The ICICI Coral Credit Card, issued by ICICI Bank, offers exclusive rewards and offers around dining, entertainment, and travel for its customers. Coral credit card comes in three variants: Visa, Mastercard, and AmEx, from which you have the independence to choose one for yourself. With this card, for every transaction of Rs. 100, you can earn up to 2 reward points, and these are redeemable against an array of categories & products. The Coral credit card also provides an opportunity to earn up to 10,000 bonus Reward Points under its milestone program annually.

Apart from these benefits, the card also offers exciting discounts on movie tickets on Inox & BookMyShow. Keeping your travel-related requirements in mind, the card provides complimentary domestic airport and railway lounge access every quarter. The list of the benefits of the ICICI Bank Coral Credit Card goes on. Keep reading to get more information:

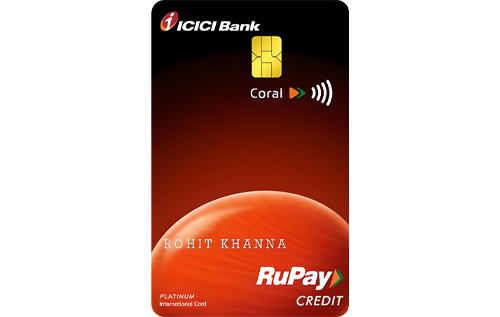

ICICI Bank Coral Credit Card

Joining Fee

Renewal Fee

Best Suited For

Movies | Dining |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

25% discount up to Rs. 100 on movie ticket booking on BookMyShow. Get up to 15% discount on dining.

Rewards Rate

1 Reward Point per Rs. 100 you spend on utilities & insurance related spends, and 2 Reward Points per Rs. 100 spent elsewhere.

Reward Redemption

The Reward Points are redeemable against an array of categories, and cash back at a rate of 1 Reward Point = Re. 0.25.

Travel

You get complimentary access to the airport and railway lounges every quarter.

Domestic Lounge Access

1 Domestic Lounge Access Every Quarter (4 Each Year)

International Lounge Access

N/A

Golf

N/A

Insurance Benefits

N/A

Spend-Based Waiver

You get a spend-based waiver in case the annual spend is more than 1,50,000 in the previous year.

Rewards Redemption Fee

Rs. 99 per redemption request

Foreign Currency Markup

3.5% of the transaction amount

Interest Rates

3.4% per month (40.80% per annum)

Fuel Surcharge

You get a fuel surcharge waiver of 1% across all HPCL petrol stations in India. This offer valid for transaction up to Rs 4,000/-

Cash Advance Charges

2.5% of the transaction amount or subject to a minimum fee of Rs.300

- 1 Reward Point per Rs. 100 you spent on utilities & insurance-related spends.

- 2 Reward Points per Rs. 100 you spend (except Fuel).

- Earn up to 10,000 bonus RPs annually under the Milestone Program.

- Get 1 complimentary domestic lounge access every quarter.

- Get 1 complimentary railway lounge pass every quarter.

- Enjoy up to 25% discount on movie ticket booking on BookMyShow and INOX.

- You get exclusive dining deals through the ICICI Bank Culinary Treats Programme using the ICICI Bank Coral credit card.

ICICI Bank Coral Credit Card Features and Benefits

The Coral Credit Card is one of the basic yet popular ICICI Bank Credit Cards. It comes with a decent reward rate and great benefits across other categories, including travel, fuel, etc. The features and benefits of the ICICI Bank Coral Card have been mentioned below:

Milestone Benefit

You get 2,000 Reward points on achieving a spend of Rs 2 lakh, and you get 1,000 bonus Reward Points on achieving the target of Rs. 1,00,000 within an anniversary year after that. The maximum bonus Points you can earn every year are capped at 10,000 Points per year.

Travel Benefits

- Enjoy 1 complimentary access to airport lounges every quarter on spending Rs. Rs 5000 in the previous calendar quarter with ICICI Bank Coral credit card.

- 1 complimentary railway lounge visit (every quarter) to railway lounges in India.

Dining Benefits

ICICI Bank’s Culinary Treats Programme brings you special offers at their partner dining establishments near you. With the card, you can get a discount of 15% or above on dining bills at over 2,500 premium restaurants, including TGI Fridays, Café Coffee Day, Pizza Hut, Mainland China, Vaango, and others.

Entertainment Benefits

- 25% discount or Rs. 100 off (whichever is lower) on buying a minimum of 2 movie tickets on BookMyShow.

- This offer can be availed twice a month only and is subject to the availability of the seats.

Joining/Renewal fee waiver

The renewal fee of Rs 500/- can be waived on spending Rs 1.5 lakh or more in the previous year.

Fuel Surcharge Waiver

- Fuel surcharge waiver of 1% across all HPCL petrol stations in India.

- This offer is valid for transactions up to Rs 4,000.

ICICI Bank Coral Credit Card Rewards

- Get 2 Reward Points per Rs 100 you spend, except for fuel.

- Get 1 Reward point per Rs 100 you spend on utilities and insurance.

Reward Redemption

- 1 Reward point is equal to Rs 0.25, and these points can be redeemed for cash or a gift.

- To redeem points earned against cash, you can contact customer care at 080-4014-6444.

- For redemption against cash, you can call on 1860-258-5000.

ICICI Bank Coral Credit Card Eligibility Criteria

- In the case of the primary cardholder, the age must be 23 years or more.

- In the case of supplementary cardholders, the age must be 18 years or more.

- The net income as per the ITR in the case of the primary cardholder must be Rs 5 lakh.

Documents Required

While applying for the ICICI Bank Coral Credit Card, a few documents have to be submitted/uploaded as mentioned below:

- You will need proof of address (Aadhaar Card, Driving License, Passport, or utility bills).

- As an identity proof, you can submit any of these: Voter’s ID, Aadhaar Card, PAN Card, Passport, etc.

- As income proof, you will need to submit salary slips or the latest ITR.

How To Apply For The ICICI Bank Coral Credit Card?

ICICI Bank Coral Credit Card can be applied online or offline as per your zone of comfort. To apply offline, visit your nearest ICICI Bank branch with all the essential documents and fill out the application form available there. And if you want to apply online, simply click on the Apply Now button on your screen. Be prepared with documents like a PAN Card, as you will have to fill out a few details about yourself. Choose the online method to apply, as it will save you time, and you can do it from the comfort of your home.

Cards Similar To The ICICI Coral Credit Card

| Credit Card | Annual Fee | Reward Rate | Main Benefits |

| ICICI Bank Coral Credit Card | Rs. 500 | Up to 2 Reward Points on every Rs. 100 spent. |

|

| SimplySave SBI Card | Rs. 499 |

|

N/A |

| HDFC MoneyBack Plus Credit Card | Rs. 500 |

|

Earn gift vouchers worth up to Rs. 2,000 every year on achieving the spend milestone. |

| Axis Bank My Zone Credit Card | Lifetime Free | 4 Reward Points on every spend of Rs. 200. |

|

ICICI Bank Coral Credit Card Review

If you are an outgoing person who likes to spend on movies and food, the ICICI Bank Coral Credit Card might be the right choice for you. You can save up to Rs 2,400 on movie tickets, assuming the cost of movie tickets is Rs 400 per ticket, if the offer is availed twice a month with this card. You can also save up to Rs 1,425 in cash rewards on annual spending of Rs 3 Lacs. Moreover, the card also comes with lounge access, which makes it a better option when compared to its counterpart ICICI Platinum Credit Card. ICICI Coral credit card helps you save money on your regular spending. Moreover, other benefits like fuel surcharge waiver, discount on dining, annual fee waiver, etc, can not be ignored as all these features make it even more reasonable for you to try this card once.