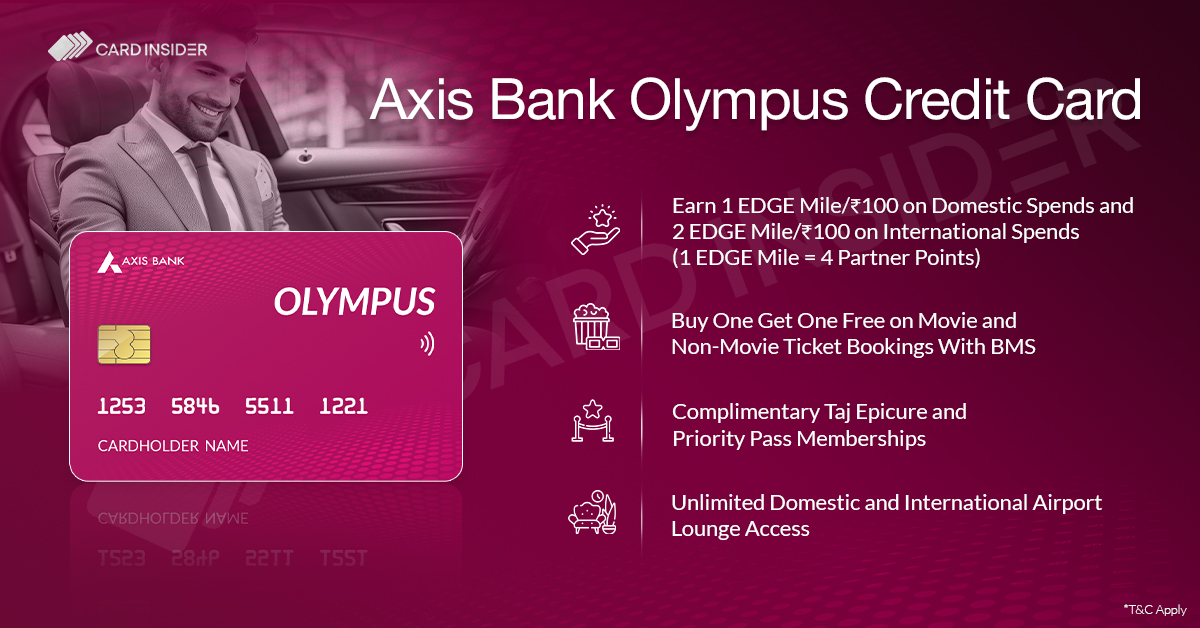

The Axis Bank Olympus credit card is one of the latest additions to the Axis Bank credit card portfolio. It boasts several advantages and can compete with many Indian super-premium cards. With this card, you’ll earn 1 EDGE Mile for every ₹100 spent domestically and 2 EDGE Miles for every ₹100 spent internationally. While this reward rate may seem low, you may be surprised to learn that 1 EDGE Mile equals 4 Partner Points. This means you would earn 4% rewards on domestic spending and 8% on international spending. Additionally, since this card charges a Forex markup fee of 1.8% + GST on international spends, the reward rate on foreign spends actually comes to 5.8%, which is quite impressive.

In addition to the high reward rate and easy redemption methods through Travel EDGE, one can easily convert 7.5 lakh EDGE Miles in a year to various flight and hotel partners. Apart from the rewarding rate of returns, this card offers exclusive airport privileges such as unlimited domestic and international lounge access, airport transfers, and concierge services. Those who have a passion for golf can enjoy eight complimentary golf sessions each year with the provision to earn more on each spending of ₹50,000 or more.

You might be wondering where luxury comes into play in all of this. Well, with this card, you’ll also receive a complimentary Taj Epicure membership, which unlocks new doors and offers for cardholders. Keep reading for more details.

Axis Bank Olympus Credit Card

Joining Fee

Renewal Fee

Best Suited For

Movies | Travel | Shopping |

Reward Type

Reward Points |

Welcome Benefits

Movie & Dining

40% Discount on Dining With Axis Dining Delights. Buy One Get One Free on Movie and Non-Movie Ticket Bookings With BMS

Rewards Rate

1 EDGE Mile/₹100 on Domestic and 2 EDGE Mile/₹100 on International Spends

Reward Redemption

Redeem on Travel Edge (1 EDGE Mile = 4 Partner Points)

Travel

Complimentary Priority Pass, Airport Transfer Service, and Concierge Services

Domestic Lounge Access

Unlimited Airport Lounge Access

International Lounge Access

Unlimited International Airport Lounge Access With Priority Pass

Golf

8 Complimentary Golf Lessons/Rounds Across Domestic Courses

Insurance Benefits

N/A

Spend-Based Waiver

N/A

Rewards Redemption Fee

N/A

Rewards Redemption Fee

N/A

Foreign Currency Markup

1.8% + GST (Effectively Costing 2.12%)

Interest Rates

3.6% Monthly (52.86% Annually)

Fuel Surcharge

1% Fuel Surcharge Waiver

Cash Advance Charges

2.5% (Minimum of ₹500)

- Axis Olympus is a super premium credit card with high rewards and a great point redemption program.

- Cardholders can earn 2 EDGE Mile/₹100 on international and 1 EDGE Mile/₹100 on domestic spending.

- This card offers frequent travelers unlimited international and domestic airport lounge access.

Pros

From movies to dining, this card offers a wide range of benefits.

Cons

Although this card is quite rewarding, it has a few drawbacks; no milestone benefits are associated with such a premium card.

Welcome/Annual Benefits – Hotel Vouchers & EDGE Miles

All Olympus credit card holders are eligible for Taj/ITC Hotel vouchers worth ₹10,000 as a welcome and annual renewal benefit. Cardholders will also receive 2,500 EDGE Miles as a welcome and renewal benefit. Both these benefits will be unlocked upon making the first transaction with the Olympus card.

Earn EDGE Miles

The cardholder will earn 1 EDGE Miles for every ₹100 spent on domestic purchases and 2 EDGE Miles for every ₹100 spent on international purchases. No reward points will be earned on the following categories: transportation and tolls, utilities, insurance, educational institutions, government institutions, wallet, rent, and fuel.

EDGE Miles Redemption With Olympus Credit Card

| Category | Redemption Value | Minimum EDGE Miles for Redemption |

| Partner Miles | 1 EDGE Mile = 4 Partner Points | 500 |

| Travel EDGE Bookings | Book Flights, Hotels, and Experiences with Travel EDGE | 500 |

Transfer Miles partners are divided into two groups, Group A and Group B, each of which has its limit on EDGE Mile transfers in a year. With the Axis Olympus, you can convert a maximum of 7.5 lakh EDGE Miles per customer ID annually.

| Group A (Annual Cap of 150,000 EDGE Mile) | Group B (Annual Cap of 600,000 EDGE Mile) |

| Accor Hotels (Accor Live Limitless) | Air France-KLM (Flying Blue) |

| Air Canada (Aeroplan) | Air India (Flying Returns) |

| Ethiopian Airlines | Air Asia |

| Etihad (Etihad Guest) | ITC |

| Japan Airlines (JAL Mileage Bank) | IHG Hotels & Resorts (IHG One Rewards) |

| Marriott International ( Marriott Bonvoy) | Qantas Airways (Qantas Frequent Flyer) |

| Qatar Airways | SpiceJet |

| Singapore Airlines (Krisflyer) | Vistara (TATA SIA Airlines Ltd) |

| Turkish Airlines | |

| Thai Airways (Royal Orchid Plus) | |

| United Airlines (MileagePlus) | |

| Wyndham Hotels(Wyndham Rewards) |

Airport Privileges

Complimentary Domestic Lounge Access

Both primary and add-on Axis Olympus cardholders are entitled to unlimited domestic airport lounge access at select airports nationwide. In addition, ten free guest visits are offered each year.

International Lounge Access (Priority Pass)

All primary and add-on cardholders of the Axis Olympus credit card are eligible for a complimentary Priority Pass membership. This would allow them unlimited complimentary access to over 1,200+ international airport lounges worldwide. Ten guest visits are also included in this membership.

Airport Concierge Services

With the Axis Olympus card, you can take advantage of eight concierge services. This can be considered one of the most premium and comfortable services offered with this card, as it is only provided with super premium Axis Bank credit cards like Burgundy Private and Axis Magnus for Burgundy.

Airport Transfer Services

2 complimentary airport pickups and transfers each year for the primary cardholder only. These can be booked by visiting Axis Bank Extraordinary Weekends.

Luxury Airport Transfers: (Mercedes/BMW/Audi): Valid across Delhi, NCR, Mumbai, Bangalore, Hyderabad, Chennai, and Kolkata.

Sedan Airport Transfers: Valid across Delhi, Gurgaon, Jaipur, Mumbai, Pune, Bengaluru, Hyderabad, Chennai, Kolkata, Noida, Faridabad, Ghaziabad, Navi Mumbai, Cochin, Goa, Ahmedabad, Vadodara, Surat, Chandigarh, Agar, Amritsar, Lucknow, Udaipur, Nagpur, Mangalore, Mysore, Madurai, Bhopal, Gwalior, Patna, Jodhpur, Leh, Srinagar, Pondicherry, Jammu, Vishakhapatnam, Trivandrum, Indore, Ranchi, Bhubaneswar, Dehradun, Aurangabad, Coimbatore, Nasik & Mangalore.

Buy 1 Get 1 on BookMyShow

Axis Bank Olympus credit cardholders can enjoy a buy-one-get-one-free offer on movie ticket bookings through BookMyShow. When booking one movie ticket, cardholders will receive the second for free or a discount of up to ₹650. The price of the second movie ticket or the maximum discount cannot exceed ₹650. Additionally, a buy-one-get-one-free offer is also available for non-movie ticket bookings. The maximum discount for the second non-movie ticket is capped at ₹1,000.

When shall this offer expire?

Since it is an ongoing offer, this shall be provided till the credit card is valid.

Golf Benefits

With the Axis Olympus credit cards, you can get eight complimentary golf lessons/rounds. In addition to these eight free visits, cardholders can get one additional round on each ₹50,000 spent with their credit card. Cardholders can book their golfing experience by visiting Axis Extraordinary Weekends or contacting Axis Olympus Concierge (1800 103 4962).

Complimentary Taj Epicure Membership

Expiring luxury with complimentary membership to Taj Epicure. Enjoy exclusive benefits with this membership.

- Up to 10 persons can enjoy 25% off food and beverages for dine-in and takeaway at participating restaurants across hotels.

- 20% discount on Spa Treatments at Jiva Spas across hotels – unlimited usage.

- 25% off on orders via the Qmin App – unlimited usage.

- 20% savings on the best available rate on rooms/suites at participating hotels – valid for one stay voucher.

- 20% off the Best Available Rate at Taj Palaces on rooms/suites for a maximum of 5 nights – valid for one stay voucher.

- 20% savings on rooms/suites at Taj Safaris for a maximum of 5 nights – valid for one stay voucher.

Complimentary Stay Program

When booking a minimum of three nights with Hotels.com from Olympus card, you’ll receive the third night’s stay for free. This offer is valid for one room only, and the reservation must be made in the primary cardholder’s name. Additionally, the primary cardholder must be present during the stay at the property. Customers can take advantage of this offer twice in a calendar year.

Compare Axis Olympus and Reserve Credit Card

The Axis Bank’s Reserve Credit Card is one of the most premium cards offered by the bank, available at a high fee of ₹50,000. In many aspects, the Axis Olympus card competes with the Reserve card, even though it can be availed at a lower fee compared to the Reserve.

| Categories | Olympus | Axis Reserve Card |

| Joining/Annual Fee | ₹20,000 + GST | ₹50,000 + GST |

| Reward Rate |

|

|

| Reward Redemption | 1 EDGE Mile = 4 Partner Point | EDGE Reward Points can be redeemed for vouchers on the EDGE Rewards redemption portal |

| Welcome Benefits |

|

|

| Movie/Dining |

|

|

| Travel Benefits |

|

Unlimited international and domestic airport lounge access |

One significant advantage of the Olympus card is the ability to convert 7.5 lakh EDGE Miles annually per customer ID. In contrast, the Reserve card limits the maximum cap to 5 lakh EDGE Reward points.

Citi Prestige to Axis Olympus Credit Card Migration

Axis Bank has begun migrating Citi Credit Cardholders to its core and generic credit cards. Hence, it has introduced a range of credit cards, including the IndianOil Axis Premium and the super-premium Olympus Credit Card. Under this migration, those with the Citi Prestige Card shall be migrated to the all-new Axis Olympus Card. The fees and reward structure will remain the same, but the new Axis Olympus card will offer better rewards and benefits compared to the Citi Prestige. For instance, a new Buy One Get One (BOGO) offer in partnership with BookMyShow has been introduced with the Axis Olympus, which was not available previously.

Axis Bank Olympus Credit Card Review

Olympus credit card serves many purposes and offers a wide range of benefits. It indeed can be prescribed as a super-premium credit card. If we’re talking about simple benefits like Buy One Get One on movies or a generous EDGE Mile transfer ratio, this card has it all. With a reasonable reward rate of 4% on domestic spends and slightly higher than 5% on international ones this card would genuinely enhance everyone’s savings, especially if you travel and spend abroad. Those who travel frequently can benefit from unlimited international and domestic lounge access, which is provided with this card for both primary and add-on cardholders.

Those looking for a premium credit card should definitely check out the features of Axis Olympus. This card currently offers some truly exciting and rewarding benefits.