My Wings credit card by Axis Bank is an entry-level travel credit card that offers exciting cashback and reward points benefits on rail, road, and air travel spends. You get complimentary airport lounge access and discount and cashback benefits on rail/air tickets. As far as road travel is concerned, the card rewards you with a discount of Rs. 100 on bus tickets and a flat Rs. 400 off on car rentals. On top of these travel-related benefits, you also enjoy dining privileges with a minimum 15% discount on dining bills at partner restaurants under the Axis Bank’s Dining Delights program. Read on to learn more about this offering by Axis Bank.

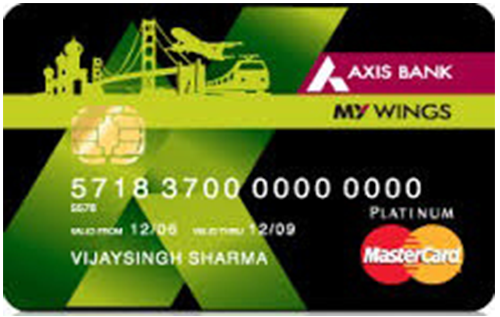

Axis Bank My Wings Credit Card

Joining Fee

Renewal Fee

Best Suited For

Travel |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

Minimum 15% off on dining at partner restaurants

Rewards Rate

4 EDGE Points for every Rs. 200 spent with the card

Reward Redemption

EDGE Points earned are redeemable for shopping/travel vouchers or products (from the given catalog) on the EDGE Rewards portal.

Travel

Complimentary domestic lounge access, cashback/discount on flight/rail/bus tickets and car rentals

Domestic Lounge Access

1 complimentary domestic lounge access per quarter

International Lounge Access

N/A

Golf

N/A

Insurance Benefits

N/A

Spend-Based Waiver

N/A

Rewards Redemption Fee

Nil

Foreign Currency Markup

3.50% of the transaction amount

Interest Rates

3.40% per month (49.96% per annum)

Fuel Surcharge

1% fuel surcharge waived off at all filling stations across India for transactions between Rs. 400 and Rs. 4,000 (max waiver capped at Rs. 400 per month)

Cash Advance Charges

2.50% or a minimum of Rs. 500

- 2 complimentary base fare domestic flight tickets on Ezeego1.

- 1 complimentary domestic airport lounge access under the MasterCard lounge program.

- Up to 20% cashback on base fare domestic flight bookings via Ezeego1.

- Rs. 25 off on every ticket booked via IRCTC.

- Cashback benefits worth Rs. 10,000 on hotel and holiday bookings (details below).

- Rs. 100 cashback on bus ticket bookings via Ezeego1.

- Flat Rs. 400 cashback on card rentals within India.

- 4 EDGE Points for every Rs. 200 spent with the card.

Axis Bank My Wings Credit Card Welcome Benefits:

You get 2 complimentary base fare domestic flight tickets via Ezeego1 as a welcome gift with the Axis Bank My Wings Credit Card.

Axis Bank My Wings Credit Card Rewards:

You earn 4 EDGE Points per Rs. 200 spent with the Axis Bank My Wings Credit Card.

Reward redemption:

The EDGE Points earned on the card are redeemable against shopping/travel vouchers or for purchasing products from the product catalog on the Axis Bank EDGE Rewards portal.

Movie and Dining:

You get a discount of minimum 15% on dining bills at partner restaurants under the bank’s Dining Delights Program.

Travel Benefits:

- 2 complimentary base fare domestic flight tickets as a welcome benefit with the card.

- 1 complimentary domestic airport lounge access per quarter.

- Up to 20% cashback on domestic flight tickets on Ezeego1 (applicable only on bookings made through 1800 120 0408 or ezeego1.com.

- Rs. 25 off on every ticket booking via IRCTC (maximum annual discount capped at Rs. 200 per cardholder).

- Rs. 100 cashback (per person) on bus ticket bookings on Eazeego1. Promo code “AXISCOMBO” needs to be used to avail the offer. The offer can be availed for a maximum of 5 times a year.

- Flat Rs. 400 cashback on car bookings/rentals in India. Promo code “AXISCOMBO” needs to be used to avail the offer.

- Cashback benefits worth Rs. 10,000 on flights, hotel and holiday bookings-

| Spends Category | Cashback Benefit |

| Domestic return air ticket | Rs. 500 |

| International return air ticket | Rs. 1,500 |

| Hotel booking across India, Nepal and Bhutan (min booking amount of Rs. 7,000) | Rs. 1,000 |

| International hotel booking (min booking amount of Rs. 7,000) | Rs. 1,500 |

| Domestic holiday booking (min booking amount of Rs. 20,000) | Rs. 2,500 |

| International holiday booking (min booking amount of Rs. 20,000) | Rs. 3,000 |

Conclusion:

Axis Bank targets frequent travelers with this credit card. Unlike other travel cards that offer only air travel benefits, this one by Axis bank gives you cashback and discount benefits on road and rail travel spends as well. You get decent cashback and discount benefits on all of the three categories of travel spend. If you’re a frequent domestic traveler and don’t want to limit your travel experience to just air travel, this card is certainly worth consideration.

What do you think about this offering by Axis bank? Do you think, instead of focusing only on air travel, card issuers should also consider the road/rail travel requirements of their customers? Do let us know your opinion in the comments. If you’re an existing card member, feel free to share your experience.