In the fast-moving world, you need more time to visit the bank and pay your credit card bills. Internet Banking has solved this problem for you; you can pay your credit card bill anytime and from anywhere. When opening an account with ICICI Bank, you get the Internet banking user ID and password in the kit. Customers who do not have an account with the Bank can also register their ICICI credit cards for online services. Keep reading to learn how you can generate your user ID or password and register your credit card for net banking services.

How to Register an ICICI Bank Credit Card for Internet Banking?

The customers who already have an account with the bank get a user ID and password in the welcome kit. Use the given login credentials to log in to your net banking account, and you can change the login credentials for security purposes. If you forget the user ID or password, you can generate both with the help of the ICICI Bank online portal. Following are the different ways to register your ICICI Bank Credit Card for internet banking:

- Via ICICI Bank’s official website

- By contacting customer care

- By visiting your nearest branch

Via ICICI Bank’s Official Website

If you have the registered mobile number with you, here are the steps for online net banking registration.

Step 1: Visit the ICICI Bank website, scroll down, and click on ‘Explore Digital Banking’.

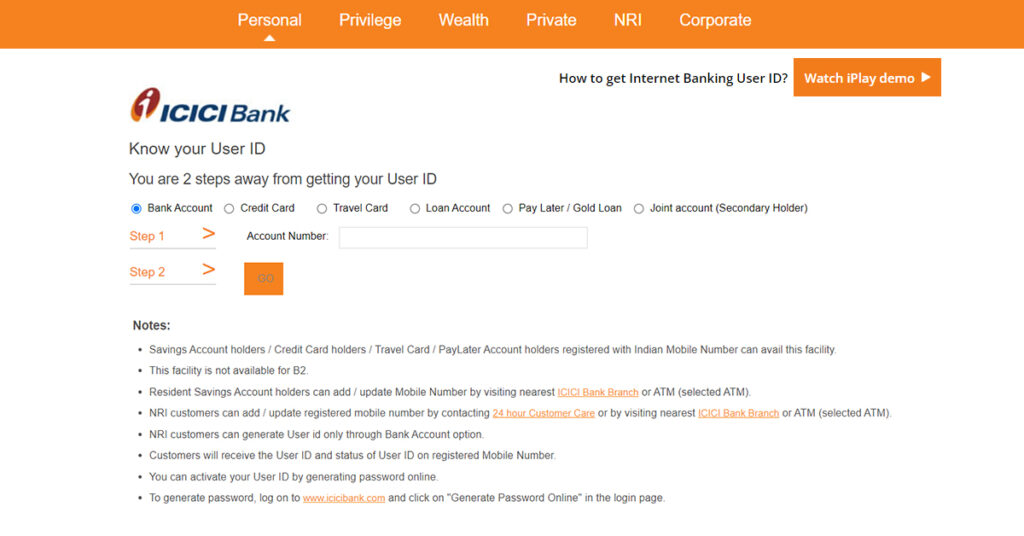

Step 2: You will be redirected to a new page. Click on the ‘Get User ID’ option.

Step 3: Select ‘Credit Card’ and enter your credit card number & registered mobile number.

Step 3: Select ‘Credit Card’ and enter your credit card number & registered mobile number.

Step 4: Proceed further, and after completion of the application process, your User ID will be sent to your registered mobile number.

By Contacting Customer Care

Even if you don’t have your registered mobile number with you, you can contact the ICICI Bank Credit Card customer care and request that they provide you with your internet banking user ID and password. They will also help you log in to your internet banking account.

By Visiting Your Nearest Branch

You can also visit your nearest ICICI branch and ask the bank officials to provide you with your Internet banking account credentials or fill in the physical application form for Internet banking registration. However, doing this via any of the above methods will be a better idea than visiting the branch.

Steps for generating Password:

Step 1: Go to ICICI Bank’s official website and click on Digital banking given in the right corner.

Step 2: You will be redirected to a new page; scroll down and click on ‘generate password.’

Step 3: On the next page, you will see the steps for generating the password; read them and click on the Proceed button.

Step 4: On clicking on to Proceed button, a new page will open. Enter your User ID and registered mobile number, and click on Go.

Step 5: In this step, you need to authenticate the account details by entering the OTP received on your registered number and clicking on go.

Step 6: Once verification is complete, you can generate a new password. Enter your desired password twice and click on the go.

You will receive a popup message on the screen stating that your password has been successfully generated.

How to Login to ICICI Bank Internet Banking?

Once you have registered your credit card for Internet banking, you can log in to your net banking account easily by following a few simple steps as mentioned below:

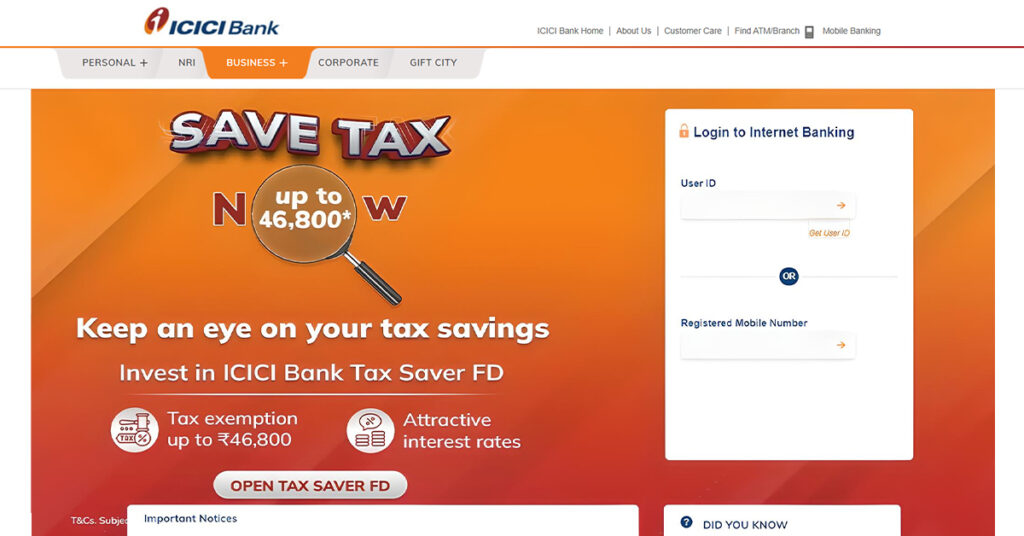

- Visit the ICICI Bank’s official website.

- Scroll down and click on the option ‘Explore Digital Banking.’

- Now, click on ‘Login Now.’

- You can log in to your net banking account either by entering your User ID or by entering your registered mobile number.

How To Reset User ID & Password?

If you don’t remember your ICICI Bank Internet banking credentials, you can get your User ID or reset your password by following the below-mentioned steps:

- Contact the ICICI Bank Credit Card customer care via call and select your preferred language.

- Choose the right option for ‘credit cards.’

- Enter your credit card number and four-digit PIN to proceed.

- Choose the right option for ‘Self Banking.’

- Select the right option to get/reset your user ID and password.

Facilities Available Through ICICI Credit Cards Internet Banking

Internet Banking has made a lot of tasks easier for cardholders. Following is a list of facilities that you can avail through internet banking:

- Getting E-statements over Email: You can get your account statements anytime via Internet banking and check all the transactions that have been made on your credit card.

- Credit Card Details: You can check all the details about your credit card, including your credit limit, payment due date, billing cycle, and many more.

- Credit Card Upgrade: You can also apply for the degradation of your credit card via Internet banking. So, if you want to get a higher credit card or another ICICI Credit Card with better features, you can simply apply for the same by logging in to your Internet banking account.

- Last 30 Days Transactions: You can also check all the transactions that have been made within the last 30 days on your credit card. It helps you check and ensure that no fraudulent transactions are being made.

- Reward Points Summary: If you have a rewards credit card, you can check the reward points summary via credit card internet banking. You can check the number of points earned and the options for redeeming these points.

- Reward Redemption: You can also redeem your earned reward points (Payback Points) by logging in to your ICICI Bank internet banking account. However, you can also do the same by logging in directly to the Payback website.

- Bill Payment: The ICICI Bank also allows you to pay your credit card bill via internet banking. Just log in to your net banking account, find an option of bill payments, and pay your credit card bill.

- Manage Credit Card: With your credit card internet banking account, you can manage the usage of your credit card. You can enable or disable different types of transactions, like international transactions, contactless transactions, etc, via Internet banking. Moreover, you can also set the maximum limit for such transactions.

- Apply For an Add-on Card: The Internet Banking facility on the ICICI Bank credit cards also allows you to apply for supplementary credit cards easily from the comfort of your home.

Steps to Pay ICICI Credit Bill Through Internet Banking

You can also make your ICICI Bank Credit Card bill payment by logging in to your Internet banking account. Following are the steps that need to be followed for the same:

- Log in to your Internet Banking account.

- Under the section ‘cards & loans,’ go to ‘Credit Cards.’

- Now, choose your credit card and find an option to pay your credit card bill. Select the payment method and pay the bill.

- There are a lot more facilities that you can avail of by logging in to your internet banking account.

Bottom Line

In short, net banking makes everything easier and more convenient for you. So, if you are an ICICI bank credit cardholder, you should register your card for Internet banking even if you haven’t done so yet.