If you have recently applied for an Axis Bank Credit Card, you might be wanting to know the progress of your application. Axis Bank allows you to check your credit card application status online as well as offline at your convenience. In order to check Axis Bank Credit Card application status, you should have your application reference number, PAN Number, and registered mobile number. Many people apply for a credit card and keep waiting for its approval for a long, but you don’t need to do it because the card issuers allow you to track your credit card application anytime. If you don’t know how to track your application status online or offline in seconds, we are here with this article to help you out. Keep reading the article to understand the same in detail:

How to Track Axis Bank Credit Card Application Status Online?

The applicants who prefer online methods can track their Axis Bank credit card application status using any of the below-mentioned methods:

– Using credit card application reference number

– Using PAN number/Through a mobile number

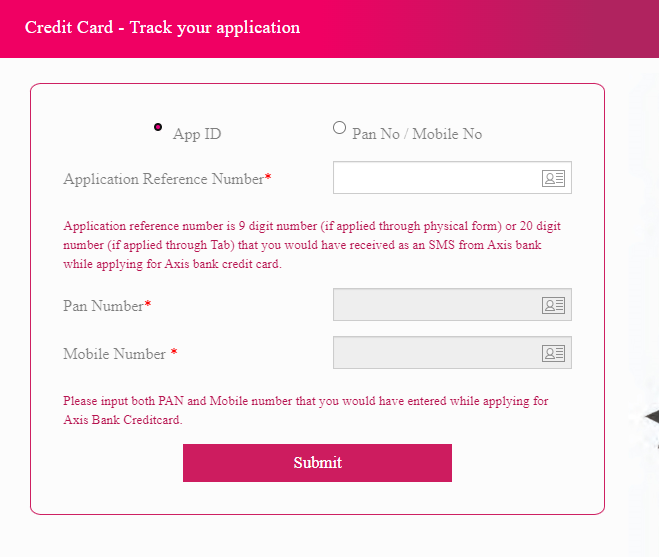

By using the application reference number

The applicant can track their Axis Bank Credit Card status using the application reference number. If you don’t know how to find your application reference number, you should note it down when it is shown on your screen after applying for a credit card. You can also find it in the SMS that was sent to you after filling out the online application form. You just need to follow a few simple steps as mentioned below:

Step 2: Choose the option ‘App Id.’

Step 3: Enter your application reference number.

Step 4: Click on submit.

The status of your Axis credit card application will be there on your screen in a few seconds after clicking on submit.

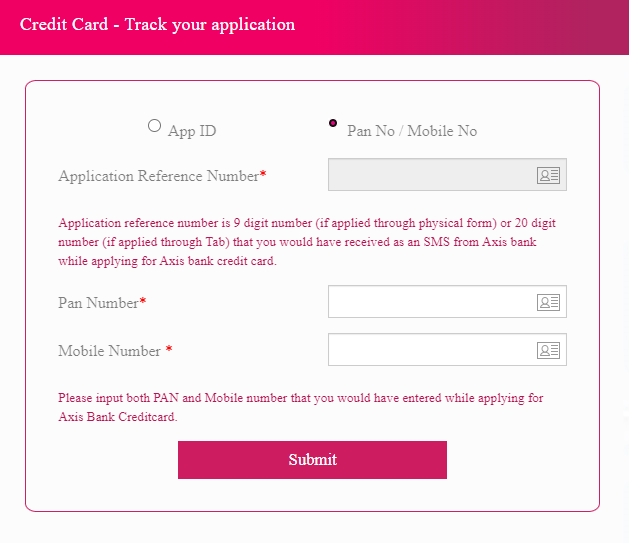

By Using the PAN Number or Through Mobile Number

If you can’t find your application Id, Axis Bank also provides you with another online way to track the status of your application. Hereunder are the steps to check your axis bank credit card status application through mobile number and PAN number:

Step 2: Enter both your PAN card number and mobile number.

Step 3: Click on submit and your application status will be on your screen soon after this.

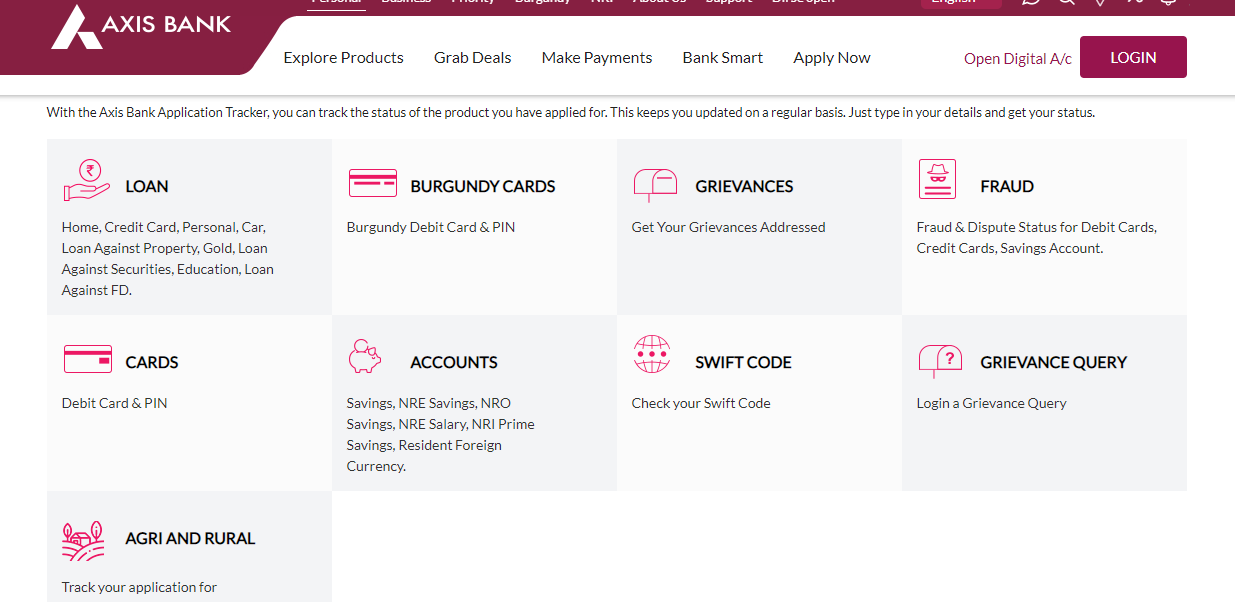

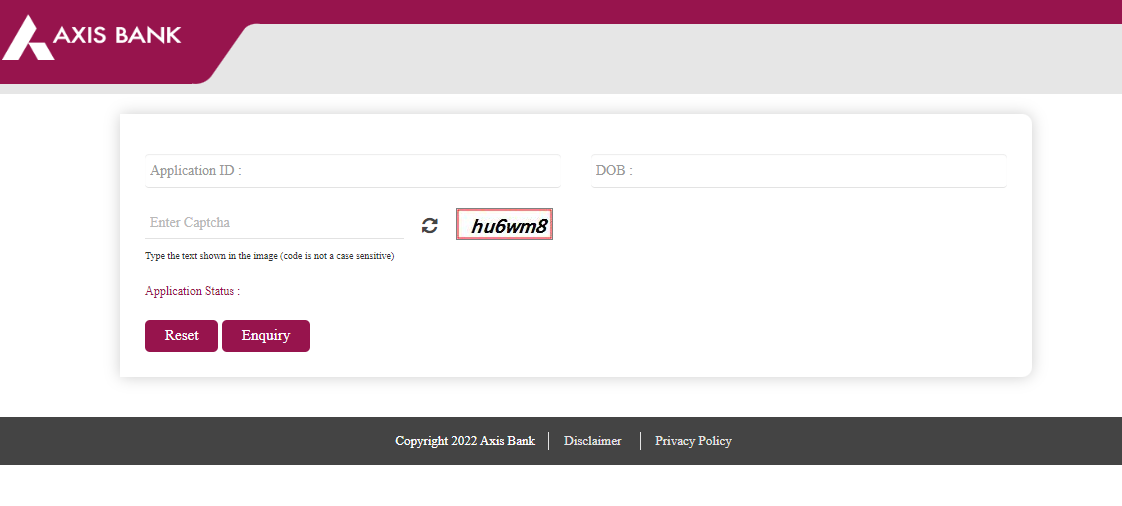

Using Application ID and DOB

Another method to track axis bank credit card application status is to do it using your application ID and date of birth. The following are the steps to do it online via Axis Bank’s official website.

- Step 1: Visit Axis Bank’s official application tracking page.

- Step 2: Click on the option ‘Loan.’

- Step 3: You will be redirected to a new page where you can enter your application ID, Date of Birth, and the Captcha code that is given on the screen.

- Step 4: Click on enquiry and your application status will be there on your screen in a few seconds.

Through Axis Bank Chatbot AHA

You can also take help from the Axis Bank chatbot ‘AHA’ regarding your credit card application status. Just visit Axis Bank’s official website and click on the ‘AHA’ icon on the bottom rightmost corner of your screen. Type ‘Credit Card Application Status’ and send. The chatbot will help you check the status of your credit card application.

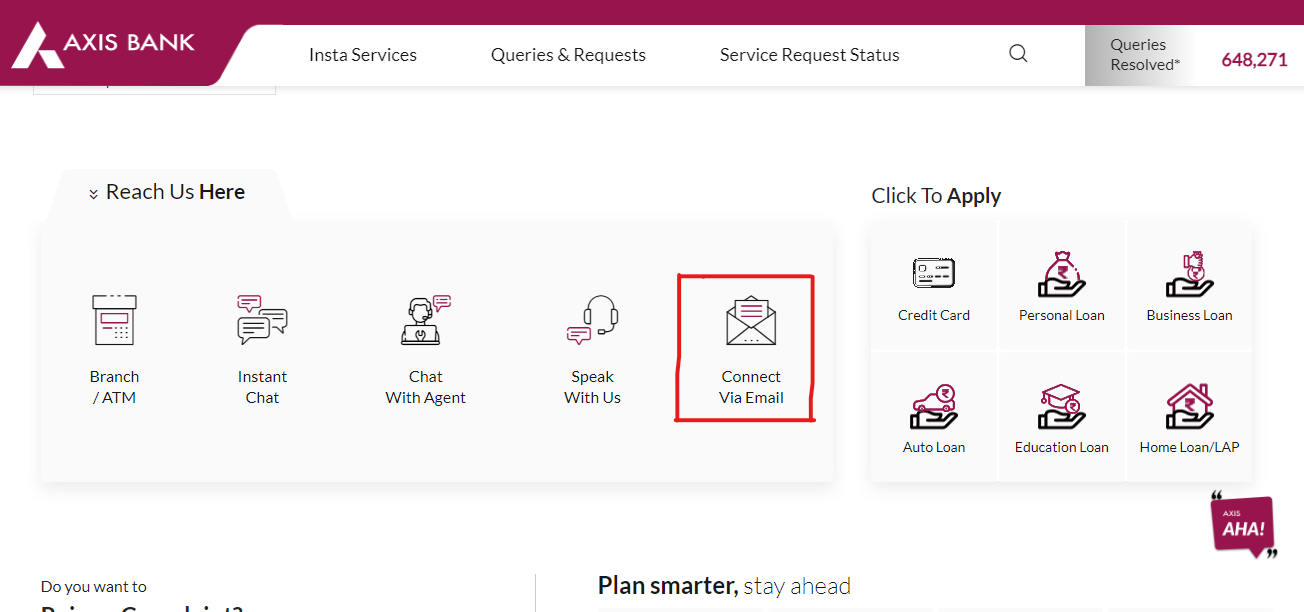

Through Email

You can also get to know about the status of your credit card application through email by following a few simple steps as follows:

- Step 1: Visit Axis Bank’s official customer support page.

- Step 2: Click on ‘Connect via Email.’

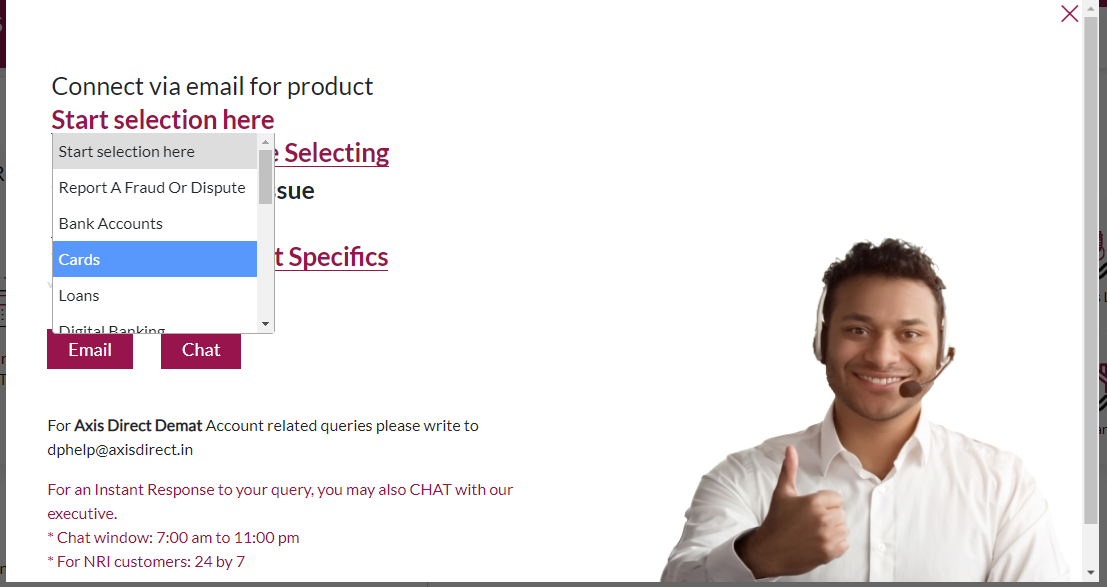

- Step 3: Click on ‘Start Selecting Here’ and then on ‘Cards.’

- Step 4: Then click on ‘Continue Selecting’ and select ‘Credit Cards.’

- Step 5: Click on ‘Choose your Query’ and select ‘Credit Card Application.’

- Step 6: Click on ‘Choose Your Query’ again and select ‘How Do I check my credit card application.’

- Step 7: You will be redirected to a page where you can compose an email regarding your query. Enter all the required details there and proceed further.

After sending the email, the card issuer will reply to you within a few business days with the updated status of your credit card application.

How to Check Your Axis Credit Card Application Offline?

If you are someone who doesn’t have easy access to the internet or who doesn’t prefer online methods for any reason, you can also check your credit card application status offline by any of the below-mentioned methods:

– By visiting your nearest branch

– By contacting customer care

By Visiting Your Nearest Branch

You can visit your nearest Axis Bank branch and ask the bank officials to assist you with the tracking details of your credit card application. While visiting the bank, make sure to keep your Axis Bank Credit Card application ID with you so that the bank can easily provide you with the details of your credit card application status. The bank officials will help you get your application status within a few minutes. You can also ask them to help you understand all the online methods so that you can track the application status of your credit card anytime.

By Calling Axis Bank Customer Care

You can contact Axis Bank Credit Card customer care on 1800-419-5555 and ask them to help you know your credit card application status. They will ask you for a few details, like your application number, registered mobile number, or PAN number, and will provide you with the required information. If you are an NRI customer, you can call Axis Bank customer care on +91-22-67987700 to know your Axis Bank Credit Card status.

Different Credit Card Application Statuses

Following are the different types of application statuses that you can find after checking for the same. To understand it more clearly, refer to the points given below:

- No records found: On entering wrong details like wrong reference number, wrong PAN number, or mobile number then the screen will display no record found. In this case, re-enter your details carefully and re-check before clicking on Submit.

- In-progress: When your application is still under process, the application status will be displayed as ‘in-progress’.

- On-hold: Banks can keep your application under the on-hold status if they think that the information provided by you is incomplete or wrong. In this case, you will be asked to provide them with the required documents or information.

- Approved: Bank notifies you through SMS also when your application is approved and the same will be updated on the credit card application tracking webpage.

- Dispatched: On approval of the credit card application you will receive an SMS stating that your credit card is dispatched, this means that it will be delivered to your address in 2-3 working days. The same will be updated on the credit card application tracking webpage.

- Disapproved: On tracking credit card applications online if you see the status as disapproved that means your credit card application got rejected. The rejection of a credit card application can depend on various reasons like not meeting the eligibility criteria, wrong information provided in the application form, wrong documents are attached with the application form, etc. So, before submitting the application form go through it once again and proofread it.