The HDFC Bank issues three credit cards in partnership with Paytm, which are: Paytm HDFC Bank Select Credit Card, Paytm HDFC Bank Credit Card, and Paytm HDFC Bank Mobile Credit Card. Out of the three, Paytm HDFC Bank Mobile Credit Card is the most basic one and is affordable for all. It comes with a very nominal monthly membership fee of Rs. 29 + GST, which can be waived off if you have spent Rs. 2,500 or more in the previous month. With this card, you can earn a cashback of up to 2% on all your spends (except a few transactions).

Other than all this, the card comes with an exclusive offer as a milestone benefit. If you spend Rs. 10,000 every month for three consecutive months, you can get the benefits of the Paytm HDFC Bank Credit Card. You can also save on all your fuel transactions as the card comes with a 1% fuel surcharge waiver on all fuel transactions above Rs. 400. To know more benefits of the card and its features, refer to the information given below:

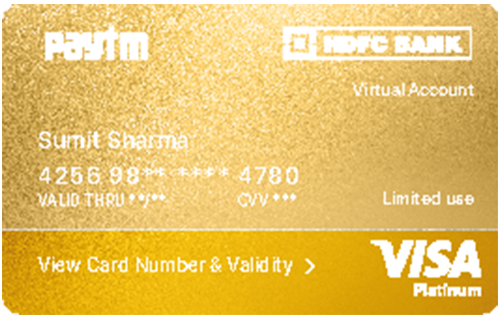

Paytm HDFC Bank Mobile Credit Card

Fees

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

Up to 20% discount on partner restaurants via Dineout.

Rewards Rate

2% cashback on Paytm mall, movies & Mini app, 1% cashback on other spends on Paytm app, and 0.5% cashback on all other spends.

Reward Redemption

Redeem your Cashpoints as Cashback along with other redemption options.Re.1 Cashpoint =Re.1 Cashback for redemption against the statement balance. Re.1 Cashpoint = Re.0.3 for redemption against travel benefits like Flight & Hotel bookings and Rewards Catalogue at the SmartBuy Rewards Portal.

Travel

NA

Golf

NA

Domestic Lounge Access

NA

International Lounge Access

NA

Insurance Benefits

NA

Zero Liability Protection

Cardholders will not be liable for any fraudulent transactions made on their card if the loss is reported to the bank in a timely manner.

Spend Based Waiver

The monthly fee is waived off on spending Rs. 2,500 or more in the previous month.

Rewards Redemption Fee

Nil

Rewards Redemption Fee

Nil

Foreign Currency Markup

3.5% on all foreign currency transactions

Interest Rates

3.75% per month (45% annually)

Fuel Surcharge

1% fuel surcharge waiver capped at Rs. 250 per month.

Cash Advance Charges

2.5% of the transacted amount subject to a minimum of Rs. 500.

Add-on Card Fee

Nil

- A cashback of 1%-2% on your spends on the Paytm app.

- An assured cashback of 0.5% on all other retail spends.

- Get all exclusive benefits of the Paytm HDFC Credit Card on achieving the milestone spend.

- Spend-based waiver of the monthly membership fee.

- 1% fuel surcharge waiver on all transactions above Rs. 250.

Paytm HDFC Bank Mobile Credit Card Cashback

- You earn a cashback of 2% for all your spends on Paytm mall, Paytm movies, and the Mini app.

- You earn a cashback of 1% on all other spends on the Paytm app.

- You earn a cashback of 0.5% on all other online & offline purchases.

- No cashback is earned on selected spends, including EMI transactions, fuel purchases, and wallet reloads.

Reward Redemption

The cashback earned on the Paytm HDFC Bank Select Business Credit Card are given to the cardholder as Cashpoints. Cashpoints can also be redeemed by the customer against outstanding balance as cashback or can be used for redeeming against other categories such as Smartbuy (Flights/Hotels), Airmiles & Product Catalogue.

Milestone Benefits

On achieving a spend of Rs. 10,000 or more in 3 consecutive months, you can unlock the benefits of the Paytm HDFC Bank Credit Card, which is a superior version of the Paytm HDFC Bank Mobile Credit Card.

Spend-Based Waiver

The monthly membership fee of Rs. 29 + GST is waived off if you spend Rs. 2,500 or more in the previous month.

Fuel Surcharge Waiver

- The 1% fuel surcharge is waived off at all fuel stations for all transactions worth Rs. 400 or more.

- The maximum benefit through the fuel surcharge waiver is capped at Rs. 250 per month for the Paytm HDFC Bank Mobile Credit Card.

Bottom Line

The Paytm HDFC Bank Mobile Credit Card is an entry-level credit card issued by the bank in partnership with Paytm. This card is aimed at providing decent saving benefits to individuals who are looking for a credit card with a nominal membership fee. It doesn’t only earn you cashback on all your spends, but also gives you an opportunity to unlock the benefits of the Paytm HDFC Bank Credit Card that comes with relatively more exciting features. You can also save on your fuel purchases by getting the 1% fuel surcharge waived off and on the membership fee by achieving a spend of Rs. 2,500 or more each month. If you are someone who is just going to start their credit journey and want to have an entry-level credit card, the Paytm HDFC bank Credit Card would be a decent choice. In case of any further doubts regarding the above information, make sure to ask us in the comment section below!