SBI Shaurya Select Credit CardApply Now |

SBI Shaurya Credit CardApply Now |

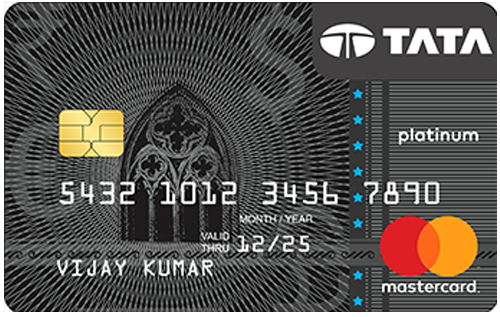

SBI Tata Platinum CardApply Now |

SBI Unnati Credit CardApply Now |

|---|---|---|---|

Joining Fee Nil | Joining Fee Rs. 250 + GST | Joining Fee Rs. 3,000 + GST | Joining Fee Nil |

Rewards and Benefits |

|||

Welcome Benefits NA | Welcome Benefits 1,000 bonus Reward Points | Welcome Benefits You get exclusive shopping e-Gift vouchers worth Rs 3000 from any partner exclusive such as Yatra, Hush Puppies / Bata, Aditya Birla Fashion, Westside | Welcome Benefits NA |

Rewards Rate 2 Reward Points on every spend of Rs. 100, 5x Reward Points on dining, groceries, departmental stores, and movies. | Rewards Rate 1 Reward Points on every spend of Rs. 100 and 5x Reward Points on groceries, dining, CSD, movies, departmental stores, etc. | Rewards Rate You can upto 3 Empower points on Dining, Departmental & Grocery shopping, and International spends. You get 1 Empower point on every Rs 100 spent on other retail categories. You earn 1 Empower point on every Rs 100 spent on retail stores | Rewards Rate 1 reward point per Rs 100 you spend |

Movie & Dining NA | Movie & Dining NA | Movie & Dining NA | Movie & Dining NA |

Reward Redemption The Reward Points can be redeemed against the card's outstanding balance and various other options. 1 Reward Point = Re. 0.25. | Reward Redemption The reward points you earn can be redeemed against various options from the Rewards catalogue or against the card's outstanding balance at a rate of 1 RP = Re. 0.25. | Reward Redemption 1 Empower Point = Rs. 1 can be redeemed against the Tata Loyalty program- The Empower Program or you can simply redeem your reward points at TATA merchant outlets. | Reward Redemption 1 RP = Rs 0.25 on redemption against a host of gifts and benefits at the SBI Card rewards catalog. |

Travel NA | Travel NA | Travel Complimentary lounge access in India at select airports | Travel NA |

Golf NA | Golf NA | Golf NA | Golf NA |

Domestic Lounge NA | Domestic Lounge NA | Domestic Lounge 8 complimentary lounge access in India with Mastercard at select airports | Domestic Lounge NA |

International Lounge NA | International Lounge NA | International Lounge NA | International Lounge NA |

Insurance Benefits Complimentary insurance cover worth Rs. 10 lakhs against personal accident. | Insurance Benefits Personal accident insurance cover worth Rs. 2 lakhs. | Insurance Benefits NA | Insurance Benefits NA |

Zero Liability Protection The cardholder will not be liable for any fraudulent transactions made against a lost/stolen card if the card is reported lost to the bank in a timely manner. | Zero Liability Protection NA | Zero Liability Protection NA | Zero Liability Protection NA |

Fees & Charges |

|||

Renewal Fee Rs. 1,499 + GST | Renewal Fee Rs. 250 + GST | Renewal Fee Rs. 3,000 + GST | Renewal Fee Nil |

Spend Based Waiver The renewal fee is waived off on spending Rs. 1,50,000 or more in the previous year. | Spend Based Waiver The renewal fee is waived off if you spend Rs. 50,000 or more in the previous year. | Spend Based Waiver NA | Spend Based Waiver NA |

Rewards Redemption Fee Rs. 99 on every redemption request | Rewards Redemption Fee Rs. 99 on each redemption request. | Rewards Redemption Fee Rs 99 per redemption request | Rewards Redemption Fee Rs 99 per redemption request |

Foreign Currency Markup 3.5% on all foreign currency spends. | Foreign Currency Markup 3.5% on all foreign currency spends. | Foreign Currency Markup 3.5% on the conversion amount | Foreign Currency Markup 3.5% on the conversion amount |

Interest Rates 2.75% p.m. (33% annually) | Interest Rates 2.75% p.m. (33% annually) | Interest Rates 3.5% per month (42% per annum) | Interest Rates 3.5% per month ( 42% per annum) |

Fuel Surcharge 1% fuel surcharge waiver on all fuel transactions between Rs. 500 and Rs. 4,000. | Fuel Surcharge 1% fuel surcharge waiver on all fuel transactions between Rs. 500 and Rs. 3,000. | Fuel Surcharge 1% surcharge waiver on fuel transactions at all fuel stations across India | Fuel Surcharge 1% surcharge waiver on all fuel purchases using the SBI Unnati credit card |

Cash Advance Charges 2.5% of the withdrawn amount or a minimum of Rs. 500. | Cash Advance Charges 2.5% of the withdrawn amount or Rs. 500 (whichever is higher) | Cash Advance Charges 2.5% on the transaction amount subject to a minimum charge of Rs 500 | Cash Advance Charges 2.5% on the amount withdrawn subject to a minimum charge of Rs. 500 |

Add-on Card Fee Nil | Add-on Card Fee Nil | Add-on Card Fee Nil | Add-on Card Fee Nil |