BoB Financial is quite popular for offering user-specific credit cards like the Varunah Credit Card for navy personnel, Yoddha Credit Card for Indian Army personnel, and many more. This time, on the occasion of Indian Republic Day, the card issuer has come up with another such offering named ‘Bank of Baroda Vikram Credit Card,’ which is exclusively for Indian Defense Personnel.

Like other targeted credit cards by BoB, this card is also lifetime free and comes with a number of decent privileges across several categories. Indian army, navy, as well as air force personnel, are eligible to apply for this card as it is not just for one particular category under defense services. For more information about the features and benefits of the BoB Vikram Credit Card, keep reading:

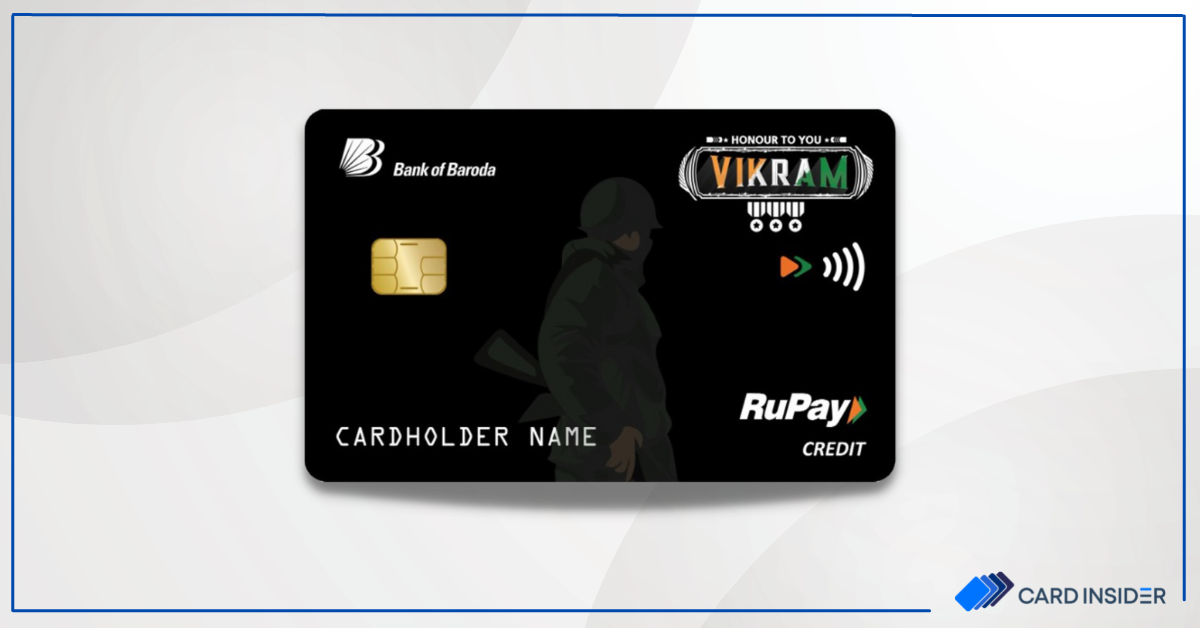

Bank of Baroda Vikram Credit Card

The BoB Vikram Credit Card comes with a zero joining/annual membership fee, i.e. it is a lifetime free credit card. Talking about its reward rates, it offers up to 5 Reward Points on every spend of Rs. 100 and these points are redeemable against a variety of options available at the BoB Rewardz portal. Moreover, the Vikram Card charges a slightly low foreign currency markup fee compared to most of the average cards in India. Some of the most crucial benefits of this card are as follows:

Also Check: BoB Launches RuPay ‘Rakshamah’ Credit Card Exclusively for Indian Coast Guards Personnel

- Welcome Benefits: With this card, you get 3 months complimentary subscription to Disney Hotstar. You can avail of this by logging in to Hotstar with the mobile number registered with your Vikram Credit Card and entering the coupon code received on your registered number.

- Reward Rates: The reward rates offered by this credit card are as mentioned below:

– 1 Reward Point on every retail send f Rs. 100.

– 5x Reward Points on groceries, movies and departmental store spends. - Interest rate: the interest rate on this credit card is just 3.25%

- Low Forex Markup Fee: the forex markup fee on this credit card is 3%, which is lower than the average fee of 3.5% charged by most of the credit cards in the market.

- Fuel Surcharge Waiver: The Vikram Card also offers a 1% fuel surcharge waiver on all transactions between Rs. 400 and Rs. 5,000. The maximum waiver per billing cycle is capped at Rs. 250.

Check more details here.

Bottom Line

The Vikram Credit Card launched by Bob Financial seems to be a direct competition to Axis Bank’s Pride Platinum Credit Card, which is also targeted at Indian Defence Personnel. The best thing about the Vikram Card is that it is a lifetime free credit card and hence is affordable for all the defence personnel in the country. With a zero annual fee, the card is offering quite good benefits, and hence, one must not think twice before applying for it if they are eligible. If you want to apply for this card or if you have any further doubts, fell free to ask us in the comment section below!

Vikram Credit Cards also offered to Indian defence, paramilitary and police personnel, who are not covered by BOB’s exclusive cobranded Credit Cards namely Yoddha (with #IndianArmy), Varunah (with #IndianNavy), Rakshamah (with #IndianCoastGuard) and The Sentinel (with #AssamRifles).

I have already used your varuna premium card can I apply for Vikram credit card.currently i am in Indian Navy

I am a Ex-servicemen from Indian Army, can I apply the Vikram card.

I have applied BoB credit throughout online but Bank of Baroda has rejected due to financial criteria.

Whether Ex servicemen (armed forces pensioners) eligible for BOB Vikram Credit card