ICICI Bank offers two co-branded credit cards in partnership with Manchester United, which is one of the most popular football clubs in the world- the Manchester United Signature Credit Card and the Manchester United Platinum Credit Card. The Signature card is more premium than the two variants, while the Platinum Card can be considered a toned-down version of the former. If you’re a Manchester United fanboy, you must possess at least one of these two ICICI co-branded cards.

Manchester United Platinum Credit Card is an entry-level offering by ICICI Bank and comes with a nominal membership fee of just Rs. 499 per annum. Like most other ICICI credit cards, you earn rewards as ICICI Reward Points on the Manchester United Platinum Credit Card. Apart from the Reward Points, you get many Manchester United exclusive benefits with this card that no other credit card currently offers (except, obviously, the Signature variant of this card). Read on to learn more about this exclusive Manchester United co-branded credit card by ICICI Bank.

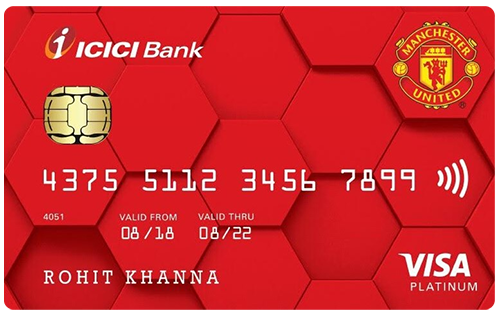

ICICI Bank Manchester United Platinum Credit Card

Fees

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

Buy 1 Get 1 offer on movie ticket bookings on BookMyShow and INOX individually (max 2 free tickets on BookMyShow and INOX individually) and 15% savings on dining bills at over 2,500 restaurants across India through Culinary Treats Programme

Rewards Rate

2 Reward Points for every Rs. 100 spent with the card, 3 Reward Points per Rs. 100 spent on Manchester United match days.

Reward Redemption

The earned Reward Points can abe redeemed against a lot of options including cashback and gifts at a rate of 1 Reward Point = Re. 0.25.

Travel

Complimentary domestic airport lounge access every quarter

Golf

N/A

Domestic Lounge Access

1 complimentary doemestic airport lounge access per quarter

International Lounge Access

N/A

Insurance Benefits

N/A

Zero Liability Protection

Cardholder not liable for any fraudulent transaction made with the card post reporting the loss of card to the bank

Spend Based Waiver

Renewal fee waived off if Rs. 1.25 lakh were spent in the previous aniversary year

Rewards Redemption Fee

Rs. 99 (plus applicable taxes) per redemption request

Rewards Redemption Fee

Rs. 99 (plus applicable taxes) per redemption request

Foreign Currency Markup

3.5% on all foreign currency spends

Interest Rates

3.67% per month (44.04% per annum)

Fuel Surcharge

1% fuel surcharge waiver

Cash Advance Charges

2.5% of the withdrawn amount subject to a minimum charge of Rs. 300

Add-on Card Fee

Rs. 100 (plus applicable taxes)

- 2 Reward Points on Every Domestic/International transaction of Rs. 100.

- 3 Reward Points per Rs. 100 spent on Manchester United match days.

- Complimentary Manchester United Branded Football as a Welcome Gift.

- 1 Complimentary domestic lounge access per quarter.

- Exclusive discount on dining bills at partner restaurants under the ICICI Bank Culinary Treats program.

Welcome Benefits

You get a complimentary Manchester United branded football as a welcome benefit when you activate your card.

Renewal Fee Waiver

The renewal fee of Rs. 499 for the next year is waived when spending Rs. 1.25 lakh or more on the card anniversary year.

Manchester United Platinum Credit Card Rewards

- 2 Reward Points per Rs. 100 on domestic/international spends.

- 3 Reward Points per Rs. 100 on Manchester United match days.

Manchester United Benefits

- The topmost spender every month across both the card variants gets a complimentary Manchester United jersey and a match ticket.

- Top 100 spenders get a Manchester United branded shirt every month.

- Top 18 spenders get an exclusive fully paid “Manchester United Experience,” which includes a private tour of the stadium and museum in Manchester, the opportunity to watch a part of a training session of the first team squad, and a visit to the Manchester United megastore at the stadium.

Rewards Redemption

- The reward points earned on the ICICI Bank Manchester United Platinum Credit Card can be redeemed for shopping/gift vouchers and products by contacting customer care of the ICICI Bank Credit Card.

- 1 ICICI Reward Point = Rs. 0.25.

Travel Benefits

- You get 1 complimentary lounge access at domestic airports across India under the Visa domestic lounge program.

- You become eligible for this lounge access benefit if you spent a minimum of Rs. 5,000 in the previous quarter.

Dining Benefits

You get a discount of 15% at over 2500 restaurants in India through the ICICI Bank Culinary Treats Programme.

Movie Benefits

- 25% discount on movie tickets on booking through Bookmyshow & INOX individually (maximum benefit of Rs. 100 per transaction).

- You can avail of these movie offers a maximum of 2 times a month.

Conclusion

The exclusive Manchester United benefits that come bundled with this credit card make it a must-have for any Manchester United fanboy looking for an entry-level credit card (you may consider the Signature variant if you want more premium benefits). Apart from the exclusive Manchester United benefits, there are 2 reward points per Rs. 100 (and 3 Points per Rs. 100 on Manchester United match days), ICICI Bank Manchester United Platinum Credit Card also offers a decent reward rate of 0.5% (0.75% on match days). What’s your opinion of the Manchester United Platinum Credit Card? Do let us know in the comments.