HDFC Bank has recently added a new feature to its Internet banking portal, through which credit cardholders can set usage limits on their cards. Being an HDFC Bank Credit cardholder, you can now decide whether your card can be used for ATM transactions or not. You can also set the maximum limit for ATM transactions, contactless transactions, merchant outlet usage, etc. To know how you can avail of the facility, go through the complete article:

Set Usage Limits On Your HDFC Bank Credit Cards

If you own an HDFC Bank credit card, you can now control the usage of your card rather than the bank controlling it. You can decide whether you want your card to be used for ATM withdrawals/international transactions/contactless payments or not. And you can even decide the limits on your own. However, there will be a pre-specified maximum limit for each particular category.

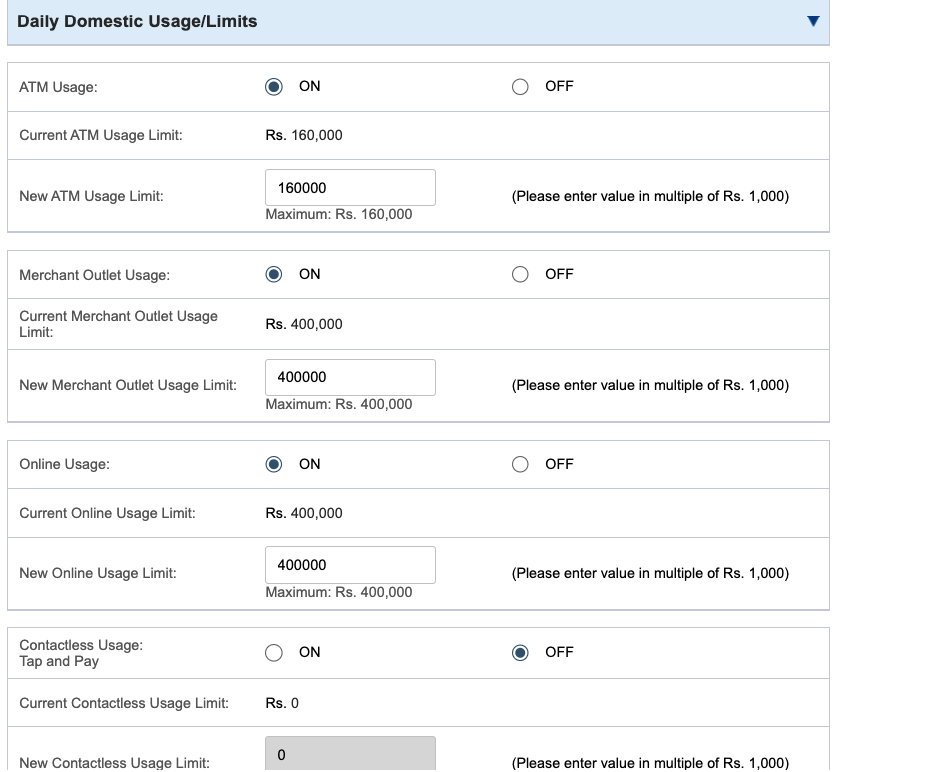

For example, if your credit card limit is Rs. 4,00,000, you can set the ATM usage limit up to 40% of your card limit, i.e. Rs. 1,60,000. If you don’t want your card to be used for ATM withdrawals, you can turn the ATM usage option off through net banking. The maximum limit for contactless payments is Rs. 50,000 and you can set it as well on your own. If you don’t want to enable contactless payments on your card, you can turn the option off. The merchant limit can be up to 100% of the card limit, and you can set it on your own. A similar process goes for international transactions as well. If you don’t want any international transactions to be done using your card, you can turn the option off, and if you want it to be used, then you can set category-wise limits.

How To Set Usage Limits on HDFC Bank Credit Cards?

To set the usage limit on your HDFC Bank Credit Card, follow these simple steps:

- Log in to your HDFC Bank internet banking account.

- Go to the option ‘Cards.’

- Click on the option requests.

- Select the option ‘Set Card Controls.’

- Click on ‘Usage Limits.’

- You will see a page that will allow you to set category-wise usage limits.

- Set the usage limits on your card and confirm.

Bottom Line

In order to catch up with other card issuers on the technology part, HDFC Bank has come up with the new feature of setting usage limits on credit cards. This is a great and much-required step taken by the bank as most of the credit card issuers were already providing this feature. Earlier, HDFC Bank credit cardholders could only enable or disable international transactions, and now, the bank has provided more control to manage credit card spending. Being an HDFC Bank Credit cardholder, you should avail of the facility as soon as possible so that you can control your credit card usage and hence avoid unnecessary spending.