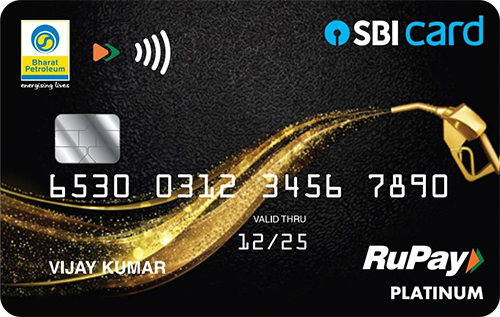

BPCL SBI Credit CardApply Now |

Cashback SBI Credit CardApply Now |

SBI SimplySAVE UPI Rupay Credit CardApply Now |

BPCL SBI Card OctaneApply Now |

Aditya Birla SBI Card SELECTApply Now |

|---|---|---|---|---|

Joining Fee Rs. 499 + GST | Joining Fee Rs. 999 + GST | Joining Fee Rs. 499 + GST | Joining Fee Rs. 1,499 + GST | Joining Fee Rs. 1,499 + GST |

Rewards and Benefits |

||||

Welcome Benefits 2,000 Activation Bonus Reward Points worth Rs.500 on payment of joining fee (credited after 20 days of the payment of joining fee). | Welcome Benefits NA | Welcome Benefits Receive 2,000 Reward Points on the expenditure of the same amount within the first 60 days of card issuance. | Welcome Benefits 6,000 bonus reward points worth Rs. 1500 | Welcome Benefits 6000 Rewards Points on card issuance. |

Rewards Rate 1 Reward Point per Rs. 100 (reward rate = 0.25%), 5x RPs on dining, movies, departmental stores, and groceries (reward rate = 1.25%), 13X RPs at BPCL pumps (reward rate = 3.25%) | Rewards Rate 5% cashback for every online transaction and 1% cashback on other offline transactions. You can earn a maximum of Rs. 5000 cashback in a single statement cycle. | Rewards Rate 1 Reward Point for Rs. 150 spent (reward rate = 0.25%), 10X RPs for spends made in movies, grocery, dining, & departmental stores (reward rate = 2.5%) | Rewards Rate 25 reward points for every Rs. 100 spends at BPCL fuel stations (reward rate = 6.25%), 10 RPs for every Rs. 100 spends on groceries, departmental stores, and movie ticket purchases (reward rate = 2.5%), and 1 reward point for every Rs. 100 spent for all other expenditures (reward rate = 0.25%) except mobile wallet uploads and fuel purchases at non-BPCL stations. | Rewards Rate Get 20X Reward Points for every Rs. 100 you spend on Aditya Birla Stores 10X Reward Points for every Rs. 100 on Entertainment, Dining, and Hotels and 2X Reward Point per Rs. 200 spent on other categories. |

Movie & Dining 5X Reward Points on movie and dining spends | Movie & Dining NA | Movie & Dining 10X Reward Points on movie and dining spends | Movie & Dining 10x reward points for every Rs. 100 you spend on dining and movie tickets. | Movie & Dining NA |

Reward Redemption Reward Points are redeemable against gift vouchers on sbicard.com or on the SBI mobile app, for purchases at BPCL petrol stations and against cash (card’s statement balance). 4 Reward Points = Re. 1. | Reward Redemption Cashback earned with the card will be automatically credited to next month’s statement. | Reward Redemption Redeem points earned for gift vouchers on sbicard.com or SBI mobile app. Also, for paying the card’s outstanding balance. (1 Reward Point = Rs. 0.25) | Reward Redemption Redeem reward points for gift vouchers on sbicard.com or on SBI mobile app, for transactions at BPCL petrol stations, and against card's statement balance. 4 reward points = Re. 1. | Reward Redemption Reward Points can be redeemed for gift vouchers on sbicard.com or SBI mobile app or for against card’s outstanding balance, 1 RP = Rs. 0.25 |

Travel N/A | Travel NA | Travel N/A | Travel Complimentary domestic airport lounge visits | Travel Complimentary access to lounges in India |

Golf N/A | Golf NA | Golf N/A | Golf N/A | Golf NA |

Domestic Lounge N/A | Domestic Lounge NA | Domestic Lounge N/A | Domestic Lounge 4 complimentary access to domestic lounges every year (1 per quarter). | Domestic Lounge 4 complimentary access to Domestic Airport Lounges |

International Lounge N/A | International Lounge NA | International Lounge N/A | International Lounge N/A | International Lounge NA |

Insurance Benefits N/A | Insurance Benefits NA | Insurance Benefits N/A | Insurance Benefits N/A | Insurance Benefits NA |

Zero Liability Protection Cardholder shall not be liable for any fraudulent transaction made on the card post reporting the loss of card to the bank. | Zero Liability Protection The cardholder will not be liable for any fraudulent transaction if the card is reported lost or stolen to the bank in a timely manner. | Zero Liability Protection On reporting the loss of the card to the bank within the stipulated time, the card holder will not be liable for any transaction done on the card. | Zero Liability Protection No liability to the cardholder if the loss of the card is reported to the bank within stipulated time. | Zero Liability Protection NA |

Fees & Charges |

||||

Renewal Fee Rs. 499 + GST | Renewal Fee Rs. 999 + GST | Renewal Fee Rs. 499 + GST | Renewal Fee Rs. 1,499 + GST | Renewal Fee Rs. 1,499 + GST |

Spend Based Waiver Renewal fee is waived off on a minimum spend of Rs. 50,000 in an anniversary year. | Spend Based Waiver The annual fee can be waived on spending Rs. 2,00,000 or more in the previous year. | Spend Based Waiver Renewal fee can be waived by spending Rs. 1 lakh in a card anniversary year | Spend Based Waiver Next year's renewal fee waived on annual expenditure of Rs. 2 lakh. | Spend Based Waiver NA |

Rewards Redemption Fee Rs. 99 (plus applicable taxes) per redemption request | Rewards Redemption Fee NIL | Rewards Redemption Fee Rs. 99 (plus applicable taxes) per redemption request | Rewards Redemption Fee Rs. 99 (plus applicable taxes) per redemption request. | Rewards Redemption Fee Rs 99 per redemption request |

Foreign Currency Markup 3.5% of the transaction amount | Foreign Currency Markup 3.5% of the international transaction | Foreign Currency Markup 3.5% of the transaction amount | Foreign Currency Markup 3.5% of the transaction amount | Foreign Currency Markup 3.5% on the conversion amount |

Interest Rates 3.5% per month (42% per annum) | Interest Rates 3.5% p.m. (42% p.a.) | Interest Rates 3.50% per month (or 42% annually) | Interest Rates 3.5% per month (42% per annum) | Interest Rates 3.5% per month (42% per annum) |

Fuel Surcharge 1% fuel surcharge waived off at all fuel stations across India for transactions up to Rs. 4,000 (max waiver capped at Rs. 100 per month) | Fuel Surcharge 1% fuel surcharge waiver for transactions between Rs. 500 and Rs. 3,000 at petrol pumps across India. (waiver capped at Rs. 100 per statement) | Fuel Surcharge 1% fuel surcharge waiver on transactions between Rs. 500 and Rs. 3,000 (capped at Rs. 100 per month) | Fuel Surcharge 1% fuel surcharge waiver on transactions up to Rs. 4,000 (max waiver of Rs. 100 in a month) | Fuel Surcharge 1% surcharge waiver on fuel transactions at all fuel stations across India |

Cash Advance Charges 2.5% of the withdrawn amount (subject to a minimum charge of Rs. 500) | Cash Advance Charges 2.5% of the amount withdrawn or a minimum charge of Rs. 500. | Cash Advance Charges 2.5% of the amount withdrawn or Rs. 500 (whichever is higher) | Cash Advance Charges 2.5% of the withdrawn amount (subject to a minimum charge of Rs. 500) | Cash Advance Charges 2.5% on the transaction amount subject to a minimum charge of Rs 500 |

Add-on Card Fee Nil | Add-on Card Fee Nil | Add-on Card Fee Nil | Add-on Card Fee Nil | Add-on Card Fee Nil |