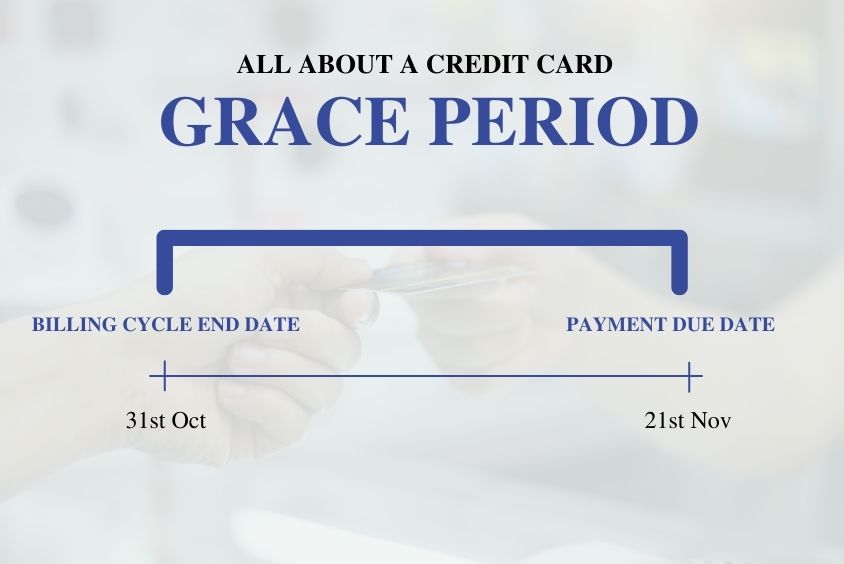

For credit card users, it is very important to understand every term related to credit cards so that they can use their cards in the right way and can get the maximum benefit. One such very important term is ‘Grace Period.’ Many of you might be aware of its definition but not of how to make the best use of it. With this article, we will help you understand what a grace period is and everything you must know about it. A credit card grace period is the time period between the billing cycle end date and the payment due date. No interest is accrued on your due amount and your purchases (except a few transactions) during this period. It can also be understood as the time your card issuer provides you to repay the money you borrowed without paying any interest or extra charges. Keep reading to know more.

How Do Credit Card Grace Periods Work?

Your credit card grace period begins on the date when your credit card statement is generated (or the day when a billing cycle ends) and generally lasts for 20-22 days (can be different for different credit card companies). For example, if your credit card billing cycle starts on October 1, 2021, and ends on October 31, 2021, then your statement will be generated on 31st October and it is the date when your grace period begins. Then, if your payment due date is November 21, 2021, it means that your grace period ends on this date and is of 20 days in total. No interest will be accrued on your outstanding amount or your purchases between October 31, 2021, and November 21, 2021. However, the regular interest is accrued on some transactions like a cash advance or balance transfer even during the grace period. You may or may not get the grace period depending on the following situations:

When You Pay Your Balance in Full

If you have paid your full due amount last month and you carry no balance on your credit card then your card will be eligible for a grace period and no interest will be charged on your outstanding amount and all the purchases you make during this period. So, it is highly advisable for you to pay your full outstanding balance every month as you can not only get the benefits of the grace period but it can also help you improve your credit score.

Also Read: 7 Ways to Increase Your Credit Score

When You Pay Only the Minimum Amount Due

Paying only the minimum amount due is not a good idea as you might not get the grace period in this case. If you don’t pay your full outstanding amount or you miss your payments, then you don’t get any grace period and interest is charged on your due amount as well as all the new purchases you make. So, paying the full outstanding amount is far better than paying only the minimum amount each month.

What is an Interest-Free Period on a Credit Card?

People often understand grace period and interest-free period as the same thing but both are different. The grace period is the period between the billing cycle end date and the payment due date, whereas the interest-free period includes the grace period and the period between the day when a transaction was made to the billing cycle end date. Let us go back to the above example. Suppose you make a transaction on 10th October 2021, then no interest will be accrued on it until the billing cycle ends and in the grace period as well, provided that you have paid your balance in full last month. In this case, you get a total interest free period of 41 days (11th October 2021 to November 20, 2021).

How To Make The Best Use of a Credit Card Interest-Free Period?

Let us take the above example again, where a billing cycle starts on the 1st of every month and ends on the last date (30th or 31st) of that month and the payment due date is on the 21st of the next month. Now, suppose your billing cycle ends on October 31, 2021, it means that all your transactions made between the 1st and 31st of October will be added to your bill and the statement will be generated. Now, the transaction you make on the 1st of November will not be added to this statement and will be added to the one that would be generated on November 30, 2021, for which you will need to pay on December 21, 2021, without paying any interest. So, in this way, you can avail an interest-free period of 50 days (30 days of billing cycle and 20 days of grace period) and you get enough time to repay your bills. Therefore, if you plan to make any big purchases, you should try to make them on the very first day of your new billing cycle.

Interest Free Periods Provided by the Major Credit Card Issuers in India

| Card Issuer | No. of days in Interest-free Period |

| HDFC Bank | 20 to 50 days |

| ICICI Bank | 18 to 48 days |

| SBI Card | 20 to 50 days |

| Axis Bank | 20 to 50 days |

| IndusInd Bank | Up to 50 days |

| American Express | 21 to 51 days |

| Kotak Mahindra Bank | 18 to 48 days |

Bottom Line

Now, you might have understood how a credit card grace period works and how you can make the best out of it. You can find the details of your billing cycle, payment due date, etc, on your credit card statement and hence calculate the number of days in the grace period provided to you by your card issuer. The no. of days in your grace period or the total interest-free period is also mentioned in the most important terms and conditions of a credit card issuer. Whenever you plan to make some big purchases, you should make them at the very beginning of your credit card billing cycle so that you can get enough time to repay your bills. In case of any further doubts regarding the topic, you can write them in the comment section below.