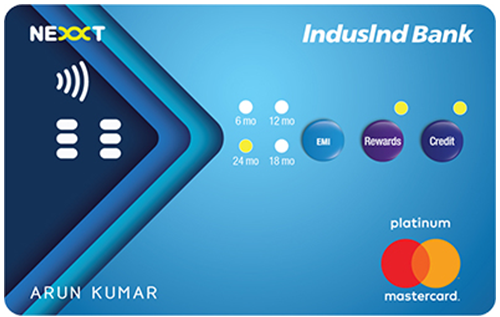

IndusInd Nexxt Credit Card is a unique card launched by IndusInd Bank. It is India’s first interactive and hassle-free card which enables you to make swift, secure, and convenient payments by tapping on the button provided on the card itself. It gives you 3 options to choose between while making payments namely; EMI, Rewards, & Credit. You can choose any of the three options at your convenience. With this card, you earn 1 Reward point on every Rs. 100 you spend and redeem these points against several options of your choice.

This card also offers benefits like ‘buy one get one offer’ on BookMyShow.com, Nexxt Auto Assist like – roadside repair, emergency towing, medical assistance, keys locked in, etc. Moreover, you can save on fuel transactions by getting the 1% fuel surcharge waived off every time.

IndusInd Nexxt Credit Card

Joining Fee

Renewal Fee

Best Suited For

Movies | Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

Avail of “buy one get one offer” every month on BookMyShow.com and Satyam Cinemas

Rewards Rate

1 Reward Point per Rs. 150 spent

Reward Redemption

1 RP = Re. 1 for redemption against cash credit & 1 RP = 1 InterMile / CV point.

Travel

N/A

Domestic Lounge Access

NA

International Lounge Access

NA

Golf

NA

Insurance Benefits

Get personal Air Accident cover up to Rs. 25 Lakhs

Spend-Based Waiver

NA

Rewards Redemption Fee

Rs. 100

Foreign Currency Markup

3.5% on the conversion amount

Interest Rates

3.83% p.m.

Fuel Surcharge

Avail 1% fuel surcharge waiver on transactions between Rs. 400 – Rs. 4000

Cash Advance Charges

2.5% or a minimum of Rs. 300

- Get exclusive welcome gift vouchers.

- Earn 1 RP on a transaction worth Rs. 150 on this card.

- Buy 1, get 1 Free offer on movie tickets.

- Personal air accident cover worth Rs. 25 lakhs.

- 1% fuel surcharge waiver.

IndusInd Nexxt Credit Card Features & Rewards

Welcome Benefit

As welcome benefits, you can select between various gift vouchers (EazyDiner, Bata, Oberoi Hotels, Yatra, Vero Moda, Aldo, etc).

IndusInd Nexxt Credit Card Rewards

- You get 1 reward point on every Rs. 150 payment made through this card.

- No reward points are accrued on fuel transactions.

Reward Redemption

- Redeem your earned reward points against various products/vouchers at Indusmoments.

- Redeem the reward points against cash credit at a rate of 1 RP = Re. 1.

- Redeem your earned reward points against Intermiles/CV Points at a rate of 1 RP = 1 InterMile / 1 CV Point.

Movie Benefits

- You get a ‘Buy One Get One offer’ on booking movie tickets on BookMyShow.

- You can avail a maximum of 2 free discounts on movies in a month.

- The price of complimentary tickets is capped at Rs. 200 per ticket.

Who Should Go for the IndusInd Nexxt Credit Card?

IndusInd Nexxt Credit Card is apt for everyone. To get this card, you only have to pay a joining fee with applicable taxes. This card can be used for day-to-day purchases at retail outlets. It comes with 3 button options, which all the way makes it easier to select payment options between EMI, Reward Points, and Credit.

IndusInd Nexxt Credit Card Review

IndusInd Nexxt Credit Card has in-built LED lights, making it look premium and attractive. This card can get your attention at the first look only. You get 3 options to choose from while making payments; first is pay with EMI option, which has in-built periods to choose from (3,6,12,18, & 24 months); second, you can redeem your accumulated reward points towards making online payments or at retail outlets, and third you can choose cash credit. It comes with a joining fee of Rs. 3,499 and no renewal fee.