The IndianOil Axis Premium Credit Card is the second card offered by the bank in partnership with IndianOil, the first being the less premium IndianOil Axis RuPay Credit Card. The IndianOil Axis Premium Credit Card provides a wide range of rewards and benefits, with a primary focus on fuel-related perks. Whether you’re seeking travel privileges or savings on daily expenses, this card has it all. Cardholders will earn accelerated 6X EDGE Miles on all fuel purchases at IndianOil outlets. Additionally, the card rewards grocery spending by offering 2X EDGE Miles on grocery and supermarket purchases of up to ₹5,000.

This card has a joining fee of ₹1,000, which can be easily waived by spending ₹30,000 a year. In addition to the fuel benefits, the card offers free airport lounge access, making travel more comfortable. Cardholders also receive discounts on food delivery through Zomato. All of these features make it a must-have, particularly for those who do not yet have a dedicated fuel credit card.

IndianOil Axis Bank Premium Credit Card

Joining Fee

Renewal Fee

Best Suited For

Fuel |

Reward Type

Reward Points |

Welcome Benefits

Movie & Dining

30% Instant Discount on Zomato. 25% Discount on Dining Via Eazydiner (Upto ₹800)

Rewards Rate

6X EDGE Miles/₹150 at IndianOil Outlets. 2X EDGE Miles/₹150 on Grocery Spends. 1X EDGE Miles on All Other Eligible Spends

Reward Redemption

EDGE Miles Can Be Redeemed for Fuel (1 EDGE Mile = ₹1). These Can Also Be Converted to Partner Points (1:1)

Travel

N/A

Domestic Lounge Access

2 Free Lounge Visits Each Quarter

International Lounge Access

N/A

Golf

N/A

Insurance Benefits

N/A

Spend-Based Waiver

Annual Fee Waiver on Spends of ₹1 Lakh or More

Rewards Redemption Fee

N/A

Foreign Currency Markup

3.5%

Interest Rates

3.6% Monthly (52.86% Annually)

Fuel Surcharge

1% Waiver on Fuel Transactions

Cash Advance Charges

2.5% (Minimum ₹500)

- The IndianOil Axis Premium Credit Card is most suited for fuel expenses.

- This card offers spend-based airport lounge access.

- You can avail of a 30% discount on food orders with Zomato.

- Apart from fuel, this card also offers accelerated 2X EDGE Miles for grocery spends.

Pros

Even though this credit card is fuel-based, it offers numerous other benefits, such as free airport lounge access and discounts on food.

Cons

Although this card offers free airport lounge visits, it is bound by spend-based criteria. Those unable to spend ₹50,000 in the previous three months will not be eligible for complimentary airport lounge visits.

EDGE Miles Earning

- Earn 6X EDGE Miles for every ₹150 spent at IndianOil outlets across the country, with a maximum cap of 600 EDGE Miles. Once you spend ₹15,000 on fuel, you will earn EDGE Miles at the base rate of 1X.

- Get 2X EDGE Miles for every ₹150 spent on groceries and supermarkets, with a maximum of 33 EDGE Miles earned at this rate for spending up to ₹5,000.

- For all other eligible spends, earn 1 EDGE Mile for every ₹150 spent.

No EDGE Miles shall be earned for the following transactions: transportation and tolls, utilities, insurance, educational institutions, government institutions, wallets, and rent.

Axis EDGE Miles Redemption

IndianOil Axis Premium Cardholders shall earn rewards as EDGE Miles. These EDGE Miles can be easily converted to other partner hotels and airlines, redeemed at Axis Banks Travel Edge portal, or simply redeemed at IndianOil fuel hotels. One of the most rewarding conversions is offered when you convert EDGE Miles to IOCL Rewards, which provides a ratio of 3:10. All the other conversions and reward point value is given below.

| Category | Value |

| For Fuel at IndianOil Outlets | 1 EDGE Mile = ₹1 |

| Miles Transfer | 2 EDGE Mile = 1 Partner Point (Air France-KLM, Ethiopian Airlines, Etihad Airways, IHGR Hotels & Resorts, Qatar Airways, Singapore Airlines, Turkish Airlines, United Airlines, Marriott International, Vistara, ITC, SpiceJet, AirAsia)

3 EDGE Miles = 10 XRPs (IOCL Rewards) |

| Bookings on

Travel Edge |

1 EDGE Mile = ₹0.20 |

Instant Discount on Zomato

Get an instant 30% discount on Zomato when paying with IndianOil Axis Bank Premium Credit Card. This offer is valid twice monthly on a minimum transaction of ₹200. The maximum discount one can get with this offer is capped at ₹150. This would allow cardholders to avail of a benefit worth ₹3,600 annually.

Complimentary Airport Lounge Access

Cardholders are eligible for up to 2 complimentary domestic airport lounge visits each quarter (8 visits annually). They can be eligible for this benefit by spending ₹50,000 or more in the previous three months.

Fuel Surcharge Waiver

The IndianOil Axis Bank Premium Credit Card offers an unlimited 1% fuel surcharge waiver for transactions made with Indian Oil outlets. Please remember that the GST charged along with the fuel surcharge, is non-refundable.

Migration of IndianOil Citi to IndianOil Axis Bank Premium Credit Card

Those with the IndianOil Citi Credit Card will be relieved to know that their card will be migrated to the IndianOil Axis Premium Credit Card, which is an equally rewarding credit card. All accumulated points or miles earned with the previous card shall be forwarded to the new Axis Credit Card. Cardholders shall receive the same value and benefits they previously received. In fact, in some aspects, like the free airport lounge access, the IndianOil Axis Premium Card can be considered an upgrade.

| Previous Citi Card | New Axis Card | Reward Transfer |

| IndianOil Citi | IndianOil Premium | 1 Turbo Point = 1 EDGE Mile |

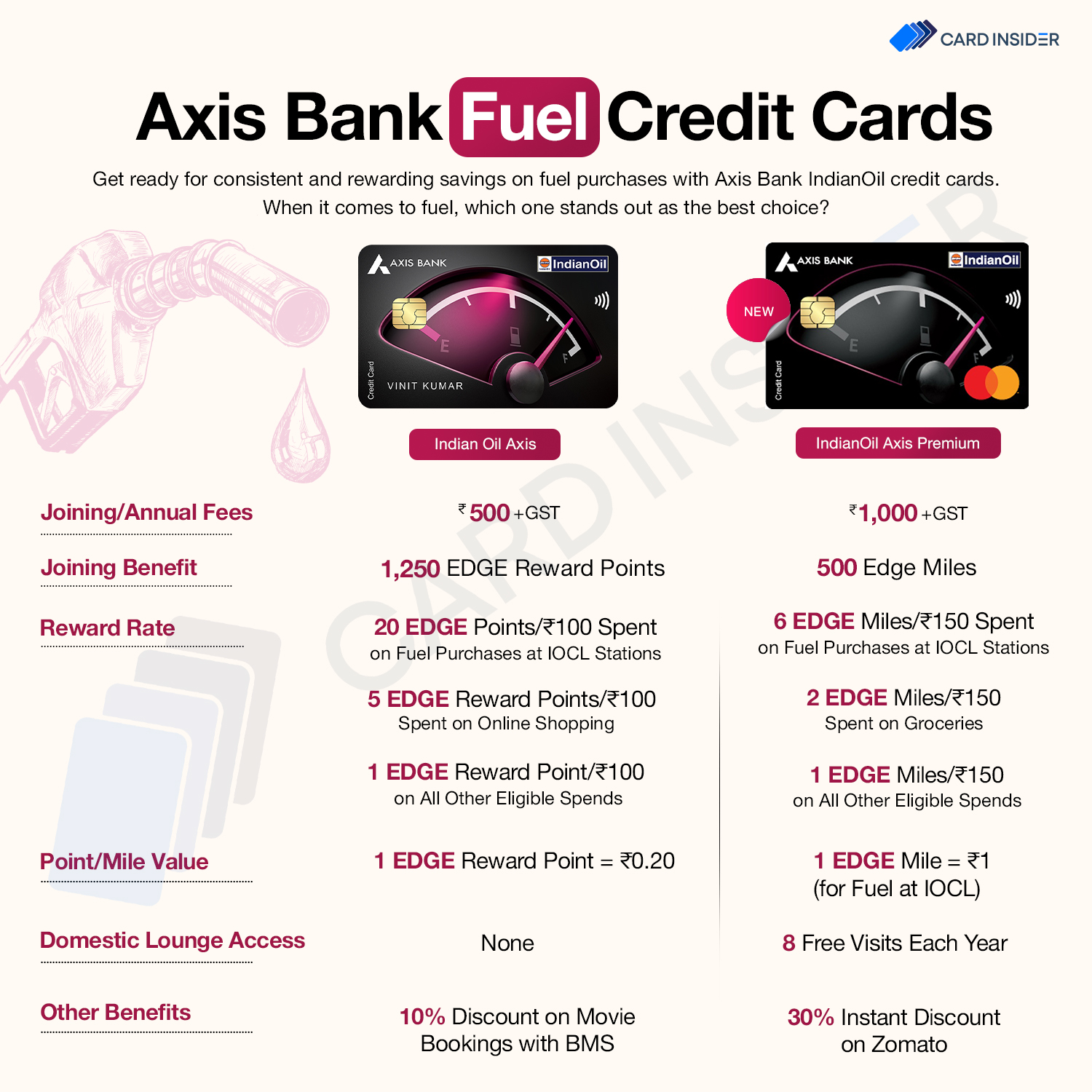

Comparison of Axis IndianOil Credit Cards

IndianOil recently introduced two variants of its credit card: the entry-level IndianOil card and the mid-level IndianOil Axis Premium Credit Card. For those interested in additional features and willing to pay a slightly higher fee, the IndianOil Premium Credit Card is a good option, while others can opt for the basic card. Both cards offer nice features, and the choice depends on individual needs.

Brief Review of IndianOil Axis Premium Credit Card

The IndianOil Axis Premium Credit Card is a fantastic option for those who frequently spend on fuel or those looking for their first fuel credit card. With a generous reward rate of 6X EDGE Miles per ₹150 spent at IndianOil outlets, it makes fueling up both economical and rewarding. The card also offers 2X EDGE Miles on grocery spending and 1X EDGE Miles on other eligible expenses, providing a well-rounded rewards program for everyday spending.

One of the standout features of this card is its complimentary airport lounge access. Cardholders can enjoy up to two free domestic lounge visits each quarter, making travel more comfortable. However, this benefit is tied to a spending criterion of ₹50,000 in the previous three months, which may be challenging for some users to meet since this card is primarily useful for fuel spending.

The 30% discount on Zomato twice a month adds significant value, making it easier to enjoy savings on food deliveries.

The IndianOil Axis Premium Credit Card is a great option for people who frequently purchase fuel and groceries and want to earn rewards and benefits. However, it’s important to be mindful of the limits on accelerated EDGE Miles earning with this card and keep track of your spending in order to maximize the benefits.