After the novel CoronaVirus hit the world, the scope of digital payments in the country has increased manifolds. Unified Payments Interface (UPI) was launched in 2016 and plays a very significant role in promoting the country’s digital economy and now has become one of the most famous and preferred source of payment for users. Earlier the Reserve Bank of India (RBI) had allowed only debit cards linking to the UPI applications but recently the Reserve Bank of India has now allowed even credit cards to be linked to the UPI Applications (BHIM app at present). In this article, we will discuss in detail how to link a credit card and make UPI Payments using a credit card.

Credit Card Transactions Via UPI

In today’s time, more and more people have started using UPI as a method to make payments. It has become a popular method as one can seamlessly scan the QR code or enter the mobile number of the merchant and the payment will be instantly done. Until now, the UPI applications allowed only bank accounts and debit cards to be linked to UPI applications but now they have allowed credit card linkage as well. As of now only RuPay credit cards can be linked with UPI and it is expected that the other credit card variants like Visa and MasterCard will also be linked with UPI very soon.

How to Link Credit Cards With UPI Application?

As mentioned, as of now RuPay Credit Cardholders would be able to link their credit cards only on the BHIM App. The process of linking credit cards on the BHIM UPI App is very easy and quick. With the help of the following steps, you can easily link your credit card on BHIM App:

- Open the BHIM App and go to Bank Accounts Tab by clicking on the top left side.

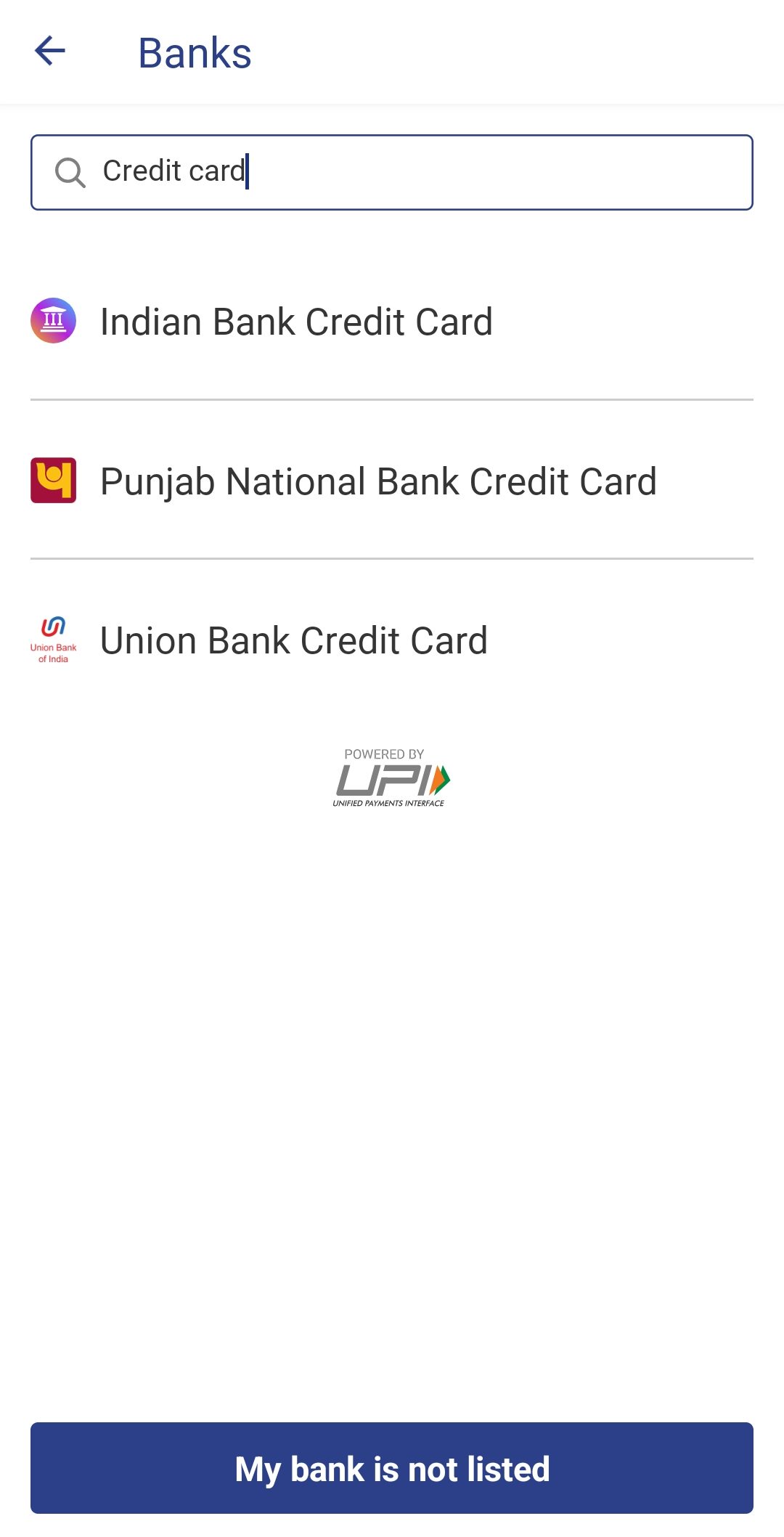

- Click on Add Account (plus sign) and search for your credit card issuer.

- Currently, only the Union Bank, PNB, and Indian Bank RuPay Credit Cards can be linked on the BHIM App.

- After selecting your card issuer, the bank will run a quick check on your contact number. Your credit card details will be automatically shown on the app. For security purposes, you would be required to enter a few details like the last 6 digits of your card and the expiry date.

- You will receive a 4-digit OTP on the registered mobile number which you have to enter. Then you will be asked to create a new UPI pin which you need to enter every time you make payments with your credit card via UPI.

Read More: PNB, Union And Indian Bank Launch Rupay Credit Cards on UPI!

Bottom Line

Credit card transactions via UPI will enable users to make seamless payments. Linking credit cards on UPI apps is a very easy process and in the case of the BHIM app, the user is not even required to upload any document. With the help of the above-mentioned steps, you can link your RuPay Credit cards with the BHIM UPI App. If you still have any doubt regarding the linking of credit cards on UPI, let us know in the comment section below: