SBI TATA Platinum Card is a co-branded car launched by SBI Card in collaboration with TATA Capital. On this card, you get upto 3 reward points on every Rs 100 spent on Dining, Departmental & Grocery shopping, and International spends. You get 1 empower point on every Rs 100 spent on other retail outlets and 1 empower point on every Rs 100 spent in other retail stores. You get upto 8 complimentary domestic lounges every year at select airports. Furthermore, you can enjoy an e-Gift voucher worth Rs 3,000 on annual spending of Rs 4 lakh and 5 lakhs. What do you think about this card? Do let us know in the comments.

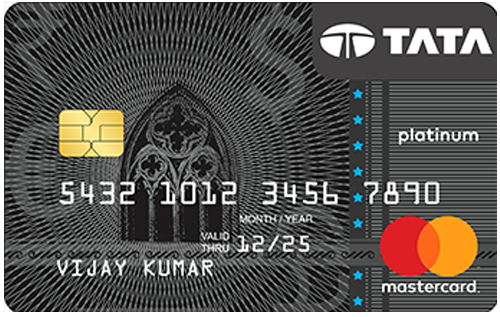

SBI Tata Platinum Card

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

NA

Rewards Rate

You can upto 3 Empower points on Dining, Departmental & Grocery shopping, and International spends. You get 1 Empower point on every Rs 100 spent on other retail categories. You earn 1 Empower point on every Rs 100 spent on retail stores

Reward Redemption

1 Empower Point = Rs. 1 can be redeemed against the Tata Loyalty program- The Empower Program or you can simply redeem your reward points at TATA merchant outlets.

Travel

Complimentary lounge access in India at select airports

Domestic Lounge Access

8 complimentary lounge access in India with Mastercard at select airports

International Lounge Access

NA

Golf

NA

Insurance Benefits

NA

Spend-Based Waiver

NA

Rewards Redemption Fee

Rs 99 per redemption request

Foreign Currency Markup

3.5% on the conversion amount

Interest Rates

3.5% per month (42% per annum)

Fuel Surcharge

1% surcharge waiver on fuel transactions at all fuel stations across India

Cash Advance Charges

2.5% on the transaction amount subject to a minimum charge of Rs 500

- Exclusive shopping e-Gift vouchers worth Rs 3000 from any partner exclusive

- 1 Point per Rs. 100 spent on other retail outlets

- 3x points on Dining, Departmental & Grocery shopping, and International spends

- 8 complimentary lounge access in India with Mastercard at select airports

- Get an e-Gift voucher worth Rs 3000 from the partner exclusives on annual spending of Rs 4 lakhs and 5 lakhs each

- 2% value back on spends on Croma and croma.com & upto 5% value back on spends on Tata outlets

- 1% surcharge waiver on fuel transactions at all fuel stations across India

SBI Tata Platinum Card Rewards

- You can earn 3 Empower points on Dining, Departmental & Grocery shopping, and International spends

- You get 1 Empower point on every Rs 100 spent on other retail categories.

- You earn 1 Empower point on every Rs 100 spent on retail stores

- 1 Empower point = Rs 1

Welcome Benefits

As a welcome benefit, you get exclusive shopping e-Gift vouchers worth Rs 3000 from any partner exclusive such as Yatra, Hush Puppies / Bata, Aditya Birla Fashion, Westside. In addition to this, you get an anniversary gift on spending Rs 2 lakhs in the previous year. The information regarding the voucher code shall be communicated within 15 days of the payment of the joining fees.

Milestone Benefits

You get an e-Gift voucher worth Rs 3000 from the following partner exclusives Yatra, Hush Puppies, Bata, Westside, Aditya Birla Retail on annual spending of Rs 4 lakhs and 5 lakhs each. The information regarding your e-gift voucher will be communicated via SMS at your registered mobile number with 7 working days.

Travel Benefits

With this card, you get 8 complimentary lounge access in India with Mastercard. You are allowed a maximum of 2 lounge access per quarter.

Fuel Surcharge Waiver

You get a 1% surcharge waiver on fuel transactions at all fuel stations across India. The waiver is applicable on transactions between Rs 5,00 to Rs 4,000. You get a maximum surcharge waiver of Rs 250 per statement cycle.

Value Back Benefits

You can get up to 2% value back on spends on Croma and croma.com and upto 5% value back on spends on Tata outlets.

Conclusion

SBI Tata Platinum Card is an entry-level card best suited for beginners offering them a wide array of benefits and privileges on their spendings. With your SBI Tata Platinum, you get accelerated rewards i.e. 3x Empower points on every Dining, Departmental & Grocery shopping, and International spends. 1 Empower Point = Rs 1, which is a decent reward rate and can be redeemed through the TATA rewards loyalty program. You get milestone rewards on spending Rs 4 lakhs and 5 lakhs each, you get an e-Gift voucher from the partner exclusives. What do you think about this credit card? Do let us know in the comments.