The Standard Chartered Manhattan Credit Card is a basic credit card offered by the Standard Chartered bank in order to deliver its cardholders with premier benefits and rewards. You get an assured cashback of 5% on groceries, supermarkets, and departmental stores with this card. On other spends, get 3 reward points per Rs. 150 spent. You can redeem the reward points for a number of options present on the 360-degree rewards portal.

The card carries a joining fee of Rs. 999 and the cardholders are welcomed with a bonus of 5,000 Reward Points. Also, the card carries a nominal annual fee of Rs. 999 and that too can be waived off depending upon your total spends in the previous year. To know more about the Standard Chartered Manhattan Credit Card, and its features, keep reading:

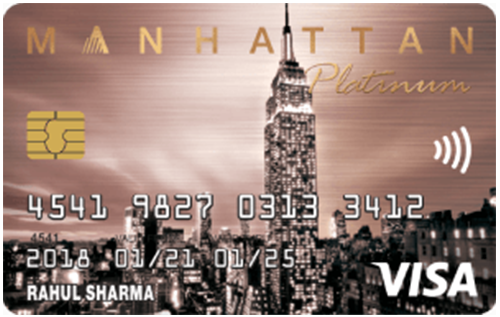

Standard Chartered Manhattan Credit Card

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

NA

Rewards Rate

3 Reward Points per Rs. 150 you spend, and 5% cashback on departmental stores, groceries, and supermarkets.

Reward Redemption

The earned reward points are redeemable on the 360-degree Rewards portal. Here, 1 RP = Rs. 0.25.

Travel

NA

Domestic Lounge Access

NA

International Lounge Access

NA

Golf

NA

Insurance Benefits

NA

Spend-Based Waiver

The renewal fee can be waived if you spend Rs. 1,20,000 or more in the preceeding year.

Rewards Redemption Fee

Rs 99 per redemption request

Foreign Currency Markup

3.5% on all overseas transactions

Interest Rates

3.75% per month (45% per annum)

Fuel Surcharge

1% fuel surcharge is applicable subject to a minimum of Rs. 10.

Cash Advance Charges

3% of the amount withdrawn or Rs. 300 (whichever is higher)

- Welcome benefit of 5,000 bonus Reward Points.

- Get a 5% cashback on groceries, departmental stores, and supermarkets.

- Get 3 Reward Points on every other purchase of Rs. 150.

- Renewal fee waiver on spending Rs. 1,20,000 or more in the preceeding year.

- Easy Reward redemption through the 360-degree Rewards portal.

Standard Chartered Manhattan Credit Card Features and Benefits

The Standard Chartered Manhattan Credit Card is an affordable yet exclusive credit card that provides cardholders with various exciting benefits across different categories. The detailed features of this card are given below:

Welcome Benefits

Get 5,000 Bonus RPs on successfully settling the joining fee of the card.

Fuel Surcharge

The 1% fuel surcharge is applicable on all fuel transactions done through the Standard Chartered Manhattan Credit Card.

Joining and Renewal Fee Waiver

The annual fee of Rs. 999 can be waived off on spending Rs. 1,20,000 or above in one anniversary year.

Standard Chartered Manhattan Credit Card Rewards

- A cashback of 5% on groceries, departmental stores, and supermarkets (maximum cashback of Rs. 500 in a month and Rs. 150 per transaction is allowed).

- This cashback is only applicable on a minimum transaction of Rs. 1000.

- You get 3 Reward Points per Rs. 150 spent with the card.

Rewards Redemption

- The Reward Points earned are easily redeemed on the 360-degree Rewards portal against various categories, such as travel, lifestyle, electronics, home & family, electronics, charity, and many more.

- 1 RP = Rs. 0.25.

- Minimum 500 Reward Points are required for redemption.

Standard Chartered Manhattan Credit Card Fees and Charges

Following are some of the most important fees applicable with the StanChart Manhattan Credit Card:

- The joining and the annual fee applicable on the Manhattan card is Rs. 999. The annual fee can be waived if you spend Rs. 1.2 Lakh or above in the last year.

- The Manhattan card carries 3.75% p.m. finance charges.

- 3.5% of the transaction amount is charged as a foreign currency markup.

- The card charges 3% of the amount withdrawn (or a minimum of Rs. 300) as a cash advance fee.

Standard Chartered Manhattan Credit Card Eligibility Criteria

The following table summarizes the eligibility criteria for the Standard Chartered Manhattan Credit Card which has to be fulfilled by the applicants:

| Particular | Criteria |

| Age | 21 years – 65 years (18 years for add-on) |

| Income | Stable income as a salaried or self-employed |

| Credit Score | Decent credit score (750 or above) |

Documents Required

Following are the documents required when applying for the Manhattan Credit card:

- Identity Proof: Voters card, passport, Aadhar card, driving license, PAN card, etc.

- Address Proof: Voter card, electricity or telephone bill, Aadhar Card, driving license, passport, etc.

- Income Proof: Latest audited ITR or Salary Slips.

How To Apply For The Standard Chartered Manhattan Credit Card?

There are two methods by which you can apply for the Standard Chartered Manhattan credit card. The first one is by applying offline, i.e, by visiting the nearest branch to you and filling in the application form. The second way is to apply online. You can follow the steps given below to apply for the card online:

- Click on Apply Now and proceed accordingly.

Conclusion

The Standard Chartered Manhattan Credit Card is a great option for those who want a card with a nominal fee and exclusive cashback offers. Not only cashback, but this card also offers you Reward Points based on your spending. Moreover, you get 5,000 Reward Points as a welcome benefit, which means a great start to your journey with this card. The spend-based renewal fee waiver is another great feature of the card. Another popular cashback card that you must check is the HDFC Millennia Credit Card.

Therefore, if you are looking for a card with exciting reward offers and great saving opportunities, the Standard Chartered Manhattan Credit Card is for you.