IDFC First Bank is one of India’s major private sector banks and is well known for its great products and services. The bank offers both premium and entry-level cards, all of which offer great privileges across multiple spending categories. The best part about their credit cards is that they have minimum charges.

RuPay is a payment system launched in India in 2014. It has since expanded its presence in the country, enabling fast and secure transactions. The IDFC RuPay Credit Card, made in India, offers various benefits and rewards. It is a great option for anyone looking for a credit card in India. Read on to learn more about the benefits of IDFC RuPay Credit Cards.

Table of Contents

List of IDFC Bank RuPay Credit Cards

Only two RuPay cards have been launched by the IDFC Bank, the summary of which is given below.

Fees

Joining Fee

Renewal Fee

Best Suited For

Fuel

Reward Type

Reward Points

Welcome Benefits

Card Details +

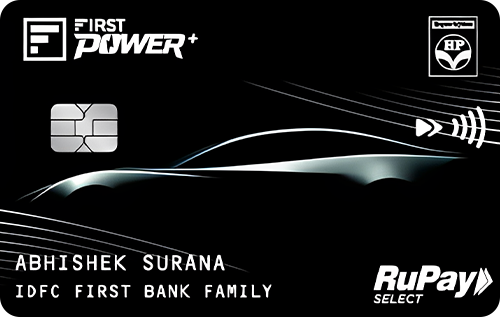

The IDFC HPCL FIRST Power Credit Card is a co-branded card between IDFC Bank and HPCL that helps users save Rs. 7000 annually. The joining fee and renewal fee are Rs. 199 plus taxes, which will be waived if you spend Rs. 50,000 in the anniversary year. The card offers Rs. 150 off on orders above Rs. 500 and more on Swiggy. Cardholders will get complimentary roadside assistance worth Rs. 1399 four times a year and insurance coverage worth Rs. 2 lakh for a personal accident, and Rs. 25,000 on lost card liability. Also, a fuel surcharge waiver of 1% is capped at Rs. 100 monthly is also provided to its users.

Fees

Joining Fee

Renewal Fee

Best Suited For

Fuel

Reward Type

Reward Points

Welcome Benefits

Card Details +

The IDFC Bank, in association with the HPCL, has introduced another credit card, the IDFC HPCL FIRST Power Plus, which helps users save up to Rs. 18,500 annually. The joining and renewal fee is Rs. 499 plus taxes, which can be waived if the user spends Rs. 1,50,000 in the previous year. As a welcome benefit, this card offers cashback of up to Rs. 500 on 1st HPCL fuel transaction of Rs. 500 or above and 5% cashback capped at Rs. 1000 on the transaction value of the first EMI. This card also offers 25% off( up to Rs. 100) on movie tickets once every month and Rs. 150 off on Swiggy orders worth Rs. 500. One complimentary domestic airport lounge visit is offered every quarter, and Rs. 1399 worth road assistance is offered four times a year. Insurance coverage worth Rs. 2 lakh is also provided with the FIRST Power Plus credit card.

Comparison of the Top IDFC RuPay Credit Cards

| Features | IDFC HPCL FIRST Power Credit Card | IDFC HPCL FIRST Power Plus Credit Card |

| Joining Fee | Rs. 199 + GST | Rs. 499 + GST |

| Renewal Fee | Rs. 199 + GST | Rs. 499 + GST |

| Reward Rate |

|

|

| Reward Redemption |

|

One reward point = Rs. 0.25 |

| Welcome Benefits | N/A |

|

| Movie/ Dining Benefits | Rs. 150 off on Swiggy orders worth Rs. 500 or more |

|

| Travel Benefits | Complimentary roadside assistance worth Rs. 1399 four times a year |

|

| Insurance Benefits | Personal accident cover worth Rs. 2 lakh | Personal accident loan cover worth Rs. 2 lakh |

Benefits of IDFC RuPay Credit Cards

Secure Payments

Transactions made through the IDFC RuPay Credit Card are extremely safe and secure when made through RuPay.

Convenient UPI Payments

In India, only RuPay credit cards can be linked with UPI apps like GPay, PhonePe, etc. RuPay Credit Cards offer easy payments with a touch. Both the IDFC credit cards, FIRST Power and FIRST Power Plus, can be linked to the UPI for fast and easy payments.

Annual Savings

Cardholders can save up to Rs. 7,000 annually with the IDFC HPCL FIRST Power Credit Card and up to Rs. 18,500 with the IDFC HPCL FIRST Power Plus Credit Card.

EMIs

Convert your purchases and card balances to EMIs with the IDFC RuPay credit card. Get 5% cashback up to a maximum of Rs. 1000 on your first EMI transaction.

How to Apply for IDFC RuPay Credit Cards?

After comparing and reading all the benefits of the IDFC RuPay credit cards, follow these steps to apply for your preferred credit card:

- Select the card of your choice and click on “Apply Now.”

- You will be redirected to the official IDFC Bank form for your preferred RuPay credit card.

- The form of the preferred RuPay credit card will open. Fill in all the important details.

- Fill in all the required details and keep your official documents in hand, such as your Aadhaar and PAN Card.

- Once you have completed the form, click “Submit” to complete your request for a new credit card.

Bottom Line

IDFC First Bank offers a wide range of credit cards, including lifetime-free cards with exclusive benefits across all spending categories, catering to everyone from beginners to high-net-worth individuals. Linking your IDFC RuPay credit card with UPI applications makes it easy to make payments anywhere, making it a great choice for people new to credit cards and those who have been using them for a while.