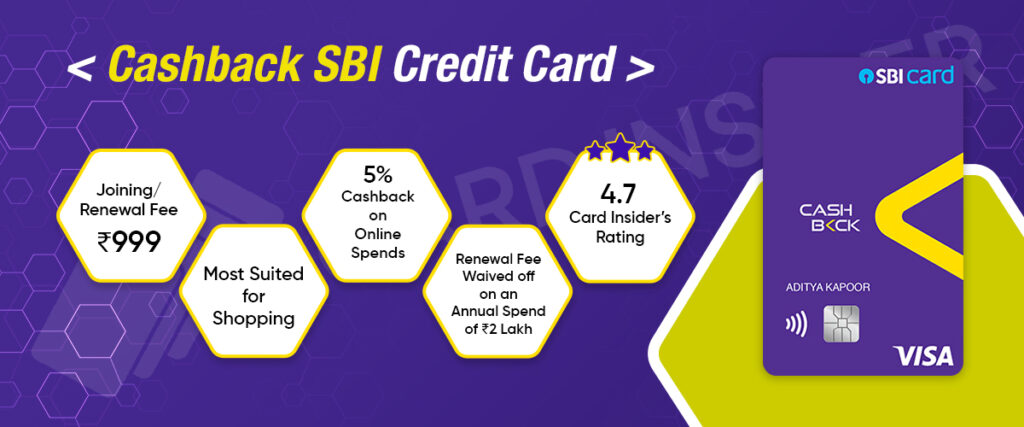

The SBI Cashback Card is a popular card offered by SBI Card. As the name suggests, the card is a cashback reward card and provides cash back for every transaction made with the card. It’s a great card as you don’t have to track your reward points or go through the hassle of redeeming points for different things. The annual charges applicable on the card are Rs. 999, and you can get it waived off on spending Rs. 2 Lakhs or more in the previous year.

With this card, you can earn up to 5% cash back on all online spending and 1% cash back on offline spends made with the card. The cashback is automatically credited to the cardholder’s account, and you even get access to other features like fuel surcharge waiver, etc. The SBI Cashback Card is considered as a veteran credit card by many and is a great entry-level card. Go through our Cashback SBI Card review to learn about its features and benefits.

Cashback SBI Credit Card

Fees

Joining Fee

Renewal Fee

Best Suited For

Shopping | Food |

Reward Type

Cashback |

Welcome Benefits

Movie & Dining

NA

Rewards Rate

5% cashback for every online transaction and 1% cashback on other offline transactions. You can earn a maximum of Rs. 5000 cashback in a single statement cycle.

Reward Redemption

Cashback earned with the card will be automatically credited to next month’s statement.

Travel

NA

Golf

NA

Domestic Lounge Access

NA

International Lounge Access

NA

Insurance Benefits

NA

Zero Liability Protection

The cardholder will not be liable for any fraudulent transaction if the card is reported lost or stolen to the bank in a timely manner.

Spend Based Waiver

The annual fee can be waived on spending Rs. 2,00,000 or more in the previous year.

Rewards Redemption Fee

NIL

Rewards Redemption Fee

NIL

Foreign Currency Markup

3.5% of the international transaction

Interest Rates

3.5% p.m. (42% p.a.)

Fuel Surcharge

1% fuel surcharge waiver for transactions between Rs. 500 and Rs. 3,000 at petrol pumps across India. (waiver capped at Rs. 100 per statement)

Cash Advance Charges

2.5% of the amount withdrawn or a minimum charge of Rs. 500.

Add-on Card Fee

Nil

- Get 5% cashback on every online transaction (maximum Rs. 5,000 cashback per month).

- 1% cash back on every offline transaction.

- Spend-based annual fee waiver.

- 1% fuel surcharge waiver capped at Rs. 100 per month.

Pros

- Decent 5% cashback on online and 1% cashback on offline spends.

- The monthly cashback cap of Rs. 5,000 is high when compared to other cashback cards.

- Great for online spendings as most cashback cards don’t offer 5% back and have lower rewards.

Cons

- There are several categories excluded from 1% cashback.

- It can be hard to reach the spend-based waiver as many major spend categories don’t accrue cashback.

- Complimentary lounge access has been discontinued on the card.

- During online sales, you do not get an instant discount on the cashback card.

Cashback SBI Credit Card Features & Benefits

The Cashback SBI Card comes with a great cashback reward rate, and the cardholders can earn lots of cashback for every transaction. Following are the detailed features and benefits of the Cashback Card by SBI Bank:

| Transactions | Cashback |

| Online | 5% |

| Offline | 1% |

Cashback Calculation

There is a max capping of Rs. 5000 on cashback per month, including both online and offline spends. Suppose you made online transactions worth Rs. 90,000, which are eligible for 5% cashback, and offline transactions worth Rs. 60,000 in the month, which are eligible for 1% cashback. Your cashback will be calculated as –

- 5% of Rs. 90,000 = Rs. 4,500

- 1% of Rs. 60,000 = Rs. 600

The total amount, including both online and offline spends adds up to Rs. 5100. However, you will only receive Rs. 5000 as there is a maximum cap on the cashback you can earn. Even if you spend more money with the card, either online or offline spends, the cashback will be restricted to Rs. 5000 per statement cycle.

Annual Fee Waiver

The Annual Fee of Rs. 999 associated with the Cashback SBI Card can be waived on spending Rs. 2 Lakh or more in the last year.

Fuel Surcharge Waiver

Get a 1% waiver on the fuel surcharge applicable on fuel transactions between Rs. 500 and Rs. 3,000 at all petrol pumps across India. The maximum waiver that can be claimed is capped at Rs. 100 per statement cycle.

Other Benefits

The Cashback SBI Card offers many other benefits:

– Get up to 2 add-ons for family members free for a lifetime.

– Contactless payments for transactions below Rs. 5,000.

Reward Redemption

The cashback earned with the Cashback SBI Card is auto-credited within two days of the card’s following statement.

Therefore, if your statement is generated on the 6th of every month (let’s assume the 6th of September), then the cashback earned on the 7th of August – 6th of September cycle will be credited after two days of your statement generation, i.e., on the 8th of September.

Exclusions on Cashback

The following spend categories are not eligible for Cashback –

- Jewelry

- Rental

- Wallet

- Fuel

- School and Educational Services

- Insurance Services

- Utilities

- Railways

- Card, Gift, Novelty & Souvenir Shops

- Quasi Cash/Member Financial Institution

Cashback SBI Card Fees and Charges

The following are the most essential charges associated with a credit card:

- Joining & Renewal fee: The joining and renewal fees for the Cashback SBI Credit Card are Rs. 999.

- Spend-Based Reversal: Reversal of renewal fees on annual spends of Rs. 2 lakhs.

- Interest Charges: The interest charges applicable on the card are 3.5% p.m. (42% p.a.).

- Cash Advance Fee: For every cash withdrawal using the card from ATMs, you are charged 2.5% of the amount or flat Rs. 500, whichever is higher.

- Foreign Currency Markup: The card charges 3.5% as the international currency markup fee.

Late Payment Charges:

- Dues less than Rs. 500 – Nil.

- Dues from Rs.500 to Rs.1,000 have to pay Rs. 400.

- Dues from Rs.1,000 to Rs.10,000 will be charged Rs. 750.

- Dues from Rs. 10,000 to Rs. 25,000 will be charged Rs. 950.

- Dues from Rs. 25,000 to Rs. 50,000 will be charged Rs. 1,100.

- Dues above Rs. 50,000 will be charged Rs. 1,300

CashBack SBI Credit Card Eligibility Criteria

The basic eligibility requirements that you need to fulfill in order to get approved for the card are mentioned below:

- The age of the primary cardholder must lie between 21 and 65 years.

- The applicant should have a stable source of income.

- The applicant should have a decent credit history.

How to Apply for a Cashback SBI Card?

If you are interested in getting the Cashback SBI Card, then you can follow any of the online or offline methods. To apply offline, visit the nearest SBI Branch and fill in the application form. However, for the online procedure, follow the steps given below:

- Click on the “Apply Now” button on the page,

- Proceed further by filling in all the required details

Other Cards Similar to Cashback SBI Credit Card

Axis Bank Ace Credit Card

The bank launched the Axis Bank Ace credit card in partnership with Visa and Google Pay. The card aims to capitalize on the rise of digital payments in the country and offers 5% cashback on utility bill payments made via the Google Pay Android app. You even get 4% cashback on partner merchants like Ola, Swiggy, Zomato, etc. The card is mainly for young professionals who mostly use online payments and spend money at these online merchants.

- 5% cashback on utility bills and mobile recharges via Google Pay

- 4% cashback on Ola, Zomato, Swiggy, etc.

- 2% cash back on other spends

- 4 complimentary domestic lounge access per year

- 1% fuel surcharge waiver

- 20% discount at more than 4000+ restaurants

- Spend-based annual and joining fee waiver

HDFC Bank Millennia Credit Card

As you can tell by the name, the HDFC Millennia credit card is for millennials and Gen-Y ’90s kids. With this card, you get 5% cashback on Cult.fit, Amazon, Sony LIV, BookMyShow, etc., and 1% cashback on other online and offline transactions. The CashPoints you earn can be redeemed against cashback and other categories. Other key features include fuel surcharge waiver, dining benefits, and more.

- 1000 CashPoints as a welcome benefit

- 1000 worth of gift vouchers on spending Rs. 1 Lakh or more in a quarter

- 5% cash back at partner merchants like Flipkart and Amazon

- 1% cash back on other spends except for fuel, rent, etc.

- 20% discount at restaurants through Swiggy Dineout

- 4 complimentary lounge access per year, maximum one per quarter

SBI SimplyClick Credit Card

A beginner shopping card by SBI Bank, the SimplyClick credit card is great for first-time users. It offers 10x reward points on popular online merchants like Apollo 24×7, Netmeds, BookMyShow, Lenskart, etc. You can earn 5x reward points on other online and 1 reward point on other offline spends. Also, you can earn Rs. 4000 worth of vouchers per year on achieving the spend milestone.

- Amazon gift voucher worth Rs. 500 as a welcome benefit

- Cleartrip gift voucher worth Rs. 2000 on annual spends of Rs. 1 Lakh and Rs. 2 Lakhs

- 10x reward points on popular merchants like Apollo 24×7, BookMyShow, Amazon, etc.

- 5x reward points on other online spends

- 1 reward point per Rs. 100 spent offline

- 1% fuel surcharge waiver and annual fee waiver

SBI Cashback Credit Card Review

The SBI Cashback Credit Card offered by SBI Card is an excellent card in terms of the cashback benefit it provides. With this card, you can get up to 5% cash back on every online spend and 1% on offline spends. Therefore, this card would be a wise choice for someone who wants to save instantly for their transactions. However, the annual fee charged with the card is slightly on the higher side, keeping in mind the benefits it provides, but the annual fee waiver justifies the same.

Also, let us know your views on the card in the comment section below and whether or not you are going to apply for the card.

10 Comments

Will i be eligible for 5% cashback on lic payment made online

There is no cashback for insurance payments.

Pay your LIC premium via Amazon Pay using SBI Cashback Card to get 5% cashback.

I think you meant to write that people can purchase Amazon gift vouchers and get the cashback and then pay their premiums through Amazon Pay.

Will i be eligible for 5% cashback on lic payment , car insurance through phone pay ya google pay app

No. You shall not receive any cashback on payments made towards insurance.

This card is rupay network available

Will I get 5% Cashback on international online payments?

How much cashback will i earn on paying to a seller in paywith indiamart? Anyone tried ?

This card was so good, then they revoked lounge access.