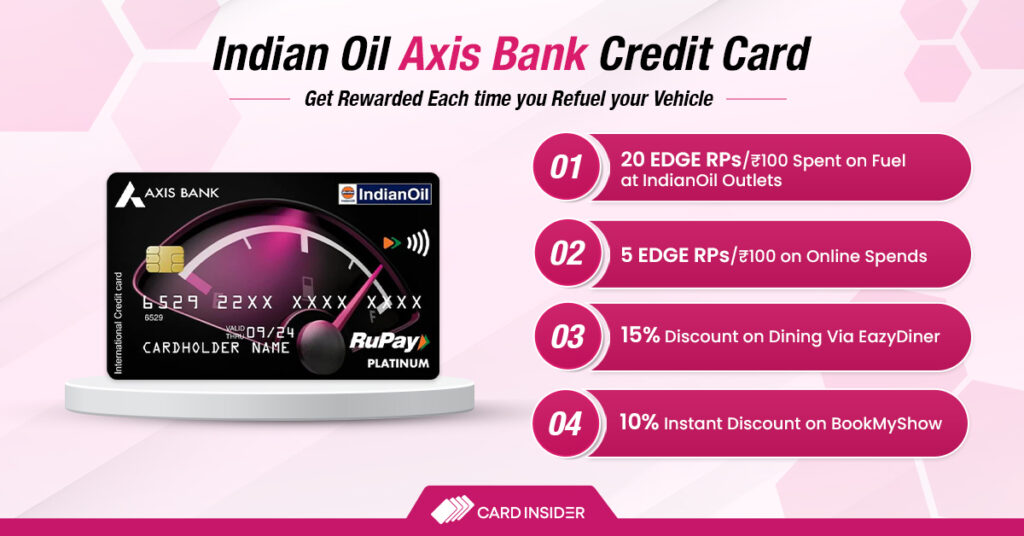

Indian Oil Axis Bank Credit Card is a co-branded fuel credit card issued by Axis Bank in collaboration with IOCL (Indian Oil Corporation Limited). The card aims to provide great saving opportunities to those who spend very often on fuel. It is an entry-level card and hence comes with a nominal joining and annual fee of Rs. 500. The card offers a particularly high reward rate of 5% on fuel spends at IOCL filling stations and a decent reward rate of 1% on online spends.

Being an entry-level credit card, although it doesn’t offer many additional benefits, you, however, do get dining and movie benefits with instant discounts on movie tickets and discounted rates at partner restaurants under the bank’s Dining Delights Program. Other than this, the cardholders get fuel surcharge waivers and many more benefits with the IndianOil Axis Bank Credit Card.

Learn more about the entry-level co-branded credit card offered by Axis Bank and IOCL.

Indian Oil Axis Bank RuPay Credit Card

Fees

Joining Fee

Renewal Fee

Best Suited For

Fuel | Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

10% instant discount on movie ticket bookings on BookMyShow

Rewards Rate

20 Reward Points per Rs. 100 on fuel transactions at IOCL stations, 5 Reward Points per Rs. 100 on online shopping and 1 EDGE Point per Rs. 100 on all other spends with the card

Reward Redemption

Reward Points redeemable for shopping/travel vouchers and products (from the given product catalog) on Axis Bank EDGE Rewards Portal.

Travel

N/A

Golf

N/A

Domestic Lounge Access

N/A

International Lounge Access

N/A

Insurance Benefits

N/A

Zero Liability Protection

Cardholder shall not be liable for any fraudulent transaction made with the card post reporting the loss of card to the bank

Spend Based Waiver

Renewal Fee Waived on Annual Spending of Rs. 3.5 Lakh

Rewards Redemption Fee

Nil

Rewards Redemption Fee

Nil

Foreign Currency Markup

3.5%

Interest Rates

3.6% Per Month (52.86% Per Annum)

Fuel Surcharge

1% Fuel Surcharge Waived for Transactions Between Rs. 400 and Rs. 4,000

Cash Advance Charges

2.5% of the Total Transaction Amount (Minimum Rs. 500)

Add-on Card Fee

Nil

- 100% value up to 1,250 EDGE Reward Points on first fuel transactions made within 30 days of card issuance.

- 20 Reward Points on every Rs 100 spent at IOCL petrol pumps.

- 5 Reward Points on every Rs. 100 spent on online shopping.

- 1 EDGE Point per Rs. 100 on all other spends with the card.

- Instant discount of up to 10% on movie tickets on Book My Show.

- Up to 15% discount up to Rs. 500 on dining bills at partner restaurants under the Axis Bank EazyDiner Program.

- 1% fuel surcharge waived at all fuel stations across India.

- Renewal fee waived off on annual spends of Rs. 3.5 lakh.

Pros

- The card is best suited for transactions at petrol stations, offering excellent cashback on fuel, a daily necessity.

- Get 10% off on movie tickets made with BookMyShow.

Cons

- While this card is great for cashback on fuel transactions, it does not provide any travel benefits.

- You won’t receive a significant welcome benefit, only 1,250 EDGE Reward Points (maximum).

Indian Oil Axis Bank RuPay Credit Card Features and Benefits

The IndianOil Axis Bank Credit Card is an exclusive fuel card that comes with great reward rates over different categories including fuel and others. Some of the most important benefits and features of this card are as follows:

Welcome Benefits

When a customer performs their first fuel transaction using their newly issued credit card within 30 days of issuance, they can earn up to 1250 EDGE REWARDS. This offer is valid only once and only within the first 30 days of receiving the card. Please note that this welcome benefit offer applies only to the Primary Card and not to add-on cards.

Movie & Dining Benefits

- Instant 10% discount on movie ticket bookings on BookMyShow.

- Up to 15% off up to Rs. 500 on dining bills at partner restaurants under the Axis Bank EazyDiner Program.

Indian Oil Axis Bank RuPay Credit Card Rewards

- 20 EDGE Points per Rs. 100 spent on fuel purchases at all IOCL stations across India for transactions between Rs. 400 and Rs. 4,000.

- 5 EDGE Points per Rs. 100 spent on online shopping for transactions between Rs. 100 and Rs. 5,000.

- Get 1 EDGE Point for every Rs. 100 spent on all other transactions except Rent, Wallet, Insurance, Education, Govt, Gold, and Utilities.

Reward Redemption

The EDGE Points earned on the IndianOil Axis Bank Credit Card can be redeemed against shopping/travel vouchers or product purchases from the given catalog on the Axis Bank EDGE Rewards Portal.

Indian Oil Axis Bank RuPay Credit Card Eligibility Criteria

The eligibility requirements that the applicants need to fulfill in order to get approved for the IndianOil Axis Bank Card are as follows:

- The cardholder must be an Indian resident or an NRI.

- The age of the primary cardholder must be between 18 years and 70 years.

- Add-on cardholder(s) must be over 15 years of age.

How to Apply for The IndianOil Axis Bank RuPay Credit Card?

One can apply for the IndianOil Axis Bank online as well as offline at their convenience. To apply offline, you can simply visit the nearest Axis Bank branch and apply by filling in the physical application form. And if you want to apply online, you can proceed further as follows:

- Click on the “Apply Now” button at the top of the page.

- Fill in your details.

- Submit your application.

- Proceed further accordingly.

Indian Oil Axis Bank RuPay Credit Card Review

If you’re looking for an entry-level fuel credit card, the IOCL Axis Bank credit card is worth considering, as you get a high reward rate of 4% on fuel spending. Apart from this fuel benefit, the card offers an accelerated reward rate of 1% on online spending. However, the reward rate for offline spending (except for fuel transactions) is low (just 0.20%). Before you make up your mind, check out two of its closest competitors- ICICI Bank HPCL Super Saver Credit Card and BPCL SBI Credit Card. These are also entry-level fuel credit cards, and just like IOCL Axis Bank Credit Card, these cards also come with a joining fee of just Rs. 500.

What’s your opinion on this co-branded offering by Axis Bank? And how do you think it stacks up against the competitors? Do let us know in the comments. If you’re an existing cardholder, feel free to share your experience.

2 Comments

I think Welcome Benifits – Amazon prime now not provided. I just checked official webpage.

If possible, try to add official t/c pdf links in each section ( like hyperlink in welcome second) for check t/c

The same has been updated.