Many people these days look for rewarding, high-end, or lifetime-free cards. Many are busy finding the best way to redeem their reward points. Almost all of us are busy keeping an eye out for all the new and ever-coming changes to credit card policies and regulations. These changes are usually termed as a devaluation while sometimes, very rarely, we even witness a revaluation like with the Swiggy HDFC credit card. Now, once again, HDFC Bank is back with more changes to its credit cards. But worry not—this time, the blow is not that brutal, as most of these changes are not a surprise.

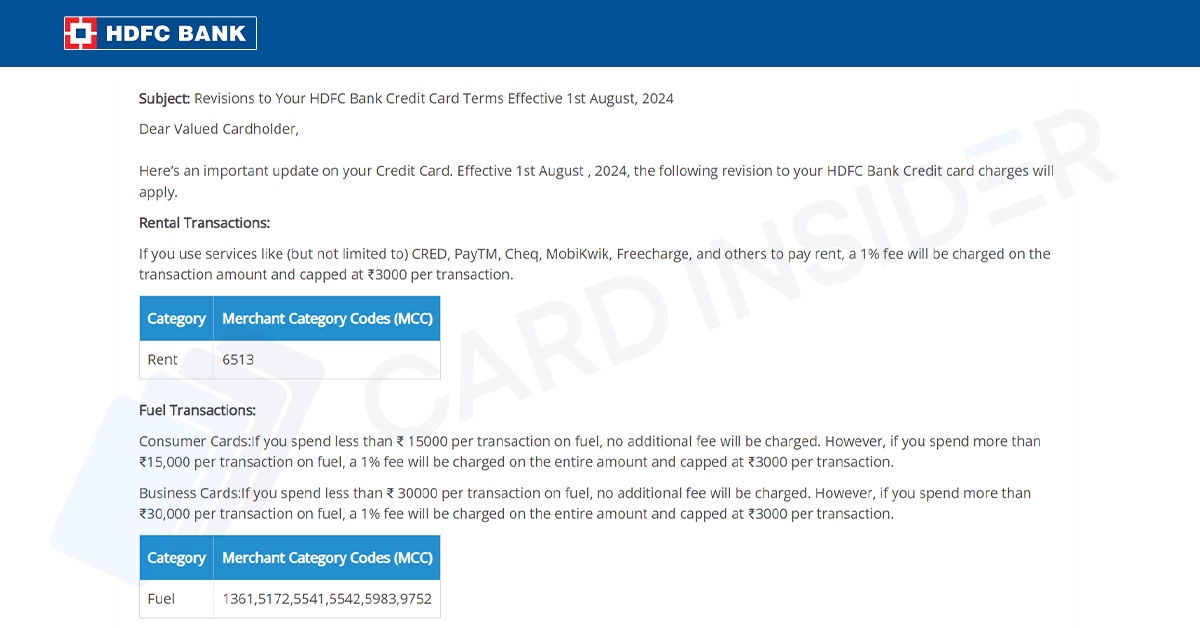

1% Charge on Rental Transactions

All rental transactions (Merchant Code 6513) made through third-party platforms such as CRED, Paytm, CheQ, and Mobikwik shall now carry a 1% charge. This charge on rental transactions made with HDFC credit cards through others shall be capped at ₹3,000 per transaction.

Utility Transactions

HDFC Bank has recently implemented a charge for large utility bill payments made with both its consumer and business credit cards. Individuals using HDFC consumer credit cards will incur a 1% fee, capped at ₹3,000 (per transaction) if their utility bill payment exceeds ₹50,000 in a single transaction. This change is unlikely to impact the majority of consumer credit card users, as it’s uncommon for individuals to make such large bill payments in a single transaction.

Similar to consumer credit cards, HDFC business credit card holders will also face a new charge on utility payments. Those who make transactions of ₹75,000 or more in a single transaction with their HDFC business credit card will be subject to a 1% charge, capped at ₹3,000 per transaction.

Educational Transactions

Those who make educational payments through third-party apps like CRED, PayTM, Cheq, MobiKwik, and any other shall be charged a 1% fee, which shall be capped at ₹3,000 per transaction. Any educational transaction made directly to the institution’s website or POS machines with an HDFC credit card shall not be charged any fees. There shall also be no charge for international education payments.

Educational transactions are categorized under MCCs 8211, 8220, 8241, 8244, 8249, and 8299.

Reward Redemption Charges

This is one of the most significant changes for many entry-level HDFC credit card users in our opinion. All of those who used to redeem their reward points for statement credit shall now be charged a fee of ₹50. This is applicable to all HDFC Bank credit cards except Infinia, Infinia (Metal Edition), Diners Black, Diners Black (Metal Edition), BizBlack Metal, Swiggy HDFC, and Flipkart Wholesale.

Pro tip: If you have reward points and plan to redeem them for credit against your statement, do so before 1 August 2024 and save ₹50.

1% Charge Fuel Transactions Above ₹15,000

Fuel transaction fees are categorized under several MCCs: 1361, 5172, 5541, 5542, 5983, and 9752.

Consumer Cards

| Transactions | Fee |

| Transactions Below ₹15,000 | No Fee |

| Transactions Above ₹15,000: | 1% Fee Capped at ₹3000 Per Transaction |

Business Cards

| Transactions | Fee |

| Transactions Below ₹30,000 | No Fee |

| Transactions Above ₹30,000: | 1% Fee Capped at ₹3000 Per Transaction |

Easy-EMI Processing Fee

If you opt for the Easy-EMI option at any online or offline store, an EMI processing fee of up to ₹299 will be charged.

Late Payments

The late payment structure for HDFC credit cards shall also be revised during this round of changes.

| Outstanding Amount | Charges |

| ₹101 – ₹500 | ₹100 |

| ₹501 – ₹1000 | ₹500 |

| ₹1001 – ₹5000 | ₹600 |

| ₹5001 – ₹10000 | ₹750 |

| ₹10001 – ₹25000 | ₹900 |

| ₹25001 – ₹50000 | ₹1,100 |

| Greater Than ₹50000 | ₹1,300 |

International/Cross Currency Transactions

A 3.5% markup fee will be applicable for international or cross-currency transactions.

However, the markup fee will remain at 2% for Infinia, Infinia (Metal Edition), Diners Black, Diners Black (Metal Edition), Biz Black Metal Card, Regalia Gold, BizPower, and Tata Neu Infinity HDFC Bank cards. The markup fee for 6E Rewards Indigo XL cards will be 2.5%.

What Now?

It’s worth noting that these changes are not entirely new or unexpected. They have been in the works for some time, and now, almost each and every credit card issuer in India is in the process of implementing them. For instance, even the popular Amazon ICICI credit card recently underwent changes specifically for rent transactions. Changes to the structure of utility bill payments are also not surprising, as similar adjustments have been occurring for some time, including changes to the utility payment structures of Yes Bank and IDFC First Bank.

One significant takeaway from these changes is that HDFC Bank credit cardholders should now avoid third-party payments. Apps and platforms such as CRED, Paytm, CheQ, and Mobikwik, which were previously used to earn rewards when paying education charges or rent, will now incur charges from the bank itself.

6 Comments

Already my card is not work thirdpart payment I think it will close the my card asap

Good for you sir. That smug attitude of closing the card for not being able to rotate money is exactly what the bank and the rest of the healthy credit card community wants. Don’t get me wrong, I am no keyboard SJW and I use my card to pay rent as well, just that I can understand why banks take such steps without getting into a “need to close card ASAP” loop.

Better stop using card

Please request me Mera Hero account open kar dijiye

When they say third party, will it include the hdfc bill pay portal payments done using redgiraffe as provider?

Third party already charging 1.8 to 2.4%,,,another 1% from bank ,,,then surcharges something they will charge you but not on same day but different day in statement…all landing to 3.4 to 4% charges,,,