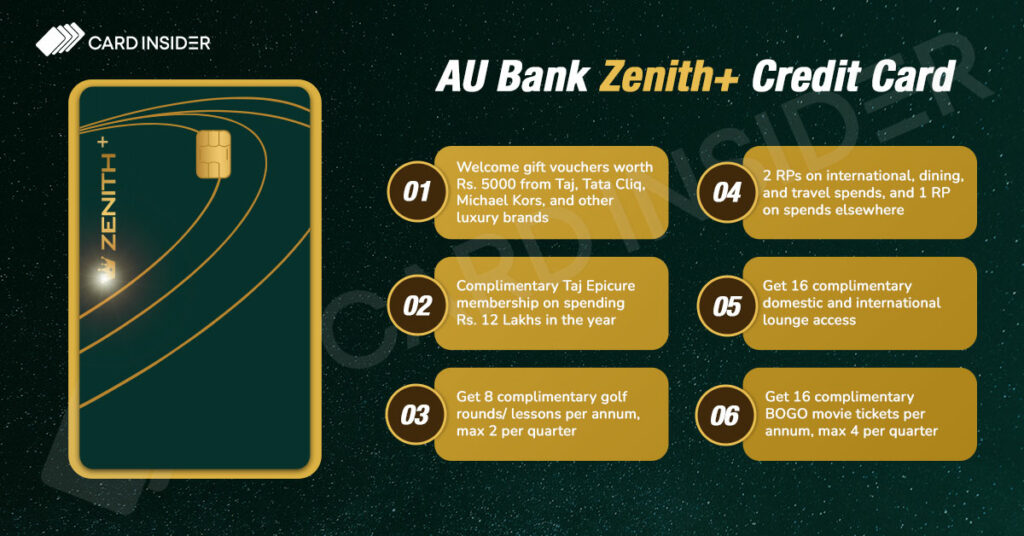

AU Bank has launched another card in the premium category, the AU Bank Zenith Plus Credit Card, which comes at a joining fee of Rs. 4999 plus taxes. It is perfect for people who frequently travel and make maximum spends with their credit card. As a welcome benefit, you get Rs. 5000 worth of gift vouchers from Taj Hotels, Michael Kors, Tata Cliq and other luxury brands.

The reward rate on the card is decent, where you can earn 2 RPs per Rs. 100 spent on dining, international, and travel spends, and 1 RP per Rs. 100 spent elsewhere. You can even get a complimentary Taj Epicure Membership on spending Rs. 12 Lakhs in the year. Moreover, you get 16 complimentary domestic and international lounge access, complimentary golf rounds, and complimentary BOGO movie tickets with the card.

Another great feature is the low 0.99% forex markup fee on the card which is great for those who regularly make foreign currency spends with the card.

Read on to learn more about the AU Bank Zenith+ Credit Card.

AU Bank Zenith+ Credit Card

Joining Fee

Renewal Fee

Best Suited For

Travel | Dining | Shopping |

Reward Type

Reward Points |

Welcome Benefits

Movie & Dining

16 complimentary Buy One Get One movie tickets per annum, max 4 per quarter

Rewards Rate

2 RPs per Rs. 200 spent on dining, international, and travel spends. 1 RP per Rs. 100 on other spends

Reward Redemption

NA

Travel

Complimentary Taj Epicure Membership on spending Rs. 12 Lakhs in the year.

Domestic Lounge Access

4 Complimentary Lounge Access Every Quarter (16 Each Year)

International Lounge Access

16 complimentary international lounge access

Golf

8 complimentary golf lessons per annum, max 2 per quarter

Insurance Benefits

Complimentary device protection plan

Spend-Based Waiver

Renewal fee waiver on spending Rs. 8 Lakhs in the year

Rewards Redemption Fee

Nil

Foreign Currency Markup

0.99% of the transaction amount

Interest Rates

1.99% per month or 23.88% per annum

Fuel Surcharge

1% fuel surcharge waiver up to Rs. 1000 per statement cycle

Cash Advance Charges

2.5% of the transaction amount or minimum Rs. 100

- Luxury brand gift vouchers worth Rs. 5000 as welcome benefit

- 1 RP per Rs. 100 spent and 2 RPs on international, dining, and travel spends

- 1000 RPs on spends of Rs. 75,000 in the month

- Complimentary Taj Epicure membership on spending Rs. 12 Lakhs in the year

- 16 complimentary domestic and international lounge access

- 16 complimentary movie tickets per annum, max 4 per quarter

- 30% discount on the Silver Spoon Dining program

- Low forex markup fee of 0.99% of the transaction amount

AU Bank Zenith Plus Credit Card – Features and Benefits

The following are the features and benefits associated with the AU Bank Zenith+ credit card–

Welcome Benefit

Get welcome vouchers worth Rs. 5000 from Taj Hotels, Tata Cliq, Michael Kors, or other luxury brands. Customers can also opt for 5000 RPs as a welcome benefit.

You can use any of the following modes of activation to get the welcome benefit voucher –

- AU 0101 Mobile App/Net banking

- Call 1800 1200 1500

- Chatbot AURO

Milestone Benefits

- Get bonus 1000 RPs on spending Rs. 75,000 or more in the month.

- Get complimentary Taj Epicure Membership on spending Rs. 12 Lakhs in the card anniversary year. With the Taj Epicure membership, you get the following benefits –

- 25% off on Food and beverages – Takeaway and Dining

- 20% off on Qmin App orders

- 20% off on Spa Treatments at Jiva Spas

- 20% off on Salon services at participating salons

- 20% off on Food and Beverages – Banquets

Cardholders also get the following one-stay exclusive vouchers –

- 20% discount on Best Available rate on Suites/Room at participating hotels

- 20% discount on Best Available rate on Taj Palaces on rooms/suites for max 5 nights

- 20% discount on Best Available rate on Taj Safaris on room/suites for max 5 nights

Renewal Benefit

Get 5000 RPs whenever you pay the card membership, i.e. renewal fees from the second year onwards.

Reward Earning Rate

- You can earn 2 RPs per Rs. 100 spent with the card.

- Earn 2 RPs per Rs. 100 spent on travel, dining, and international spends. Certain spend categories are not eligible to earn reward points.

- The value of 1 RP = Rs. 1. Cash advances, fuel, and EMI spends are not eligible to earn reward points.

Travel Benefits

- Get 16 complimentary international lounge access per annum, a maximum of 4 per quarter, with the Priority Pass membership. Click this link to check out the list of eligible Priority Pass lounges.

- Get 16 complimentary domestic lounge access per annum, max four quarter, with the credit card. Check out this link to view the list of eligible lounges.

- Get a complimentary Taj Epicure Membership on spending Rs. 12 Lakhs in the card anniversary year.

- Get complimentary meet and greet services with end-to-end VIP check-in four times per year, max once per quarter. You can book the service by calling the concierge at 022-42320298 or 1800 210 0298

Golf Benefits

Get eight complimentary golf rounds or lessons per annum, max 2 per quarter.

Movie and Dining Benefits

- Get complimentary 16 Buy One Get One movie tickets per annum, max 4 per quarter. The maximum discount per booking is Rs. 500.

- Up to 30% discount at partner restaurants with the Silver Spoon dining program

Insurance Benefits

- Air Accident Cover – Up to INR 2 Crore

- Card Liability Cover – Up to INR 15 Lakhs

- Credit Shield – Up to INR 15 Lakhs

- Purchase Protection – Up to INR 50,000

- Other travel-related covers – In the event of baggage delay, delay in flight, loss of passport and plane hijack.

Other Additional Benefits

- Complimentary device protection plan

- Complimentary concierge services

- 1% fuel surcharge waiver at outlets across the country, with maximum benefit capped at Rs. 1000 per statement cycle

Fees and Charges

The following are the fees and charges associated with the credit card –

- The joining and annual fee of the credit card is Rs. 4999 plus taxes. You can get the renewal fee waived off on spending Rs. 8 Lakhs in the card anniversary year.

- The interest rate on the credit card is 1.99% per month or 23.8% per annum

- The card charges a low forex markup fee of 0.99% of the transaction amount which is great for individuals who regularly make foreign currency spends with their card.

- The cash advance fee on the card is 2.5% of the transaction amount or a minimum of Rs. 100

Eligibility Criteria

The applicant must meet the following eligibility criteria –

- The age of the applicant must be 21 to 60 years of age, and the add-on cardholder must be over 18 years old

- The applicant must be a resident of India

- The applicant must have a net monthly income of Rs. 2.5 Lakhs

AU Bank Zenith+ Credit Card Review

Similar to the Zenith credit card, AU Bank has launched the premium Zenith+ credit card that comes at a joining fee of Rs. 4999 plus taxes. The cad has decent features and privileges for almost all spend categories and offers Rs. 5000 gift vouchers from luxury brands. You can get 2 RPs on international, dining, and travel spends, and 1 RP on spends made elsewhere.

For those who travel frequently, cardholders can get a complimentary Taj Epicure Membership as milestone benefits, complimentary domestic and international lounge access, complimentary golf rounds, and a low forex markup fee of 0.99%. The card also offers excellent movie and dining benefits to the cardholder. It is a great choice and offers various benefits similar to the Zenith credit card at a lower fee.

Head over to the comments section and let us know your thoughts regarding this new card by AU Bank.

What are the features of Marriott hotel membership. No where on the Zenith plus landing page (AU website) i see a mention of Marriot membership.

Given the features of the card, dont you think Zenith is better over Zenith Plus, where you earn almost 5% on restaurants and 2.5% for international transactions, Grocery and Departmental stores. Though they are certain advantages with Zenith plus, i would still prefer existing Zenith over Zenith +. Your view on it?

Hi Rakesh,

We have updated the article. Marriott membership isn’t available with Zenith Plus.

Regarding reward points, Zenith was better, but now they have stopped issuing it.

Thinking of getting this. Not really big into the CC Reward points, but should be able to make the spends to get Fee waiver