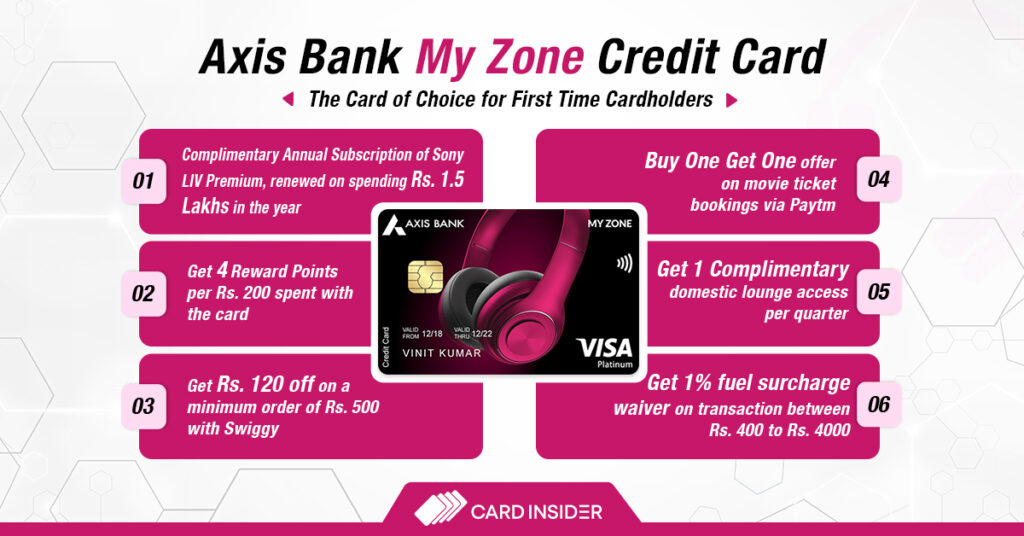

The My Zone Credit Card is an entry-level offering by Axis Bank. The card welcomes its customers with a complimentary premium subscription to SonyLiv worth ₹999. Considering that this offering can be availed at a joining fee of ₹500, the card comes packed with plenty of value-added benefits, including movie & dining offers, complimentary domestic airport lounge access, and many more. Regarding the reward rate, you earn 4 EDGE Points for every ₹200 you spend with the card, where 1 Edge Reward = ₹0.20. This adds up to a reward rate of 0.4%.

Moreover, you are given a buy 1 get 1 free offer on movie tickets monthly via Paytm Movies. Keeping the dining requirements of its customers in mind, Axis Bank offers up to 15% off up to ₹500 on dining with this credit card. Besides all these privileges, you also get complimentary access to domestic airport lounges every quarter, although, after the recent devaluation, you would need to meet the minimum spend criteria to be eligible for one. The card comes with additional benefits including milestone benefits, and exciting discount offers on shopping brands like AJIO.

Our review of the Axis My Zone credit card will reveal all its features, benefits, and associated fees. Additionally, readers will learn how to make the most of their cards for maximum benefits.

- Axis My Zone Credit Card – Rewards

- What Can I Redeem My Points For?

- Free Annual SonyLiv Membership

- Milestone Benefit

- Buy One Get One” With Paytm Movies

- Instant Discounts of ₹120 on Swiggy

- My Zone Credit Card Discounts With EazyDiner

- Discount on Shopping With Ajio

- My Zone Credit Card Complimentary Airport Lounge Access

- Axis My Zone RuPay UPI Credit Card

- Fuel Surcharge Waiver

- My Zone Credit Card Benefits Calculator

- Axis Bank My Zone Credit Card Eligibility Criteria

- Axis Bank My Zone Credit Card Limit

- How to Apply for the Axis Bank My Zone Credit Card?

- Other Cards Similar to Axis Bank My Zone Credit Card

- Card Insider’s Review of Axis Bank My Zone Credit Card

- FAQ

Axis My Zone Credit Card

Joining Fee

Renewal Fee

Best Suited For

Movies | Shopping | Food |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

BOGO offer on movie ticket bookings via Paytm Movies, up to 15% off at partner restaurants with Dining Delights & flat Rs 120 off on food orders with Swiggy.

Rewards Rate

4 EDGE Points/₹200 (Reward Rate of 0.4%)

Reward Redemption

EDGE Points earned on the card are redeemable against shopping/travel vouchers or for purchasing products on the Axis Bank EDGE Rewards Portal

Travel

N/A

Domestic Lounge Access

1 Complimentary Lounge Access Every Quarter (4 Each Year)

International Lounge Access

N/A

Golf

N/A

Insurance Benefits

N/A

Spend-Based Waiver

N/A

Rewards Redemption Fee

Nil

Foreign Currency Markup

3.5% of the transaction amount

Interest Rates

3.6% per month (52.86% per annum)

Fuel Surcharge

1% fuel surcharge waived off at all filling stations across India for transactions between Rs. 400 and Rs. 4,000 (max waiver capped at Rs. 400 per month)

Cash Advance Charges

2.5% of the withdrawal amount subject to a minimum charge of Rs. 500

- Complimentary SonyLiv Premium annual subscription (renewed on spending Rs. 1.5 lakh in an anniversary year).

- 4 EDGE Points per Rs. 200 spent with the Axis Bank My Zone Credit Card.

- Discount on Swiggy of Rs. 120 per order (minimum order value of Rs. 500 required).

- Buy One Get One offer on movie ticket bookings via Paytm movies.

- 1 complimentary domestic airport lounge access per quarter.

- Flat discount of Rs. 1000 on AJIO on minimum spends of Rs. 2,999.

- 15% off up to Rs. 500 on a minimum order of Rs. 1500 with the EazyDiner program.

Pros

- Incredibly beneficial for moviegoers, this card offers great one-plus-one deals on bookings with Paytm Movies.

- The Axis Bank My Zone Credit Card provides great discounts on Swiggy orders. Use coupon code “Axis 120” to avail of this offer.

Cons

- Although this card offers free airport lounge access, it can only be availed on making spends of ₹50,000 or more in the previous quarter.

- No Reward Points for spends on movie ticket booking.

Axis My Zone Credit Card – Rewards

Often people associate credit cards as a tool for a simple line of credit. But a credit card is quite more than that. Let’s take the Axis My Zone Card with this card, you would earn 4 EDGE Points/₹200 spent on all eligible categories with this card. These EDGE Reward Points would allow you to maximize your savings while spending on daily needs. No EDGE Rewards will be earned on movies, fuel, wallet reloads, insurance, education, government-related, and EMI transactions.

What Can I Redeem My Points For?

The EDGE Points earned on the card are redeemable for shopping/travel vouchers or for purchasing products (from the given product catalog) from the Axis Bank EDGE Rewards Portal. The value of 1 EDGE Point = ₹0.20.

Free Annual SonyLiv Membership

You get a complimentary annual premium membership of SonyLiv worth ₹999 as a welcome benefit. Cardholders will be eligible for the complimentary membership only after making their first transaction within 30 days of the card issuance. The voucher code will be sent to you via SMS on your registered mobile number within 45 days of card issuance.

Milestone Benefit

The complimentary SonyLiv membership is renewed every year on spending a minimum of ₹1.5 lakhs in an anniversary year. The voucher code will be sent to you within 60 days after the payment of the annual fee. Transactions made on Rent (MCC – 6513) and Wallet (MCC – 6540) shall not be considered towards milestone spends.

“Buy One Get One” With Paytm Movies

Buy One Get One offer on movie tickets on Paytm movies – up to 100% discount on a second movie ticket (max benefit of ₹200 per month per customer). Coupon code “AXIS200” needs to be used to avail of this offer. Although cardholders would get the benefit of a free movie ticket with the My Zone Card no reward points shall be awarded for these transactions. This feature makes the My Zone Card a must-have for frequent moviegoers. Those who would like to maximize their movie benefits with a credit card would be able to receive benefits of up to Rs. 2,400 in a year with the My Zone Credit Card.

Instant Discounts of ₹120 on Swiggy

Get ₹120 off on the popular food delivery platform Swiggy on orders of ₹500 and above. My Zone cardholders can avail of the offer twice a month. “AXIS120” is the valid code to be used for redeeming this offer. It’s not valid at Haldiram’s restaurants across India.

My Zone Credit Card Discounts With EazyDiner

15% off up to ₹500 on a minimum order of ₹1500 via the exclusive dining program of Axis Bank in collaboration with EazyDiner. This discount of ₹500 can be availed once per month and would yield savings of ₹6,000 in a year.

Discount on Shopping With Ajio

For those who like to stay updated with the latest fashion trends the My Zone Card also offers generous discounts on popular clothing platforms. Get up to ₹1,000 off on the popular online shopping platform AJIO on a minimum spends of ₹2,999. This means that My Zone credit card holders can easily get up to a 33.33% discount on purchases made with Ajio. Use coupon code ‘AJIOAXISMZ‘ to avail of the offer. Please keep in mind that this discount is only available on select styles of T-shirts, jackets, sweaters and sweatshirts, party wear etc.

How to Redeem AJIO Offer?

- Click on the specially curated link for AJIO discount with My Zone Card.

- Select the products of your choice from the curated styles and add them to your cart.

- Login or sign up on AJIO before applying the coupon code.

- Apply the coupon code AJIOAXISMZ under ”Use coupon” to get the discount.

- After applying the discount, you need to use your My Zone credit card to place the order with the instant discount.

- Once you input your card details, the system will check the eligibility of your My Zone credit card.

- If your card is eligible, you can successfully place the order with the discount.

My Zone Credit Card Complimentary Airport Lounge Access

Many credit cards in India are currently undergoing changes, particularly regarding free lounge access. However, with the Axis Bank My Zone Credit Card, you can still easily access domestic airport lounges throughout India once every quarter. These four complimentary airport lounge access in a year are especially noteworthy since this card is available at a low joining fee of ₹500. Please note that starting from May 1st, 2024, access to domestic airport lounges will be based on a minimum eligible spend of ₹50,000 in the previous three calendar months.

In the case of a newly issued card, the minimum spend criteria is waived for the month of card issuance as well as for the following 3 calendar months. Here is the complete list of lounges that can be accessed with the My Zone Credit Card.

| City | Airport Lounge | Airport Terminal |

| Bangalore |

|

|

| Chennai |

|

|

| Hyderabad |

|

|

| Kolkata |

|

|

| Mumbai |

|

|

| New Delhi |

|

|

Axis My Zone RuPay UPI Credit Card

The My Zone Credit Card from Axis Bank is now available on the RuPay network in addition to MasterCard and Visa. RuPay Credit Cards can be easily linked to UPI applications, which is a huge benefit for many people. Those who find this feature useful can choose the RuPay variant of the My Zone Credit Card and make convenient payments through apps like PhonePe and Google Pay.

Fuel Surcharge Waiver

A 1% fuel surcharge will be waived at all petrol stations across India for transactions between ₹400 and ₹4,000 (max waiver capped at ₹400 per statement cycle). No reward points shall be awarded for fuel transactions.

My Zone Credit Card Benefits Calculator

This table displays the various benefits that can be availed with the card. It takes into account the discounts offered on different brands, travel benefits, and the value of welcome benefits. It does not consider any eligible spends made with the card that earn EDGE Reward Points.

| Benefit | Amount of Benefit (Annual) |

| SonyLiv Membership | ₹999 |

| BOGO With Paytm Movies | ₹2400 |

| Online Food Orders With Swiggy | ₹2880 |

| Free Airport Lounge Access | ₹2000 |

| Discounts on Ajio | ₹1,000 |

| Total Benefits | ₹8,799 |

Considering the affordable joining fee this card is extremely rewarding.

Axis Bank My Zone Credit Card Eligibility Criteria

The basic eligibility criteria that you will have to fulfill to get approved for the Axis Bank My Zone Credit Card are as follows.

- The primary cardholder must be between 18 years and 70 years of age.

- Add-on cardholder(s) must be above 15 years of age.

- You must have a stable source of income.

- The cardholders must be Indian residents or NRIs.

Axis Bank My Zone Credit Card Limit

The credit limit assigned with the Axis Bank My Zone Credit Card is not fixed for every cardholder. It may vary depending on their past payment behavior, their credit history, income, and a few other factors. People with a high credit score generally get a higher credit limit than those with an average or low credit score.

However, if you are not satisfied with the credit limit you have, you can always apply for a higher credit limit. To do this, you can either contact your credit card customer care or visit your nearest Axis Bank branch. However, it is highly advisable to use your My Zone card responsibly for a few months before applying for a credit limit increase.

How to Apply for the Axis Bank My Zone Credit Card?

Applying for the Axis Bank My Zone Credit Card is convenient, as you can choose to do it online or offline. To apply offline, you need to visit the nearest branch and fill out the physical application form. If you prefer to apply online, follow these easy steps:

- Click on the Apply Now button at the top of this page.

- You will be taken to the Credit Card application page.

- Simply fill in a few details and apply for the Axis Bank My Zone Credit Card.

- Your card shall be delivered after approval.

Axis Bank Customer Care

For any queries or complaints related to your Axis Bank My Zone credit card, you can contact the Axis Bank credit card customer care via the following contact details:

- For any emergency assistance, you can call customer care at 1860-419-5555, 1860-500-5555, and +91-22-67987700 (24*7 helpline).

- To contact customer care via mail, go to Axis Bank’s official website, click on the option ‘support,’ select ‘Contact via Email’ and proceed further to write and send the email.

Other Cards Similar to Axis Bank My Zone Credit Card

The Axis Bank My Zone Credit Card is a basic yet highly popular card offered by the bank. For a nominal fee of just ₹500, it provides a range of exciting benefits across various categories such as travel benefits, milestone benefits, and more. There are several other cards available at the same annual charge that offer features comparable to this card. To help you compare, we have provided a table below with other popular cards that can be availed at an annual fee of ₹500.

| Features | My Zone Credit Card | SBI SimplyCLICK Credit Card | Airtel Axis Bank Credit Card |

| Fees | ₹500 + GST | ₹499 + GST | ₹500 + GST |

| Reward Structure | 4 EDGE Points/₹200 | 5X Reward Points on Online Spends and 1 Reward Point/₹100 on Offline Spends | 25% Cashback on Airtel Bill Payments, 10% Cashback on Utility Bills and 1% Cashback on All Other Spends |

| Free Lounge Access | 1 Complimentary Lounge Access Every Quarter (4 Each Year) | N/A | 1 Complimentary Lounge Access Every Quarter (4 Each Year) |

| Offers on Popular Brands | BOGO On Paytm Movies and Discounts of Ajio and Swiggy | 10X Reward Points on Online Purchases at Cleartrip, BookMyShow, Dominos, Lenskart, Yatra, Apollo24x7, Myntra and Netmeds | 10% Cashback on Spends Made With Swiggy, Zomato and BigBasket |

Card Insider’s Review of Axis Bank My Zone Credit Card

Looking for a card that offers discounts on dining, travel, and food delivery? Look no further! This card not only offers these benefits but also provides a discount on the popular clothing platform Ajio. You can enjoy free airport lounge access, discounts on popular brands, and a low joining fee with this card.

Axis Bank My Zone Credit Card can be the card of choice for new to-credit millennials/Gen Z or first-time cardholders for whom movie and dining spending account for a substantial portion of their total monthly spending. This card offers discounts on the food delivery app Swiggy, discounts on dining bills at partner restaurants, a complimentary SonyLiv membership, and a Buy One Get One offer on movie tickets on Paytm Movies.

What’s your opinion of this entry-level offering by Axis Bank? Do let us know in the comments. And if you’re an existing cardholder, feel free to share your experience.

Free airport lounge facility is available for Add-on Card member of Axis Bank My Zone Credit Card?

There is only one free airport lougne, per quarter is available. Is it possible for a Add-on Card holder to use that free airport lounge?

Hello! No, this facility is only for the primary cardholder.

How can someone get an Axis MyZone credit card with no annual fees or lifetime free?

Hello! This card currently has a joining/annual charge of Rs. 500, but you can get it for free for life through select channels.

Can I apply Axis Bank My Zone Credit Card Against FD and does it affect my credit limit?

Hello! Yes, you can apply for this card against your FD. Your credit limit will be equal to or lower than the fixed deposit.

Will you forgive a late payment?

Hello! There are late payments charges which have to be made.

Does Axis Bank offer a dining discount with MyZone credit card?

Hello, Rajeshwari. You can get flat Rs. 120 off on Swiggy orders on a minimum spend of Rs. 500 with the Axis Bank MY ZONE Credit Card. Also, you can avail 15% discount at partner restaurants with the Dinning Delights Program.

Please let me know how I can redeem my 3000+ Edge Reward Points and what they can be used for?

You can redeem your EDGE Reward Points for vouchers, products or even against your credit card statement.

How can i check the application status of the axis bank myzone credit card please let me know? I have applied for this card 2 days ago and i am not able to track my application process.

Go and check your Axis Bank Credit Card application status here.

which card is better flipkart axis bank credit card or my zone credit card, please suggest me the better one in both of these cards so that i can get more discounts on shopping and movies.

This depends on your usage if you shop often with Flipkart then the Flipkart Axis Bank would offer you 5% cashback whereas with the MyZone Credit Card you can get many offers and discounts on movies. You should choose the card which will benefit you the most, according to your spends.

Do I get any points for each transaction?

You will get 4 EDGE REWARD Points for each transaction of Rs. 200 made with the Axis Bank MY Zone Credit Card. Except for a few transactions like Fuel, Rent, Utilities, Insurance etc.

Which axis bank cc variant is best .. my zone credit card or rewards credit card.

Entirely dependent upon your spending habits. You can compare the features of both on our website.

Can i replace the sonyLiv subscription with netflix or amazon prime membership? 1 reward point is equal to how many rupees or discount? and what is the time period of getting one after applying for it?

No, you shall receive free SonyLiv membership as a welcome benefit. 1 EDGE REWARD Point = Rs. 0.20. After successful approval of application you shall receive the card within 10 to 12 working days.

I’ve compared both Axis Bank MyZONE Credit Card and Axis Bank Neo Credit Card and in my opinion, both cards have relevant benefits as per the requirement. Where MyZONE Credit Card offer good cashback and discounts on dining, movies, travel benefits, and shopping, while Neo Card comes with benefits like fuel surcharge waivers and other specific discounts. So, you can go for any one of them as per your choice.

Axis Bank My Zone CC is now an LTF credit card and the eligibility of this card is-

1. Employment status: Salaried or self-employed

2. Income: Rs 15,000 per month (Salaried), Rs 30,000 per month (self-employed)

3. Age: 21-65 years

4. 700+ Cibil