The Essentia Platinum card by Kotak Mahindra bank is one of the entry-level credit cards. Still, it can be very rewarding if it fits your spending habits and used the right way. There is no other credit card in the Indian market that is more rewarding as far as grocery and essential spends are concerned. If that is how you’re gonna use your card, just close your eyes and sign up for this Essentia Platinum credit card; you certainly can not go wrong with this one. The card gives you a 10% return on grocery spends as Saving Points which can be redeemed at Kotak Rewards portal or used as cash at partner merchants (one saving point is equivalent to Re. 1). Doesn’t it sound cool to earn Saving Points for grocery spends and redeem them for a flight ticket on your next vacation!

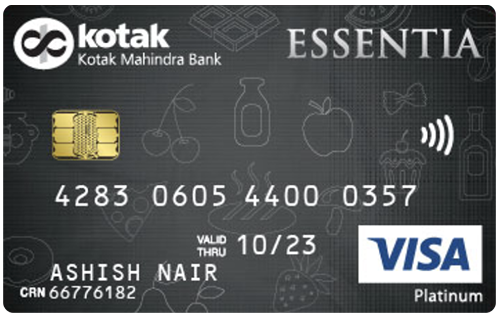

Kotak Essentia Platinum Credit Card

Fees

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

6 movie tickets by PVR on the expenditure of Rs. 1,25,000 in 6 months.

Rewards Rate

10 Saving Points/Rs. 100 on purchases made at grocery and departmental stores and 1 Saving Point/Rs. 250 on all other spends

Reward Redemption

Saving Points redeemable on Kotak Rewards portal for travel-related spends, shopping, mobile recharge, shopping vouchers and movie tickets. The Saving Points can also be used as cash (1 Point = Re. 1) at partner merchants.

Travel

NA

Golf

NA

Domestic Lounge Access

NA

International Lounge Access

NA

Insurance Benefits

Insurance cover worth Rs. 1.25 lakh against unauthorized transactions up to 7 days prior to reporting the loss of card.

Zero Liability Protection

Cardholder not liable for any fraudulent transaction of up to Rs. 1,25,000 up to 7 days prior to reporting the loss of card.

Spend Based Waiver

Nil

Rewards Redemption Fee

Nil

Rewards Redemption Fee

Nil

Foreign Currency Markup

3.5% + GST

Interest Rates

3.50% per month or 42% annually

Fuel Surcharge

Applicable, subject to a minimum surcharge of Rs. 10

Cash Advance Charges

Rs. 300 per Rs. 10,000 (or part thereof) withdrawn.

Add-on Card Fee

Rs. 299/card

- Reward Points earned as Saving Points for all transactions.

- 10 Saving Points for every Rs. 100 spent on departmental and grocery stores (min transaction of Rs.1,500 and max transaction of Rs. 4,000).

- Saving Points earned on purchases from grocery and departmental stores capped at 500 Points/month.

- 1 Saving Point for every Rs. 250 on all other spends (no cap in this case).

- 1 Saving Point = Re. 1 redeemable on Kotak Rewards Portal or for payments at partner merchants.

- 6 movie tickets or 1200 Reward Points on expenditure of Rs. 1,25,000 in 6 months.

- Support for contactless payment with Visa payWave. No PIN required for transactions up to Rs. 5,000.

- Priority assistance with KASSIST.

Kotak Essentia Platinum Credit Card Rewards:

- You earn Kotak Saving Points with this credit card.

- 10 Saving Points/Rs. 100 on spends at grocery and departmental stores.

- 1 Saving Point/Rs. 250 on all other spends (including spends at fuel stations).

- The accelerated rate of earning Saving Points at grocery and departmental stores applicable only for transactions between Rs. 1,500 and Rs. 4,000 and caped at a maximum of 500 Saving Points/month (at accelerated rate). However, no restrictions are applicable for Saving Points earned for all other spends (at the lower rate of 1 Saving Point/Rs. 250).

- 1 Saving Points is equivalent to Re. 1.

- Saving Points are valid for a period of 2 years and expire thereafter.

Reward Redemption:

The Saving Points earned can be redeemed:

- At Kotak Rewards portal for travel-related spends (flight/hotel bookings), mobile recharge, purchasing the products available at the portal and shopping vouchers (from popular brands including Amazon, Flipkart, Big Bazaar, etc.).

- For shopping at partner merchants (including brands like Puma, Archies, Giny & Jony, etc.) under Kotak’s PayByPoints program.

Kotak Essentia Platinum Credit Card Milestone Benefits:

- You get 6 movie tickets by PVR Cinemas or 1200 Reward Points on achieving the milestone of spending Rs. 1,250,00 in 6 months.

- The PVR tickets will expire 3 months after the program period gets over.

- You can use the PVR tickets to watch any show any day. The tickets are also transferable.

- If you choose to get Reward Points instead, the same are credited to your card account in the next billing cycle.

- There are many options for the redemption of the Reward Points like air tickets, movie tickets, mobile recharge and branded merchandise.

- The Reward Points must be claimed within 3 months after the program gets over.

Insurance:

You get an insurance cover of Rs. 1.25 lakh from New India Assurance Company Ltd against any unauthorized transaction made using the card up to 7 days prior to reporting the loss of card to the bank.

How to apply:

Applying for Kotak Mahindra credit cards is very simple. You can apply online by simply visiting the card’s page on the bank’s website. Alternatively, you can also fill this form on the bank’s website, and their officials will get in touch with you. You will need a few documents like identity/address proof (like Aadhar card, Voter card, driving license, etc.) for KYC and a proof of income like salary slips (for salaried applicants) or ITR (for self employes applicants).

Kotak Essentia Platinum Credit Card Eligibility:

- The age of the applicant must be between 21 and 65 years.

- The card is available only at select locations – Ahmedabad, Bangalore, Chandigarh, Chennai, Delhi (including Gurgaon and Noida), Hyderabad, Kolkata, Mumbai, Navi Mumbai and Pune.

Customer Care:

- Kotak Mahindra Bank provides priority assistance to its credit card members with KASSIST.

- If you have any queries, all you have to do is send an SMS: KASSIST to 5676788 and the bank officials will get in touch with you within 30 minutes. The 30 minutes timeline is applicable only if the message is sent between 10 am and 6 pm from Monday to Saturday. You can also dial their 24×7 helpline number 1860 266 2666 for credit card related queries.

- To report the loss of card you can dial 1800 209 0000 (24×7 operational toll-free number).

Conclusion:

In our opinion, the is no better credit card for you if you pay for all your grocery (and other essentials) expenses using your credit card as this card gives you a 10% return on spends at grocery and departmental stores. To make the most of this credit card (i.e. to earn maximum Saving Points), you must spend at least Rs. 5,000 in a month at grocery/departmental stores. If you spend that much, this credit card is certainly worth considering.

That’s just our opinion. Do let us know what do you think about this offering from Kotak Mahindra bank in the comments below. If you already have this card, feel free to share your experience.