The AU Spont Credit Card is the latest addition to the bank’s range of innovative credit cards. It is ideal for small payments and transactions, particularly those related to UPI. Cardholders receive a 1% cashback on all UPI spends, which is capped at Rs. 500 per statement cycle. This means that to receive the maximum allowed cashback, you would need to spend Rs. 50,000 in a month. The card has a low joining fee of Rs. 299 and is available to anyone with a monthly income of over Rs. 10,000. The credit card offers free access to domestic airport lounges and railway lounges, making it an attractive option. Read our review to learn more about the features and benefits of this credit card.

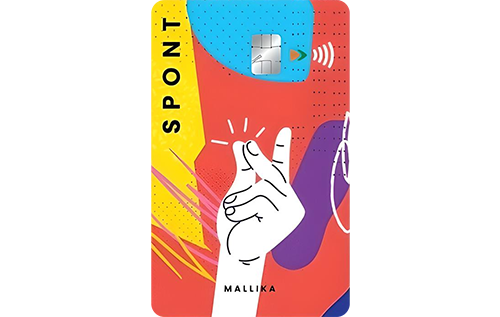

AU Spont Credit Card

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Cashback |

Welcome Benefits

Movie & Dining

N/A

Rewards Rate

1% Cashback on All UPI Spends (Up to Rs. 500)

Reward Redemption

N/A

Travel

2 Complimentary Railway Lounge Visits

Domestic Lounge Access

2 Free Visits Each Quarter on spending Rs. 30,000 in the Previous Quarter

International Lounge Access

N/A

Golf

N/A

Insurance Benefits

N/A

Spend-Based Waiver

N/A

Rewards Redemption Fee

N/A

Foreign Currency Markup

3.5%

Interest Rates

3.49% Per Month

Fuel Surcharge

1% Fuel Surcharge Waiver on Transactions Between Rs. 400 and Rs. 5000

Cash Advance Charges

2.5% of the Transacted Amount or Rs. 100

- You can earn cashback on all UPI transactions with this card.

- Spend-based airport lounge access is offered with this card.

- Free railway airport lounge access is provided.

Cashback With AU Spont

- Earn 1% cashback on all UPI spends across multiple channels.

- Earn 1% cashback on eComm, POS & contactless transactions.

- A maximum of Rs. 500 can be earned in a statement cycle.

- No cashback shall be awarded for Fuel, Rent, Cash Withdrawals, EMIs & Insurance spends

Earn Coins on UPI Spends

- Earn 5 coins on each UPI transaction made on the AU 0101 App.

- Earn 500 coins on the first transaction made via the AU 0101 App.

- These coins would never expire i.e. they have lifetime validity.

- These coins can be redeemed at AU Rewardz.

Free Airport Lounge Access

By spending Rs. 30,000 in the previous quarter AU Spont Cardholders can avail up to two complimentary airport lounge visits in the next quarter.

Complimentary Railway Lounge Access

With the AU Spont Credit Card, you would get two complementary railway lounge access each quarter (eight each year).

Bottom Line

One of the main disadvantages of this card is its low cashback rate. To earn the maximum cashback of Rs. 500, you would need to spend Rs. 50,000 in a month. On the other hand, if you use the AU101 app for UPI transactions, you’ll receive 5 coins for every transaction, and the first transaction will earn you 500 bonus coins. The card offers free access to airport and railway lounges across India, and the joining and renewal charges are just Rs. 500, which makes it a good option for those who are looking for their first credit card.