India has witnessed phenomenal changes in its financial system, whether we talk about regulations, plastic money, digital money, or the general way in which we handle our day-to-day transactions. From rummaging through our pockets for notes to simply clicking a few buttons on our phones, we have all come a long way.

A huge part of our financial revolution is plastic money. Credit cards have not only provided us with freedom by offering a simple line of credit, but they have also rewarded our spending. Even though there has been a dramatic and almost meteoric rise in the use of UPI, credit cards still play a significant role. The linking of RuPay credit cards to UPI applications like GooglePay is a testament to this.

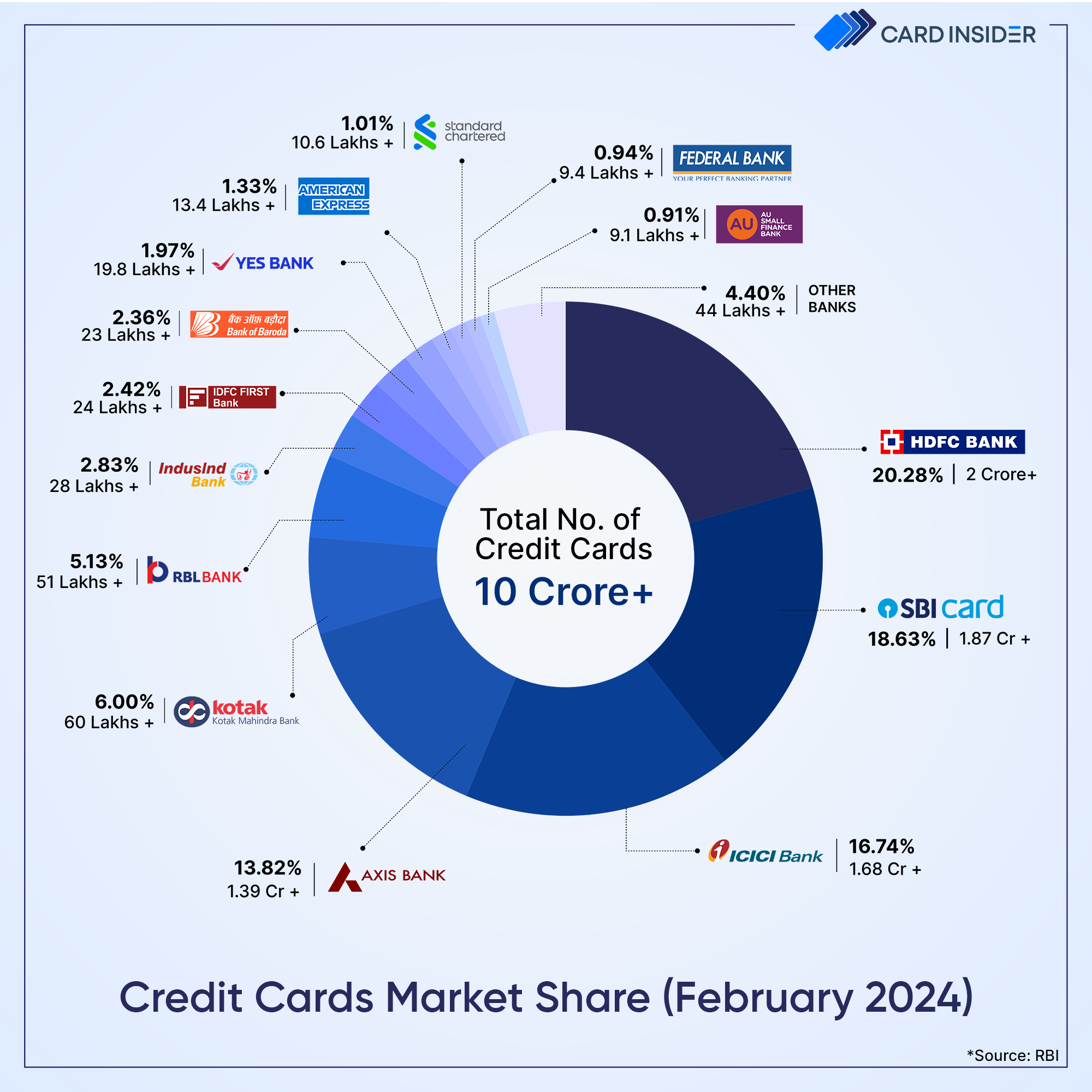

In February of 2024, India officially crossed the mark of over 10 crore credit cards (100 million) in the country. This marks a milestone in the credit card revolution in India. While credit cards are the norm in developed nations, our country lagged. From having the first credit card issued by the Central Bank of India to now having a large variety of cards, we have all come a long way. Whether it is specific cards for fuel or co-branded credit cards like Swiggy HDFC Bank Credit Card, there is a perfect card for everyone.

Let’s have a look at a few figures.

- HDFC Bank is the largest card issuer in India. It is also the first to cross the 2 crore credit card mark. Last year, in February, it had nearly 1.72 crore cards in circulation.

- SBI Card had nearly 1.65 crore credit cards in circulation in February 2023, while currently, it has 1.87 crore credit cards. As of now, SBI Card is the second-largest credit card issuer in India.

- Apart from HDFC and SBI, both ICICI Bank and Axis Bank have a large number of credit cards. ICICI Bank has over 1.68 crore credit cards while Axis Bank has 1.39 crore.

Bottom Line

HDFC Bank has emerged as the leader in the credit card market in India with over 2 crore credit cards. This is surprising because SBI is the favorite banker of the masses. Yet, due to its beneficial cards, HDFC has surpassed all the other issuers in the country. SBI closely follows HDFC Bank with 1.87 crore credit cards and ICICI Bank with 1.39 crore cards.

The rise in the use of credit cards can also be attributed to the younger generation. As awareness about the benefits of credit cards spreads, the numbers naturally increase. It’s also worth noting that credit cards with partnerships with popular brands have led many to experiment with cards, as they would receive benefits from their favorite brands. Whether Reliance, Swiggy, BookMyShow, or Titan, there is a wide range of co-branded cards.

From hindrances in acceptance and stigma around credit cards to being widely used, plastic money in India has seen a long and eventful journey. Do you own and use a credit card? Share some of your thoughts on this growth of credit cards in India.