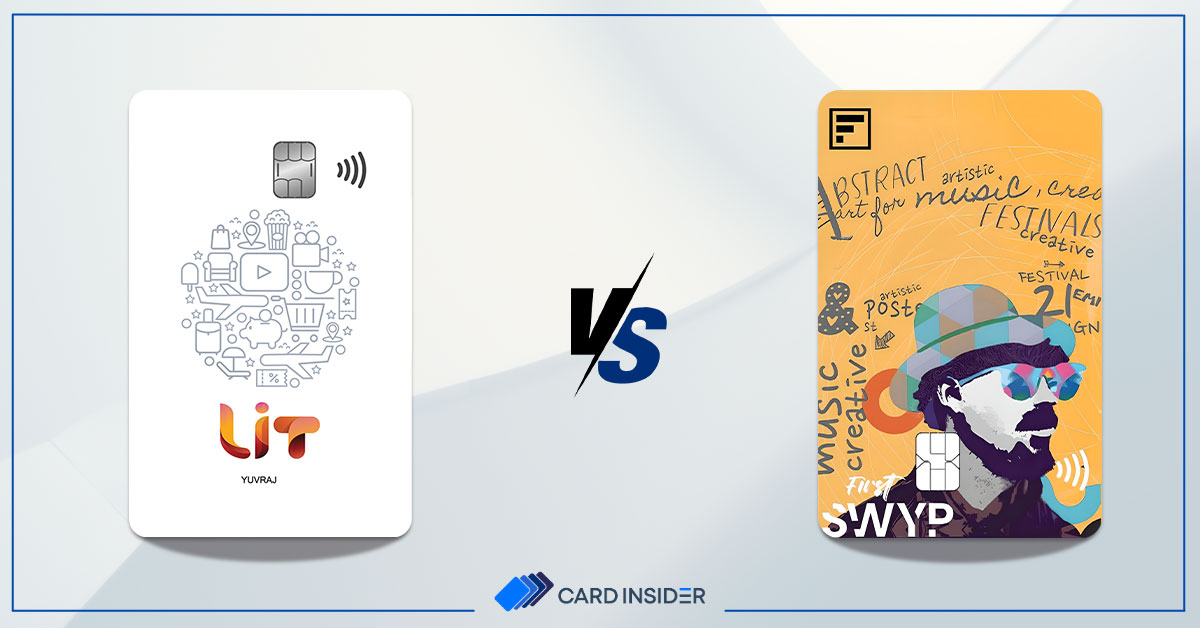

Are you looking for a new credit card with better rewards? Or are you a credit card enthusiast looking to expand your knowledge? Or are you confused between the two maestros -IDFC FIRST Bank SWYP and AU Bank LIT Credit Card?

Credit cards have become quite popular in India, particularly with the introduction of UPI and its linking with credit cards. With the convenience of making payments at your fingertips, credit cards and their benefits have taken over all our minds. 2023 saw the addition of many new and innovative credit card offerings by AU and IDFC Bank, and this trend of offering the best shall continue well into 2024.

Both these banks are known for offering some interesting and affordable credit cards in the market, especially for millennials and the younger generation.

AU LIT Credit Card is a popular choice among many, while the IDFC SWYP Credit Card is a fairly new addition to the Indian credit market. In some aspects, the SWYP Card matches the benefits of India’s first customizable credit card – the LIT Card. If you are looking for a new credit card or are confused between these two, we shall discuss all the pros and cons of these credit cards.

Quick Glance at AU Bank LIT Credit Card

The LIT Credit Card is offered by AU Bank and is free for a lifetime. It is India’s first customizable credit card. You can pay only for the features that you require and ignore the rest. With the LIT Card, you can build your own credit card that will suit your spending habits and provide you with the maximum benefit in terms of cashback and rewards. Zee 5, Amazon Prime, and Cult.fit membership can also be availed at a discounted price with this card. The prices for some of the features that you can opt for are mentioned below.

- One Lounge Access for ₹199

- 5% Additional Milestone Cashback for ₹299

- 1% Fuel Surcharge Waiver for ₹50

- 10X Rewards Points on Online Transactions for ₹299

All the above are valid for a period of 90 days.

Quick Glance at IDFC Bank FIRST SWYP Credit Card

The FIRST SWYP Credit Card by IDFC Bank boasts innovative features. What sets this card apart from others is that you have the option to either pay the total amount due at the end of each cycle or convert it into easy EMI spends.

The card comes with a host of benefits, including reward points and discounts on popular brands such as Tata CLiQ, Zomato, and Dominos, making it a top choice for youngsters. At just Rs. 499, the joining fee is affordable, and the card can be easily linked to your UPI apps.

With this credit card, you won’t have to worry about paying hefty interest as it offers flexible EMIs.

Comparison of AU LIT and IDFC SWYP Credit Cards

| Features | AU Bank LIT Card | IDFC Bank FIRST SWYP Card |

| Joining/Renewal Fee | Nil | ₹499 + GST |

| Welcome Benefit | N/A | 1,000 RPs on First EMI Transaction, 1 Year Lenskart Gold Membership & 1-Year Times Prime Membership |

| Most Suited for | Shopping | Travel | Shopping |

| Rewards Redemption Fee | N/A | ₹99 |

| Rewards Rate | 10X RPs for Online Transactions (Rs. 299 for 90 Days) | 200, 500, and 1,000 RPs on Spends of Rs. 5,000, 10,000, and 15,000 Respectively |

| Movie & Dining | – | 25% Discounts on Movie Tickets |

| Travel Benefit | One Lounge Visit ( Rs. 199 for 90 Days) | 4 Free Railway Lounge Access Each Quarter |

Which is the Best LIT or FIRST SWYP Credit Card?

Although the AU Bank LIT Card is a lifetime offering, it requires you to pay for the benefits you wish to avail. On the other hand, the IDFC SWYP Credit Card offers all its given features simply by paying the yearly fees.

The LIT Credit Card is customizable, but you need to pay for the features for 90 days. This feature can be a nightmare for some, while it can be a boon for many. You can literally customize the cashback category you would like to choose, whether it’s electronics or apparel.

If someone doesn’t need lounge access, they don’t need to pay for it. With the AU Bank LIT Card, you can opt for the features you use and skip all else.

On the other hand, the IDFC SWYP Credit Card offers clear and transparent benefits for which you need to pay a small joining fee of Rs. 499. This card is ideal for the young and hearty who sometimes get short on funds and wish to convert those expenses into EMIs. The IDFC SWYP Credit Card will provide you with maximum financial flexibility.

Our Verdict

And the winner is… *drumroll* AU Bank LIT Credit Card.

Choosing between two advantageous credit cards can be difficult, but the AU Bank LIT Credit Card would be the most suitable for the majority of people. This card offers customizable features such as cashback percentages and airport lounge visits, making it the perfect choice. With this credit card, you can earn unlimited cashback on certain categories while also earning accelerated reward points on others. But keep in mind you have to select and pay for the features you need. The benefits would surely outweigh the costs.

Do you agree or disagree? Leave a comment and share your thoughts.