AU Bank is a rising player in India’s credit card market, with a range of innovative and exciting credit cards. Recently, the bank has focused on providing affordable and rewarding credit cards within the country. There are some popular credit cards offered by AU Bank, such as Altura, Altura Plus, and LIT Credit Card, that are available to customers for free for a lifetime. This has created a lot of buzz around AU Bank cards and is expected to lead to a rise in its customer base. The bank has also introduced the co-branded ixigo credit card, catering to travelers and frequent flyers. However, even AU Bank Credit Cards are not immune to the cloud of devaluation and revisions.

All AU Bank Credit Cards shall undergo some change or the other effective from 1st April 2024, whether it’s changes in the annual rate of interest, late payment charges, or major devaluations for cards like Zenith. AU Bank Cards shall be modified in the near future, and customers need to be aware of this. Even those who are yet to receive their cards or are considering applying for an AU Bank Credit Card should be well aware of these changes.

Devaluation of AU Zenith Credit Card

Once the most premium card offered by AU Bank, Zenith Credit Card shall now undergo some significant changes and devaluations, which shall come into effect from 1st April.

- Zenith cardholders can avail of 8 complimentary domestic airport lounge access (within India) using his/her Visa credit card in a year. A maximum of 2 complimentary visits per calendar quarter can be availed.

- On insurance spends, the cardholders can earn 1 Reward Point per ₹100. Please note that insurance merchant category codes/MCCs are limited to 5960 and 6300.

- Cardholders can earn up to 5,000 Reward Points per statement cycle on Dining spends with participating merchant category codes (MCCs): 5811, 5812, 5813, and 5814.

- Cardholders will earn a maximum of 25,000 Reward Points in a statement cycle.

Revision of Reward Points Earning on Telecom/Utility

With the new revisions, all AU Bank Credit Card holders shall now earn 1 Reward Point per ₹100 on utility & telecom spends. Reward Points will be limited to 100 per transaction and capped at Rs. 10,000. This is not applicable to Zenith Plus Credit Card, ixigo AU Credit Card, or Aditya Birla Finance AU Pro/Flex/Nxt/Biz Credit Cards.

| Reward Rate | Categories | Applicable Cards |

| 1 Reward Point Per ₹100 | Utility & Telecom (4812,4814,4899 & 4900) | AU Bank Altura Plus, Vetta, InstaPay, Zenith, Altura, and Xcite Credit Cards |

Discontinuation of Reward Points/Cashback

Most AU Bank Credit Card holders shall no longer be able to earn any RPs or cashback for payments made towards Rent, Education, and Government transactions. A vast majority of credit cards don’t offer any rewards in these categories, and now AU Bank has joined the list.

All AU Bank Credit Cards except Zenith+ Credit Card, ixigo AU Credit Card, and Aditya Birla Finance AU Pro/Flex/Nxt/Biz Credit Cards shall no longer be able to earn any Reward Points on the below-mentioned categories and MCC codes.

| Categories | MCC |

| Rent | 6513 |

| Education & Government | 8211, 8220, 8241, 8244, 8249, 8299, 9211, 9222, 9223, 9311, 9399, 9402, 9405, 9950 |

Revision of Charges/Interest Rates for AU Small Finance Bank Credit Cards

Revision of Annualized Percentage Rate (APR)

Starting from 1st April, the Vetta, Zenith, Xcite Ace, and Xcite Ultra Credit Card series will have an APR of 3.59% per month, which amounts to 43.08% per annum.

Prior to this change, the Xcite AU Credit Card series had an interest rate of 3.59% per month, while Vetta and Zenith had interest rates of 3.49% per month (41.88% annually) and 1.99% per month (23.88% annually), respectively. With this change, almost all of the AU Bank Credit Cards have come under the same umbrella. Almost all of them shall now have the same interest rate except for the premium Zenith+ Credit Card.

Revision of Cash Withdrawal Charge

When using AU Credit Card to withdraw cash, a fee of 2.5% of the withdrawal amount, or ₹500, whichever is higher, will apply. However, Zenith+ Credit Cardholders are exempted from cash withdrawal charges.

Previous AU Bank Credit Cards Cash Advance Charges – 2.5% of the amount withdrawn, subject to a minimum of ₹100.

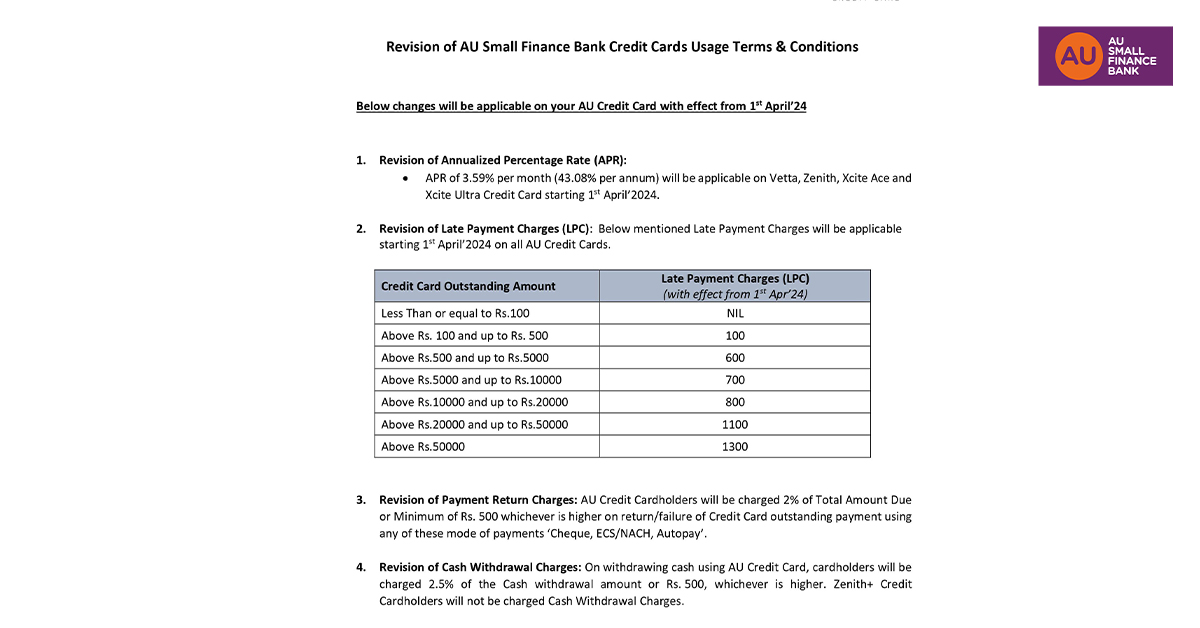

Revision of Late Payment Charges (LPC)

There has been a slight increase in the late payment charges for AU Bank Credit Card. Their previous and new late fee charges are mentioned below.

| Statement Balance | Late Payment Charges OLD | Late Payment Charges NEW |

| Less Than or Equal to ₹100 | Nil | Nil |

| Above ₹100 and up to ₹500 | ₹100 | ₹100 |

| Above ₹500 and up to ₹5,000 | ₹500 | ₹600 |

| Above ₹5,000 and up to ₹10,000 | ₹700 | ₹700 |

| Above ₹10,000 and up to ₹20,000 | ₹800 | ₹800 |

| Above ₹20,000 and up to ₹50,000 | ₹900 | ₹1,100 |

| Above ₹50,000 | ₹1,100 | ₹1,300 |

Click here to view the official notification for revisions by AU Bank.

Bottom Line

Devaluations and revision of benefits offered by credit cards are the talk of the town. Ever since the end of the previous year and the beginning of this one, there have been many important changes to the cards of major banks and issuers in India. AU Bank is no exception to this. Whereas a few months ago, AU Bank received praise from credit card enthusiasts all around for improving the ixigo Credit Card, now the bank has brought some considerable changes to its credit cards and fee structure. The official notification for these changes came out on the 1st of March and all changes shall be valid and implemented from 1st April 2024.

In recent times, AU Bank has been the only bank to revise the fee structure of its credit card so extensively. This includes the changes to late fee payment charges, annual interest rates, loan processing fees, and cash withdrawal charges. Apart from the fee changes it seems that Zenith Credit Card users shall be most affected by these changes as lounge access and accelerated reward point earning all aspects have undergone some change.

AU Bank Credit Card holders or new applicants can share their views on this latest update from the bank in the comment section below. Feel free to ask any questions you may have regarding the same.