Bank of Baroda is a well-known credit card issuer with a diverse card portfolio. They offer credit cards that provide attractive rewards for shopping, travel, and dining. BoB Credit Cards not only allow you to earn reward points on your purchases but many of them can also be availed without any joining or annual charges. This article will cover all the details surrounding Bank of Baroda Credit Card Reward Points. It includes information about their expiration, earnings, rewards on UPI transactions, and more. Keep reading to learn more about the RPs earned with BoB Cards.

Reward Points shall be earned on transactions of ₹100. No Reward Points shall be awarded for transactions of less than ₹100 with Bank of Baroda Credit Cards. It is worth mentioning that with the HPCL BoB Energie Credit Card, Reward Points will be accrued/earned for transactions where the amount is ₹150 or higher i.e. transactions below ₹150 will not earn any Reward Points.

BoB Credit Card Reward Point Validity/Expiry

Reward Points earned with BoB Credit Cards shall be valid for a period of two years. If they are not used/redeemed within this period, they shall lapse. This is valid for all Bank of Baroda Credit Cards except the Eterna Card, whose reward points never expire.

BOB Financial Solutions Ltd (BFSL) maintains the right to cancel or suspend any Reward Points earned on the Credit Card if the Card Account is in arrears, restructured, suspended, or defaulted or if there is a reasonable suspicion of fraudulent activity on the account.

Reward Points Earning With Popular Bank of Baroda Credit Cards

Bank of Baroda Credit Cards offer 5X accelerated reward points on specific categories. The accelerated reward points are automatically posted to your account in the following statement cycle. Below are all the categories for which you can earn accelerated reward points on your BoB Credit Card. Mentioned along is also the maximum cap of reward points that can be earned in a statement cycle.

| Card | Categories for 5X Reward Points | Cap on Accelerated Reward Points Earning |

| Easy Credit Card | Departmental Store (5311) and Movies (7832) | 1,000 |

| Select | Online Spends and Dining (5812) | 1,000 |

| Premier | Dining (5812), Travel (4722) and International Spends | 2,000 |

| ConQR | Online, Dining (5812) and Utilities (4812, 4899, 4900 and 6300) | 1,000 |

| Bank of Baroda IRCTC Credit Card | Grocery (5411) and Departmental Store (5311) | 1,000 |

| SnapDeal Bank of Baroda Card | E-commerce, Grocery (5411) and Departmental Store (5311) | 2,000 Reward Points |

| CMA One | Online Spends, Dining (5812 and 5814) and Utilities (4812, 4899, 4900, 6300) | 1,000 |

After reaching the maximum spending cap, you will earn regular reward points. For complete details, click here.

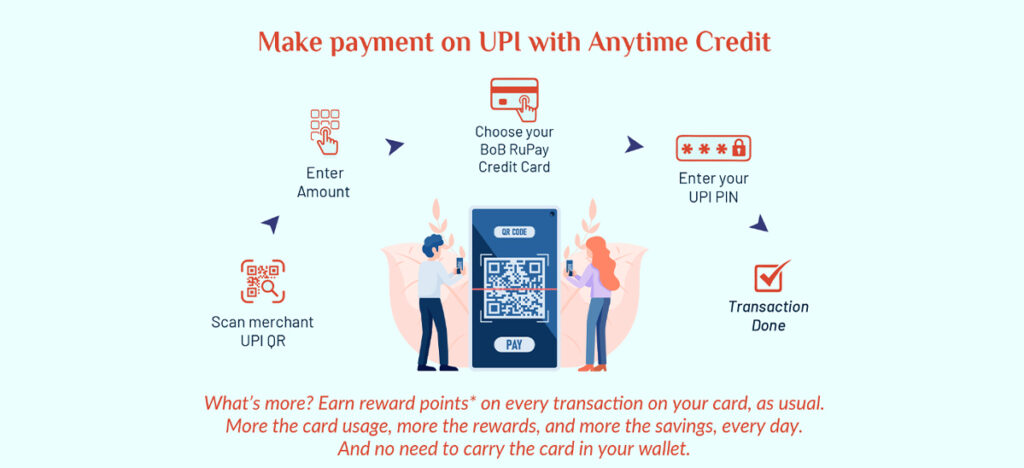

Reward Points on UPI Spends With Bank of Baroda RuPay Credit Cards

With a Bank of Baroda Credit Card, you can only earn core Reward Points, which means no Reward Points shall be awarded at an accelerated rate. It is also important to know that a maximum of 500 reward points can be earned for UPI spending in a statement cycle. Read the table below to check the reward rate for UPI spending with your particular BoB Credit Card.

| Card Name | RPs on Spends | RPs on Select Category |

| RuPay Easy | 1 RP per ₹100 | 0.5 RP per ₹100 |

| RuPay Premier | 2 RP per ₹100 | 1 RP per ₹100 |

| RuPay IRCTC | 2 RP per ₹100 | 2 RP per ₹100 |

| RuPay Snapdeal | 4 RP per ₹100 | 4 RP per ₹100 |

| RuPay HPCL Energie | 2 RP per ₹150 | 2 RP per ₹150 |

| RuPay Varunah | 1 RP per ₹100 | 1 RP per ₹100 |

| RuPay Renaissance – Nainital Bank | 1 RP per ₹100 | 1 RP per ₹100 |

| RuPay Indian Army Yoddha | 2 RP per ₹100 | 2 RP per ₹100 |

| RuPay CMA one | 1 RP per ₹100 | 1 RP per ₹100 |

Bottom Line

It is crucial to have a clear understanding of all the major features of a credit card before applying for it. Even after receiving the credit card, it is advisable to know which transactions are eligible for rewards and which are not. Bank of Baroda Credit Cards offer various rewards across multiple categories. While some categories may receive accelerated reward points, others, such as UPI transactions, may only receive core Reward Points. With this article, we hope to have answered any and all queries regarding Bank of Baroda Credit Card Reward Points.

Share your queries or opinions in the comment section below.