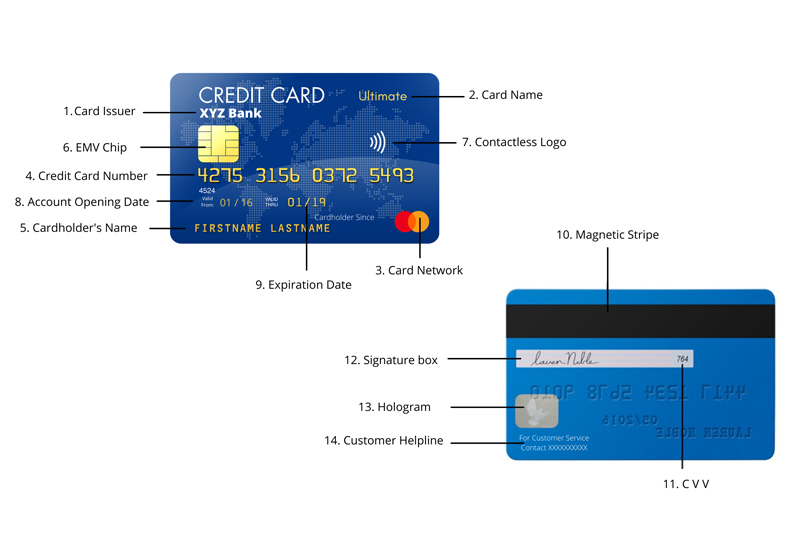

Almost everyone is aware of credit cards today as it has become a basic need for most people. But for people who don’t know what it is: a credit card, also known as Plastic Money, is a financial tool that allows you to make purchases for which you can pay later. As a credit cardholder, you borrow money from the card issuer to make your purchases and pay them back later. Before having a credit card or even after having one, it is essential to know each and every part/element of your card and its function. With an aim to make you aware of your credit card’s parts, we have come up with this article explaining the anatomy of a credit card.

Front Side of a Credit Card

1. Card Issuer’s Name

The first thing on the topmost corner (can be right or left both) on the front side of your credit card is the card issuer’s name. It is the name of the bank at which you apply for credit card. In the image shown here, XYZ Bank is the card issuer.

2. Name of the Credit Card

As every bank issues various credit cards with different features, it is important to give them different names. So, every credit card issued by a bank is given a different name. The full name of a credit card consists of the card issuer’s name + the particular card’s name. In the above example, the name of the particular card is Ultimate & it is issued by XYZ Bank. So, its full name would be XYZ Bank Ultimate Credit Card.

3. Card Network

Credit Card Networks are the financial institutions that work behind the scenes to make all the credit card payments possible. Credit card networks decide where your credit card will be accepted and where not. They act as bridges between the card-issuing company and the shops where credit cards are accepted. Following are the 5 major Credit Card Networks in India:

- Visa

- MasterCard

- American Express

- Diners Club

- RuPay

In the image shown above, the card network is MasterCard. To know more about credit card networks, click here.

4. Credit Card Number

It is a unique 16-digit number (15-digit for American Express cards) that helps in the identification of a particular card issuer and the card network. Whenever you use your credit card to make transactions, the credit card number is asked in order to get the information about your card issuer, card network, and other details. The first 6 digits of a credit card number are known as the Bank Identification Number (BIN). It is also called the issuer identification number (IIN) as it provides information about the card issuer. In the above case, 4275 31 is the BIN.

5. Cardholder’s Name

It is the name of the cardholder, i.e., whom the credit card belongs to.

6. EMV Chip

EMV, which stands for EuroPay, Mastercard, Visa, is a part of the modern way of payment. It is a chip embedded in the credit card and contains information about the credit cardholder. In this case, the chip below the name of the credit card is the EMV chip. Due to the EMV chip technology, credit cards have become a more secure mode of payment.

Every time you swipe your card for making a payment or you use it to withdraw cash, the swiping machine/ATM takes your account information through the chip, then you need to enter your PIN for verification and hence you make your transaction successfully.

7. Contactless Payment Technology

The symbol resembling the WiFi sign on your credit card is a chip that enables contactless payment on your credit card. It means you don’t always need to swipe a card to make a transaction. The chip emits radio waves that make the transaction possible without physical contact. You just need to tap on your credit card and the transaction will be done, provided the card reader is also enabled for contactless payments.

Also Read: All You Need To Know About Contactless Credit Cards

8. Account Opening Date

The account opening date of a credit card is the date when the card is issued to you. It is written in MM/YY format. In the above example, the account opening date is 01/16, i.e, the card has been issued to the cardholder in January 2016.

9. Expiration Date

It is the date when your card expires and you need to get a new one issued. It is generally 3 years after the account opening date. Generally, the card issuers send you the new credit card by themselves, or otherwise, you can contact them to do so. The new credit card comes with a new CVV and a new expiration date. In some cases, the account number can also be different from the previous card. It is also given in MM/YY format. In the above example, the expiration date is given to be 01/19, i.e, the card will expire in January 2019.

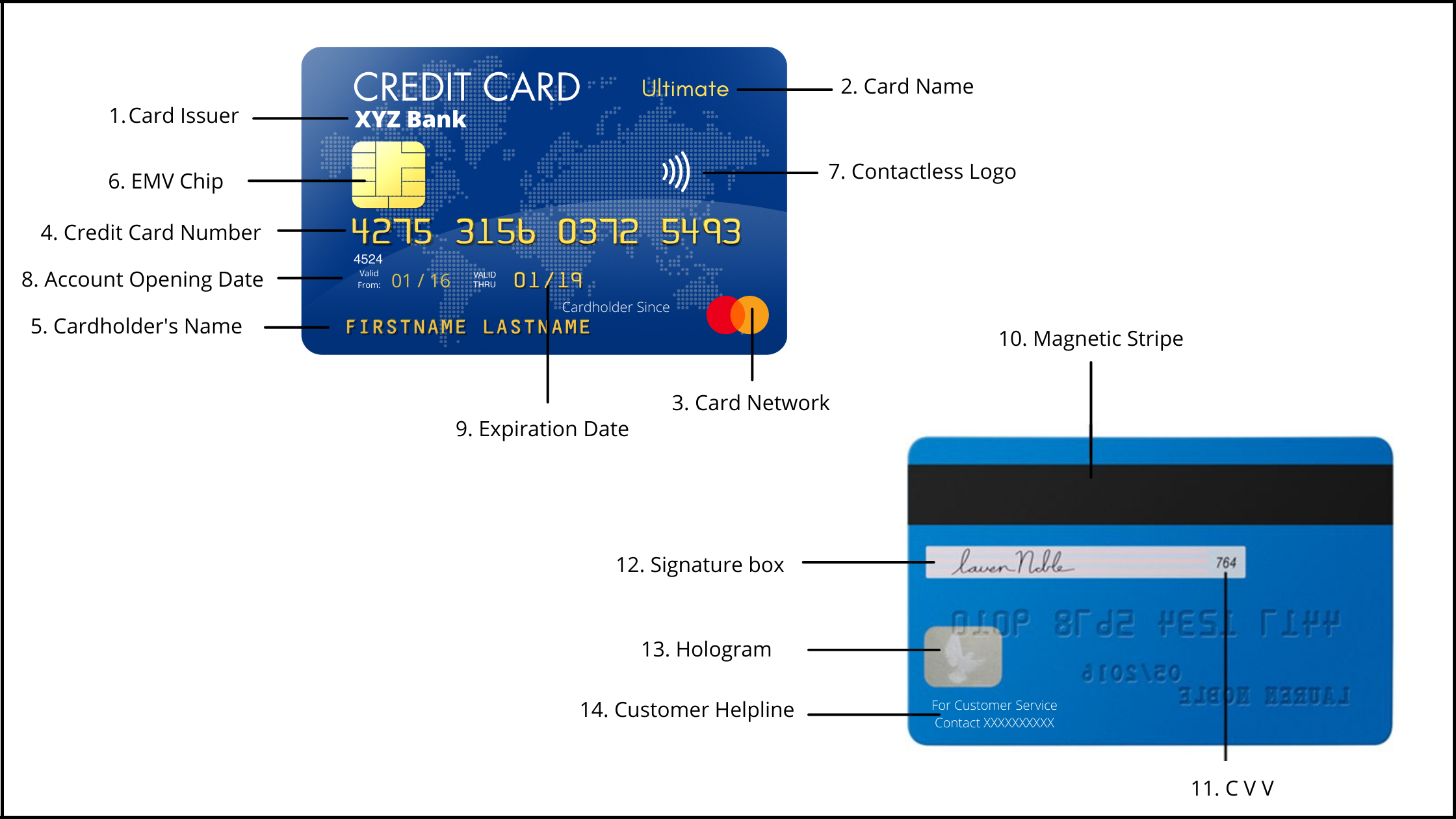

Backside of a Credit Card

10. Magnetic Stripe

A magnetic stripe, also referred to as magstripe, is a stripe made up of tiny magnetic particles at the back of a credit card. This stripe stores all the information about your account, including your name, credit card number, and other important details. When you swipe your credit card to make a transaction, this magnetic stripe helps the merchant’s swiping machine to identify your account.

11. CVV

CVV (Card Verification Value) is a 3-digit number (4-digit for AmEx cards) at the back of your credit card which is aimed at adding an extra layer of security to your online transactions. The CVV is unique for each and every card and should be kept very personal. It is asked whenever you make an online transaction in order to verify that you have the physical credit card with you.

12. Signature Box

A Signature Box is another element at the backside of a credit card. It needs to be signed by the cardholder so that whenever they make a transaction, the merchant can match the signature with any of their ID cards in order to make sure that the card belongs to them. But, the importance of the signature box has become really less as no merchant checks the signature box and asks you to show them an ID card. So, it is not really important to sign on the signature box of your credit card, but you can do it if you feel so.

13. Hologram

The hologram on a credit card acts as its fraud prevention tool. It is made up of several layers of different images aligned at different angles, making it almost impossible to be copied physically. The hologram is unique for each and every card due to the layers of hidden images in it and is added so that the card can not be duplicated.

14. Customer Helpline Number

The customer helpline number on the backside of your credit card is a general number that you can contact for credit card-related queries. You can also call this number if you want other customer services helpline numbers, like for concierge services and many more.

Bottom Line

Knowing all these credit card elements and their functions is the first thing you should do when applying for a credit card. We hope that we have been able to make you understand the anatomy of a credit card. If you still have doubts, make sure to write them in the comment section below and we will be more than happy to help you.