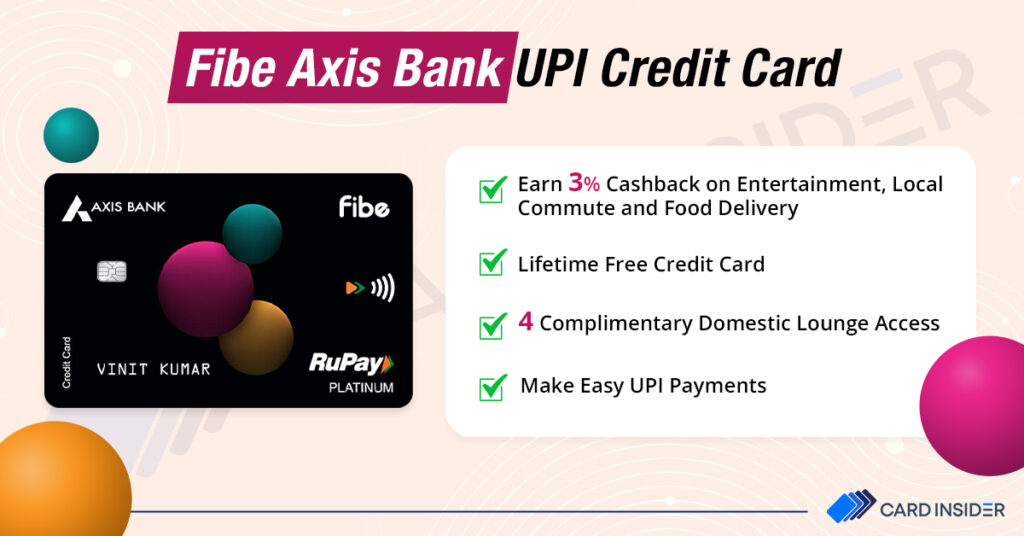

Axis Bank has launched the first numberless credit card in India. It would ensure more safety and security for users as the card would feature only a chip without any details such as Expiry and CVV on it. This is a co-branded credit card presented by the association between Axis Bank and FIBE. This credit card offers primary benefits to users. Being a lifetime free credit card, this card will be especially attractive and lucrative for first-time credit card holders. Whether looking to begin your credit journey or for a UPI Credit Card, this offering by Axis Bank is highly beneficial. You can easily link this card to your UPI applications and start making transactions.

You can get direct cashback of up to 3% with this card and also four complimentary domestic lounge access with this card. Keep on reading to learn more about the benefits and fees of this RuPay Credit Card.

Fibe Axis Bank RuPay Credit Card

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Cashback |

Welcome Benefits

Movie & Dining

3% Cashback on Entertainment Spends & 15% Off With the Axis Bank Dining Delights Program.

Rewards Rate

3% Cashback on Entertainment, Food Delivery & Commute

Reward Redemption

Direct Cashback

Travel

Domestic Lounge Access Available

Domestic Lounge Access

1 Complimentary Domestic Lounge Access Every Quarter

International Lounge Access

N/A

Golf

N/A

Insurance Benefits

N/A

Spend-Based Waiver

N/A

Rewards Redemption Fee

N/A

Foreign Currency Markup

3.5% of the Transaction Amount

Interest Rates

3.6% Per Month (52.86% Yearly)

Fuel Surcharge

1% up to Rs. 400

Cash Advance Charges

2.5% of the Transaction Amount or a Minimum of Rs. 500

- This is a lifetime free credit card.

- You get 4 complimentary domestic lounge access with this card.

- Earn up to 3% on eligible spends.

Pros

- Make seamless UPI transactions with this credit card.

- Enjoy 3% cashback on entertainment, commute and food delivery.

Cons

- No welcome benefits are provided with this card.

- This card offers an introductory cashback on a few categories.

Fibe Axis Bank Credit Card Features

It’s important to know all the features and details of any credit card before applying. So let’s have a look at all the features of the new Fibe Axis Bank Credit Card.

Lifetime Free Credit Card

The Fibe Axis Bank Credit Card comes with no annual or recurring renewal charges.

Numberless Credit Card

Being a numberless credit card, the Fibe Axis Bank Credit Card offers consumers an added layer of security. This is the first numberless credit card in India.

UPI Enabled

Easily make UPI payments with the Fibe Axis Credit Card.

Fibe Axis Bank Credit Card Rewards

Cashback on Spends

With the Fibe Axis Bank Credit Card, you can earn direct cashback as a reward on transactions.

- Earn up to 3% on entertainment, commute and food delivery transactions.

- Get 1% cashback on all other spends.

- Cashback is not eligible for transactions of less than Rs. 100.

- Maximum cashback amount = Rs. 1500 in a statement cycle.

- Cashback is not applicable in the following categories – cash withdrawal, wallet reloads, fuel spends, purchase of gift cards, EMI transactions, rental payments, insurance payments, and government service payments.

Domestic Lounge Access

Enjoy up to 4 complimentary domestic lounge access (one each quarter) with the Fibe Axis Bank Credit Card. Given below is a list of all the lounges you can access with the Fibe Axis Bank Credit Card.

Participating Airport Lounges for Fibe Axis Bank Credit Card

| City | Domestic Lounge | Terminal |

| Bangalore | BLR Domestic Lounge | Domestic T1 |

| Bangalore | 080 Domestic Lounge | Domestic T2 |

| Chennai | Travel Club Lounge A | Domestic T1 |

| Chennai | Travel Club Lounge B | Domestic T1 |

| Mumbai | Travel Club Lounge | Domestic T1c |

| Mumbai | Adani Lounge | Domestic T2 |

| Kolkata | Travel Club Lounge | Domestic T1 |

| Hyderabad | Encalm Lounge | Domestic T1 |

| New Delhi | Encalm Lounge | Domestic T1 |

| New Delhi | New Delhi Domestic T2 Lounge | Domestic T2 |

| New Delhi | Encalm Lounge | Domestic T3 |

Entertainment and Movies

Enjoy up to 3% cashback on entertainment spends.

Dining

Receive a 15% discount up to Rs. 500 on over 1000 restaurants with the Axis Bank Dinning Delights Program.

Fuel Surcharge Waiver

Fibe Axis Bank Credit Card offers a 1% fuel surcharge waiver on transactions between Rs. 400 and Rs. 5,000. The waiver limit is set at Rs. 400.

Fibe Axis Bank Credit Card Charges

The Fibe Axis Bank RuPay Credit Card comes with few charges as it is a lifetime-free credit card.

- This card comes at zero annual or renewal charges. It is a lifetime free credit card.

- 1% is chargeable on all rental payments and transactions. The maximum cap for this is at Rs. 1500.

- You will be charged 3.5% for all foreign transactions.

Eligibility Criteria for Fibe Axis Bank Credit Card

You should fulfil the following criteria to be eligible for this credit card.

- Applicants should be between the ages of 18 and 70 years.

- Applicant must be a resident of India.

How to Apply for a Fibe Axis Bank Credit Card?

Keep a few necessary documents like your PAN Card ready as it might be required while filling out the application form. You can easily apply for the Fibe Axis Bank UPI RuPay Credit Card with Card Insider by simply clicking on the “Apply Now” button on your screen.

Documentation Needed:

The following documents might be required for applying for the Fibe Axis Bank Credit Card.

- PAN Card

- Address Proof like an Aadhaar Card, Passport or Driving License

- Latest Salary Slips or Form 16

- Passport Size Photographs

Fibe Axis Bank RuPay Credit Card Review

The Fibe Axis Bank RuPay Credit Card is a lifetime free offering. With this card, you can enjoy cashback of up to 3% on eligible transactions. Not only this, you shall also get 4 complimentary domestic lounge access in a year with a card. This complimentary lounge access, along with no annual fees, makes this credit card a must-have for all users. Along with all these features, you can also make UPI payments with this card; no longer carry your credit card with you everywhere you go. Simply link it to your preferred UPI app and start making spends.

Fibe Axis Bank Credit Card is the first numberless credit card in India. This means that your card would not have any CVV, Expiry Date or Card Number on it. This card offers exceptional safety measures to protect cardholders from fraudulent transactions and unauthorized use.

Tell us your thoughts on this newly launched RuPay Credit Card by Axis Bank in the comments below.

1- kya koi bhi online saman khardane par charge lagata hai?

2- Kya Market se Saman kharidari kiye UPI payment transactions par charge lagata hai?