Citibank through an internet banking facility offers a variety of services to its credit card customers. Citibank credit cardholders can view their credit card bill and the list of unbilled transactions on their credit card on the bank’s netbanking portal. Customers can also pay their credit card bills and manage their Citibank credit cards (changing the credit limit, disabling the card for a particular type of transaction) through the internet banking facility. Netbanking is one of the most convenient services that you can avail of as it makes all the things available at your fingertips, from anywhere and at any time you can use this service. Keep reading to learn more about Citibank Credit Card login/net banking.

How To Register for Citibank Credit Card Net Banking Service?

If you are a first-time credit card user then you need to register first for the netbanking services. If you are worried about how to register for Citibank’s netbanking services then you need to know that you can do so by sitting at your home, no need to go to the bank to get it activated. In order to register for the Citibank credit card netbanking service, the credit card holder needs to follow the given below steps.

Step 1: Visit the official Citibank net banking website and click/tap on login.

Step 2: Click/tap on ‘First time user? Register Now’ on the pop-up window that opens.

Step 3: You will be redirected to a new webpage, select credit card under the product information.

Step 4: Enter your 16 digit credit card number, CVV number, Date of Birth, and check the terms and conditions box (it’s better to first read the T&C before you check the box).

Step 5: Now click/tap on Proceed and an OTP will be received on your registered mobile number.

Step 6: Enter the OTP to verify the details. After verification, choose your user ID and password or IPIN.

Step 7: Re-enter your IPIN and click on confirm. Your netbanking account is now activated.

How To Log in To Citi Credit Card Internet Banking?

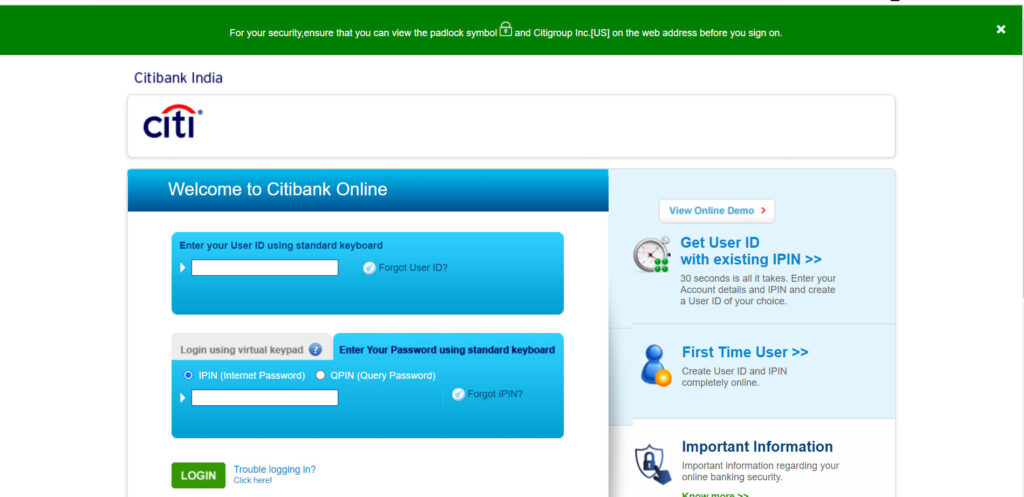

Once you register for a Citi bank credit card netbanking the next step comes is how to log in to Citi credit card internet banking. Here are the steps that you can follow to log in to your account.

Step 1: Go to Citibank’s Official internet banking website and click on ‘Login Now’.

Step 2: You will be redirected to the login page, enter your user ID and IPIN (Internet Banking).

Step 3: Click on Login.

How to Reset User ID/Password?

In case you forget your User ID/password/PIN, Citibank allows you to easily retrieve the same and continue using the internet banking services without any interruption. The steps to reset your Citibank netbanking User ID/password/PIN are as follows-

Step 1: Visit the Citibank official netbanking portal and click on forgot user id/password.

Step 2: You will be redirected to a ‘Forgot User ID/IPIN?’ page.

Step 3: Choose one of the given options, for instance, click on Retrieve User ID.

Step 4: You will be redirected to a new page, select credit card under product information.

Step 5: Enter your 16 digit credit card number, CVV number, Date of Birth, and check the terms and conditions box.

Step 6: This step requires you to authenticate the account information through OTP generation. Enter the OTP received on your registered mobile number.

Step 7: On successful verification of account details, now you can retrieve your User ID.

The same steps are required to retrieve the PIN in case you forget it. From entering the account details to the details authentication step, after these, you can choose a new IPIN.

Features and Benefits of Citibank Credit Card Internet Banking

- With net banking enabled for your credit card, you can access your account information anytime and from anywhere. You can view your credit card transaction history, credit card limit, and due amount.

- Citibank’s Net-Banking facility also allows you to view and make Citibank credit card bill payments as well. Moreover, you can pay other bills like utility bills, grocery bills, DTH, etc through net banking also.

- Netbanking is safe and secure, all your account information stays confidential. The chance of fraudulent activity reduces with it.

- It is user-friendly and easy to understand. From teenagers to adults everyone can easily understand how to use netbanking services.

- The registration process is simple and quick. You can register for netbanking from anywhere and at any time. Gone are the days when you had to stand in long queues to get your credit card internet banking activated.

Citi Card Services offered by Citibank net banking:

- View your credit card statements online: If you wish to view your credit card statement online then you can follow the given below steps:

Step 1: Log in to your Citibank credit card internet banking account.

Step 2: Click on Credit Cards from the menu and choose ‘e-statement option’.

Step 3: Select the months for which you need the statement and click on submit.

- Register credit card statement on e-mail: You can also get your credit card statement on your registered e-mail as well. Follow these simple steps to get your credit card statement on your e-mail.

Step 1: Log in to your Citibank credit card internet banking account.

Step 2: Click on Credit Cards from the menu and choose ‘e-statement option’.

Step 3: Select Register for e-statements on e-mail.

- Place a request for a duplicate statement: In case you lose your statement then you can also request a duplicate statement. bear in mind that for the duplicate statement the card issuer will charge a fee. For getting a duplicate statement follow the given below steps.

Step 1: Log in to your Citibank credit card internet banking account.

Step 2: Click on other Card services from the menu and choose ‘duplicate statement option’.

Step 3: Select the months you wish to get the duplicate statement for.