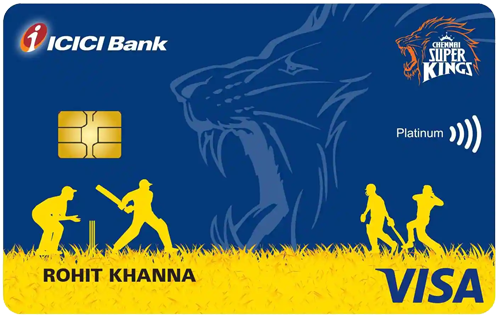

The Chennai Super Kings ICICI Bank Credit Card has recently been launched by the ICICI Bank in partnership with the IPL team, CSK. It is targeted at individuals who are big fans of the team and have a dream of meeting the team players or getting their autographs. With this credit card, you may get an opportunity to get the autograph of key CSK players and you may even meet them. Other than offering exciting privileges targeted at CSK fans, the card also offers a decent reward rate on all other retail spends and accelerated rewards on CSK match days. The earned reward points are redeemable against a variety of options including CSK merchandise.

The CSK ICICI Bank Credit Card comes with an annual fee of Rs. 500 and can be considered a great choice for sports enthusiasts. The ICICI Bank already issues sports two credit cards in partnership with Manchester United, named Manchester United ICICI Bank Platinum & Signature Credit Cards, and now this new launch has been added to the card issuer’s portfolio. To know more about the features and all the fees & charges of the CSK ICICI Bank Credit Card, keep reading the article:

Chennai Super Kings ICICI Bank Credit Card

Fees

Joining Fee

Renewal Fee

Best Suited For

Shopping |

Reward Type

Reward Points

Welcome Benefits

Movie & Dining

NA

Rewards Rate

2 Reward Points on every retail spend of Rs. 100, 10 Reward Points on every Rs. 100 during CSK match days and 1 Reward Point on all Insurance and utility spends.

Reward Redemption

The earned Reward Points can be redeemed against CSK merchandise. 1 Reward Point = Re. 0.25.

Travel

Complimentary domestic airport lounge access.

Golf

NA

Domestic Lounge Access

1 complimentary domestic lounge access every quarter on spending Rs. 5,000 in the previous quarter.

International Lounge Access

NA

Insurance Benefits

NA

Zero Liability Protection

You get a zero liability protection against a lost/stolen card if the card is reported lost to the bank in a timely manner.

Spend Based Waiver

The annual fee is waived off on spending Rs. 1.5 lakhs in the previous year.

Rewards Redemption Fee

Nil

Rewards Redemption Fee

Nil

Foreign Currency Markup

3.5% on all foreign currency spends.

Interest Rates

3.4% per month

Fuel Surcharge

1% fuel surcharge waiver on all fuel transactions worth up to Rs. 4,000 at all HPCL pumps.

Cash Advance Charges

2.5% of the withdrawn amount subject to a minimum of Rs. 500.

Add-on Card Fee

Nil

- Welcome and renewal benefit of 2,000 Reward Points.

- Up to 10 Reward Points on every spend of Rs. 100.

- Complimentary domestic airport lounge access.

- The top spenders every month get memorabilia autographed by the key players of the team.

- The cardholders may also get an opportunity to meet the players of the team.

- Complimentary tickets to CSK matches during the match season.

- 25% discount up to Rs. 100 on movie ticket bookings via BookMyShow.

- 1% fuel surcharge waiver at all HPCL fuel stations.

- Spend-based waiver of the annual fee.

Chennai Super Kings ICICI Bank Credit Card

The CSK ICICI Bank Credit Card is a newly launched co-branded credit card that is exclusively for the CSK fans and comes with exciting privileges for them. Other than this, you also earn reawrd on your regular spends. Following are all the detailed features and benefits of this card:

Welcome Benefits

You get 2,000 bonus Reward Points after successful payment of the joining fee.

Reward Points

- You get 10 Reward Points on every spend of Rs. 100 during the CSK match days (except fuel).

- You get 2 Reward Points on every retail spend of Rs. 100 (except fuel).

- You get 1 Reward Point on every Rs. 100 spent on insurance and utility categories.

Reward Redemption

- The reward points you earn can be redeemed against CSK merchandise a wide range of options available under the ICICI Bank Reward Programme.

- 1 Reward Point = Re. 0.25.

Travel Benefits

You can enjoy 1 complimentary domestic lounge access every quarter if you have spent Rs. 5,000 or more in the previous quarter.

Movie & Dining Benefits

- You get a 25% discount of up to Rs. 100 on booking a minimum of two movie tickets via BookMyShow. This benefit can be availed up to twice per month.

- You get exciting deals and offers over dining with the ICICI Bank’s Dining Delights Programme.

Partner Benefits

- Monthly top spenders get memorabilia autographed by key players of the team.

- You have an opportunity to get complimentary CSK match tickets during the match season.

- You may also get a chance to meet the popular CSK players and attend their practice sessions.

Fuel Surcharge Waiver

You get a 1% fuel surcharge waiver on all fuel transactions worth up to Rs. 4,000 at all HPCL fuel pumps across India.

Spend Based Waiver

The annual fee of Rs. 500 is waived off if you have spent Rs. 1,50,000 or more in the previous anniversary year.

CSK ICICI Bank Credit Card Fees and Charges

The detailed information about the fees and charges of the Chennai Super Kings ICICI Bank Credit Card is mentioned below:

- The joining and annual fee of the CSK ICICI Bank Credit card is Rs. 500, which can be waived off (second year onwards) by spending Rs. 1.5 lakhs or more in the previous year.

- The interest rate on this credit card is 3.4% per month.

- The foreign currency markup fee on the CSK ICICI Bank Credit Card is 3.5% of the total transactions amount. This fee is charged on making a transaction in a different currency using your credit card.

- The cash advance fee on this credit card is 2.5% of the transaction amount or a minimum of Rs. 500. This fee is charged when you withdraw cash using your credit card.

Chennai Super Kings ICICI Bank Credit Card Eligibility & Documentation

The basic eligibility criteria that need to be fulfilled in order to get approved for the CSK ICICI Bank Credit Card:

- The age of the primary cardholder should be above 21 years.

- The age of the supplementary cardholder should be 18 years or more.

- The applicant should either be self-employed or salaried.

- The applicant should have a decent credit score.

Documents Required

You will also need a few documents while applying for this credit card. The list of these documents is as follows:

- Identity Proof: Aadhar Card, Driving License, Voters’ Id, PAN Card, etc (any one of these).

- Address Proof: Utility bills, Passport, Aadhar Card, Driving License, etc.

- Income Proof: Latest bank statements/salary slips, or Latest ITR.

How To Apply For The CSK ICICI Bank Credit Card?

The ICICI Bank allows you to apply for the CSK ICICI Bank Credit card online as well as offline as per your comfort. To apply offline, simply visit yor nearest ICICI Bank branch and fill in the physical application form to apply for a credit card. Just make sure to carry all the required documents with you. If you want to apply online, you can do it easily by visiting this page. Just click on ‘Get Chennai Super Kings ICICI Credit Card Online’ and proceed further accordingly.

Conclusion

As it is clear by all the above features and benefits, the Chennai Super Kings ICICI Bank Credit Card is best suited for CSK fans and offers a host of benefits for them. If you are a big CSK fan, you would be definitely having a dream of meeting them. Now, with this credit card, you have an opportunity to get your dream fulfilled. Other than all these benefits, you can also earn regular reward points on all your retail spends and accelerated rewards during the match days. With a nominal annual fee of Rs. 500, the cardholders can get all these exclusive benefits which is not a bad deal at all. You can even get the annual fee waived off every year on the basis of your annual spends. So, if you are a fan of Chennai Super Kings, you should definitely try getting this card. Just make sure to check for the eligibility criteria before applying for the card. Also, if you have any additional doubts, make sure to ask us in the comment section below!