If you are frequently using your card to pay for the purchases made online, you will always be asked to provide details such as your card number, name on the card, expiry date, and something called a CVV number. You are asked to enter this number to validate your purchases. You may have entered this number multiple times but have you ever wondered what actually does this CVV number means.

It is a new authentication scheme that is established by credit card companies that provide strong protection towards reducing fraud related to internet transactions. CVV number is a three-digit number that can be found on the backside of the credit card. These numbers help you to secure your account balances while making payments through your card.

What is CVV on a Credit Card?

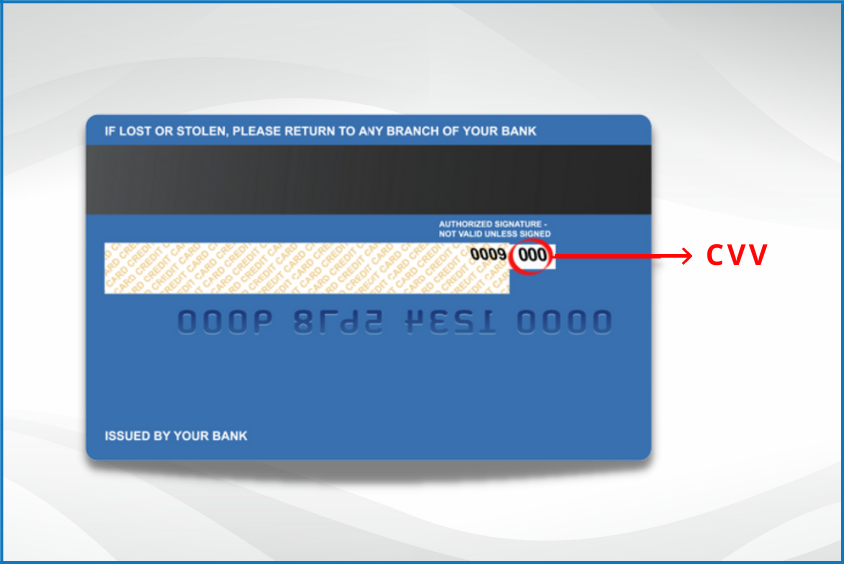

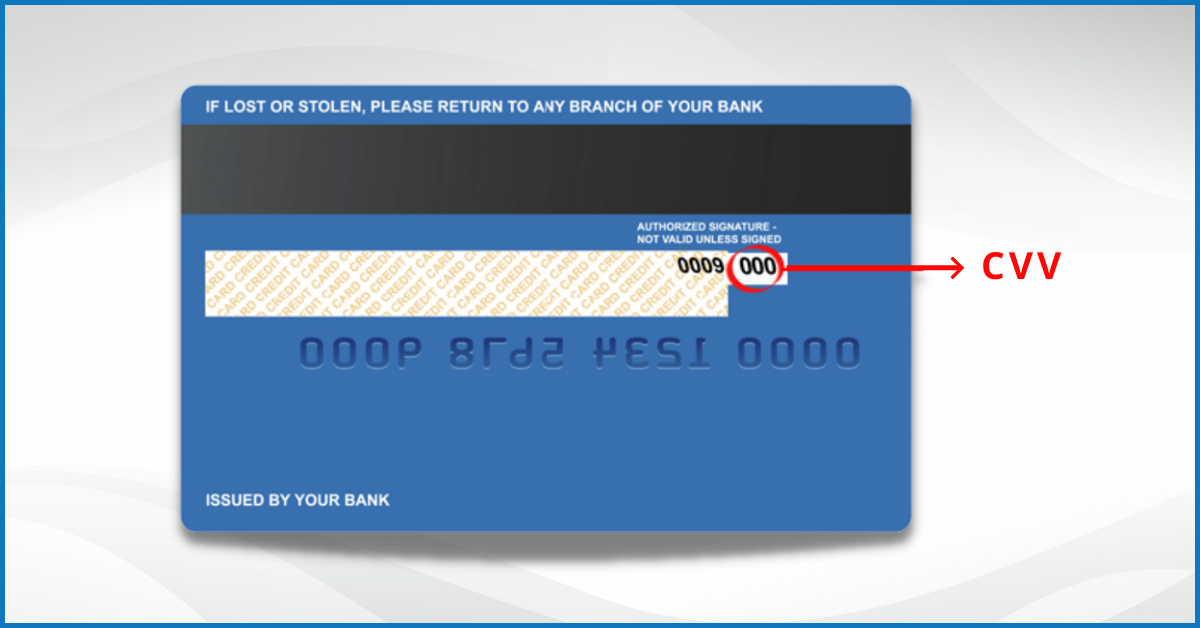

Card Verification Value or CVV on a credit card or debit card is a 3-digit number present on a credit card in addition to the card number, expiry date, and name of the cardholder. Present on the backside of the credit card, it is a numeric code printed just beside the signature panel on the card. The CVV number adds an extra layer of security while you are making purchases through online platforms. It is a 3-digit code in the case of Visa and Mastercard credit cards but in the case of American Express Credit Cards, it is a 4-digit code. Since it is just a printed code on your card, you have to make sure that your card is in a safe and secure place.

Where can I find the CVV number on the card?

Some people might get confused between a credit card number and a card verification number but these 2 are different things. While a credit card number is a 15/16-digit long number present on the face of the card, a card verification value number is a 3-digit code present on the reverse side of the credit card next to the magnetic stripe of the card.

Purpose of CVV

The CVV works as a security layer against cyber fraud or theft when the card is used for paying for the purchases made through the online method. This number is just not a random combination of 3-digits but this number is very smartly generated using special, undisclosed, and precise algorithms. CVV ensures that it is only the cardholder who is making the payment. CVV has to be entered every time while making payments hence protecting the transactions from fraud. Online transactions cannot be completed without a CVV.

Are CVV and PIN the same?

The CVV (Card Verification Number) and the PIN (Personal Identification Number) are not the same. Both of these numbers are used for different purposes. While a PIN number is used for ATM transactions or POS transactions, a CVV is used to make online payments.

How to protect Your CVV?

It is important to keep the CVV restricted to yourself as it will help in protecting ourselves from fraud. The following point can be taken care of to keep your CVV number safe –

- Make a note that you do not share your credit card details and CVV with anyone.

- Never leave your credit card unattended.

- Make sure that you enter your credit card details on the trusted websites only.

- Do not write down your credit card details and CVV number and store them in a diary or on your desktop.

- Anti-virus should be installed in your system to scan your computer away from any threats.

- Never share your credit card details with anybody over the phone call.

Bottom Line

All the credit and debit cards nowadays come with a CVV number that adds an extra layer of security to your card while making purchases either online or by phone. It is quite difficult to crack as compared to a credit card number. It acts as a guarantee that you have possession of the physical card. It is a 3 or 4-digit number printed on the backside of the card just beside the magnetic stripe. This number should not be shared with anybody and you should not enter your card details on any unprotected sites or over untrusted public wifi connections to protect your card from being misused. In case of unfortunate circumstances where you lose your card or your card has been stolen, you should inform your respective bank about the same.