The Bank of Baroda Select Credit Card aims to provide cardholders with exciting and rewarding offers. This BoB Credit Card can be availed for a low joining and annual charge of Rs. 750 plus applicable taxes. For every Rs. 100 you spend with this card, you get 1 Reward Point and 5 Reward Points per Rs. 100 spent on dining and online transactions. This card has several key features, including the fuel surcharge waiver, which will help you save more on your fuel purchases. To know more about the Select card, the fees & charges, and its advantages, refer to the information given below:

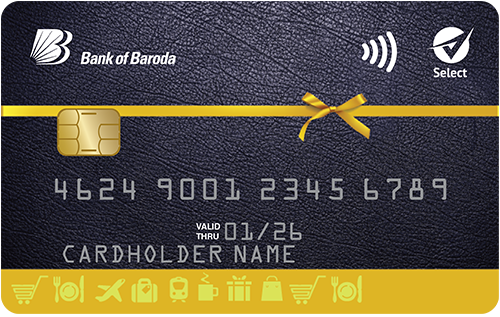

Bank of Baroda (BoB) Select Credit Card

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

NA

Rewards Rate

1 Reward Point per retail spend of Rs. 100 & 5 Reward Points per Rs. 100 you spend on utility bills, dining, and online purchases.

Reward Redemption

The earned reward points are redeemable against cash or various other options.

Travel

NA

Domestic Lounge Access

NA

International Lounge Access

NA

Golf

NA

Insurance Benefits

An accidental death cover is provided.

Spend-Based Waiver

Spend Rs. 7500 within 60 days of card issuance for joining fee waiver and spend Rs. 70,000 for the annual fee waiver

Rewards Redemption Fee

Nil

Foreign Currency Markup

3.5% for all foreign currency transactions

Interest Rates

3.25% per month

Fuel Surcharge

1% fuel surcharge waiver for fuel transactions between Rs. 400 & Rs. 5,000.

Cash Advance Charges

2.5% of the amount withdrawn or Rs. 300 (whichever is higher)

- 1 Reward Point per Rs. 100 spent (except on fuel).

- 5 Reward Points per Rs. 100 spent on online transactions, utility bills, and dining.

- Spend Rs. 7,500 in 2 months and get your joining fee waived off.

- Spend Rs. 70,000 in a year and get a waiver on the renewal fees.

- 1% waiver on fuel surcharge at all fuel stations.

- Accidental death insurance cover.

Bank of Baroda Select Credit Card Reward Points Earning

- Get 1 Reward Point per Rs. 100 spent.

- You get 5x Reward Points per Rs. 100 spent on dining and online transactions.

- 0.5 Reward Points for every Rs. 100 spent on Select MCCs.

- The 5X Reward Points are capped at a maximum benefit of 1000 Reward Points in a month.

- Fuel transactions are not eligible for Reward Points.

Reward Redemption

- The Reward Points earned are redeemable against cash or several different options as per your choice.

- 1 Reward Point = Rs. 0.25.

BoB Select Credit Card Features

The BoB Select Credit Card carries zero annual fees and offers a good reward rate along with many other privileges across various categories. Following are some of the most significant features & benefits:

Insurance Benefits

You get an accidental death insurance cover through your Bank of Baroda Select Credit Card.

Fuel Surcharge Waiver

- 1% fuel surcharge waiver across all fuel pumps for every transaction between Rs. 400 & Rs. 5,000.

- The maximum waiver is capped at Rs. 250 per month for the Bank of Baroda Select Credit Card.

Bank of Baroda Select Credit Card Fees and Charges

The following are the fees and charges associated with the BoB Select Credit Card –

- The card charges an interest rate of 3.25% per month

- The card charges a forex markup fee of 3.5% of the transaction amount

- The card has a cash withdrawal fee of 2.5% of the amount or Rs. 300, whichever is higher

- The card does not charge any fee for add-on credit cards.

Bank of Baroda Select Credit Card Eligibility Criteria

The following are the eligibility criteria required to get approved for the BoB Select Credit Card:

- The primary cardholders should be above 21 years of age (18 years for add-on applicants).

- The applicant should either be self–employed or salaried.

- The applicant should have a decent credit score.

How To Apply For BoB Select Credit Card?

To apply for the Bank of Baroda Select Credit Card online, follow the steps given below:

- Click on the Apply Now button,

- You will be shifted to the official application page,

- Fill in your particulars carefully,

- Submit your application.

Conclusion

The Bank of Baroda Select Credit Card allows you to save on all your transactions through its exclusive and rewarding offers. Apart from regular rewards, you get extra rewards on dining and online transactions. Moreover, this card is affordable for everyone. So, if you are among the people who are going to start their credit journey or who are looking for a card to help them save on all their spends, you can choose the Bank of Baroda Select Credit Card without any doubt.

Another similar credit card that must be checked is the IDFC First Select Credit Card, which is also one of the famous lifetime-free credit cards in the Indian market. That was the BoB Select card review from our side; drop your views on the card in the comments below!

Can i access Airport domestic lounge for Rs 2?

Yes