Axis Bank is among the most popular and trusted private banks in our country, offering many great products and services. Being a major card issuer, Axis Bank has credit cards catering to the needs of different types of people. It offers basic entry-level, lifestyle, travel, fuel, shopping, cashback, and super-premium cards, each offering its own set of privileges and benefits to people.

Depending on the benefits offered by the card, different credit cards have different reward programs and earning rates. You should know about the reward rates on your credit card, the spend categories eligible to earn reward points, and exclusions.

If you just focus on earning reward points without redeeming them, then you are not using your credit card in the correct manner. You can redeem your reward points for products and vouchers on the rewards portal, cashback on flight/hotel bookings, and more. Thus, you should be well versed with all reward points redemption options and use points before expiry.

Axis Bank Credit Cards Reward Points – How to Earn

Some super-premium credit cards have a high reward earning rate, while entry-level cards offer lesser reward points on your spends. Some travel-based cards offer air miles, while some cards offer cashback. Let’s check out the reward rates offered by popular Axis Bank credit cards –

| Credit Card | Reward Points |

| Axis Bank Reserve Credit Card | 15 RPs per Rs. 200 spent

30 RPs per Rs. 200 spent on international transactions |

| Axis Bank Magnus Credit Card | 12 RPs per Rs. 200 spent

5x RPs on travel spends through TravelEdge portal |

| Axis Bank Burgundy Private Credit Card | 15 RPs per Rs. 200 spent |

| Axis Bank Select Credit Card | 10 RPs per Rs. 200 spent

20 RPs per Rs. 200 spent on retail |

| Axis Bank Atlas Credit Card | 5 Edge Miles per Rs. 100 spent on travel

2 Edge Miles per Rs. 100 spent elsewhere |

| Axis Bank Vistara Infinite Credit Card | 6 Club Vistara points per Rs. 200 spent |

| Axis Bank MY ZONE Credit Card | 4 RPs per Rs. 200 spent with the card |

| Samsung Axis Bank Signature Credit Card | 10 RPs per Rs. 100 spent on partner brands

5 RPs per Rs. 100 spent elsewhere |

| Samsung Axis Bank Infinite Credit Card | 15 RPs per Rs. 100 spent on BigBasket, Zomato, Tata 1mg, etc.

15 RPs per Rs. 100 spent on international transactions 5 RPs per Rs. 100 spent on other spends |

| Indian Oil Axis Bank Credit Card | 20 RPs per Rs. 100 spent on Indian Oil outlets |

| Axis Bank Rewards Credit Card | 2 RPs per Rs. 125 spent

20 RPs per Rs. 125 spent on apparel and departmental stores |

Axis Bank Credit Cards Cashback

Many credit cards like the Ace, Airtel Axis, and Flipkart Axis Bank credit card mainly offer cashback to the cardholders. The cashback you earn will be automatically credited to your credit card account.

You will receive the cashback some days after making the transaction. The money you receive is added to your overall credit limit, and you can use it anytime you want.

| Credit Card | Cashback |

| Flipkart Axis Bank Credit Card | 5% cashback on Flipkart

4% cashback on Swiggy, Uber, PVR 1.5% cashback on other spends |

| Axis Bank ACE Credit Card | 5% cashback on gas, electricity, water bill payments.

4% cashback on Ola, Zomato, Swiggy 2% cashback on other spends |

| Airtel Axis Bank Credit Card | Up to 25% cashback on DTH, wifi, and mobile recharges via the Airtel Thanks app.

10% cashback on utility bill payment via Airtel Thanks app. 10% cashback on BigBasket, Zomato, Swiggy |

| Axis Bank Freecharge Plus Credit Card | 5% cashback on all Freecharge spends

1% cashback on spends elsewhere |

EDGE Reward Points As Welcome Benefit

Certain Axis Bank credit cards offer you bonus EDGE reward points as a welcome benefit when you activate your card and fulfill all conditions. The following are the welcome benefits offered by various Axis Bank credit cards –

- Axis Bank Rewards Credit Card – 5000 RPs on spending Rs. 1000 within 30 days of card activation

- Samsung Axis Bank Infinite Credit Card – 30,000 RPs as welcome benefit on making 3 successful transactions with the card

- Samsung Axis Bank Signature Credit Card – 2500 RPs on making at least 3 transactions within 30 days of card issuance

- Axis Bank Privilege Credit Card – 12,500 RPs on paying the joining fee

- Axis Bank Burgundy Private Credit Card – 30,000 reward points

- Axis Bank Reserve Credit Card – 50,000 RPs on card activation and every year on card renewal

EDGE Reward Points As Milestone Benefits

Most Axis Bank credit cards offer EDGE reward points when you reach certain spend-based milestones on the card. The following are the milestone benefits offered by some Axis Bank credit cards –

- Axis Bank Rewards Credit Card – 1500 RPs on spends of over Rs. 30,000 per statement cycle

- Axis Bank Magnus Credit Card – 25,000 RPs on spending Rs. 1 Lakh or more per month

- Axis Bank Select Credit Card – 5000 RPs on spending Rs. 3 Lakhs or more per year

- Axis Bank Privilege Credit Card – On spends of Rs. 2.5 Lakhs or more per year, you can convert your earned reward points into travel/shopping vouchers worth twice their value

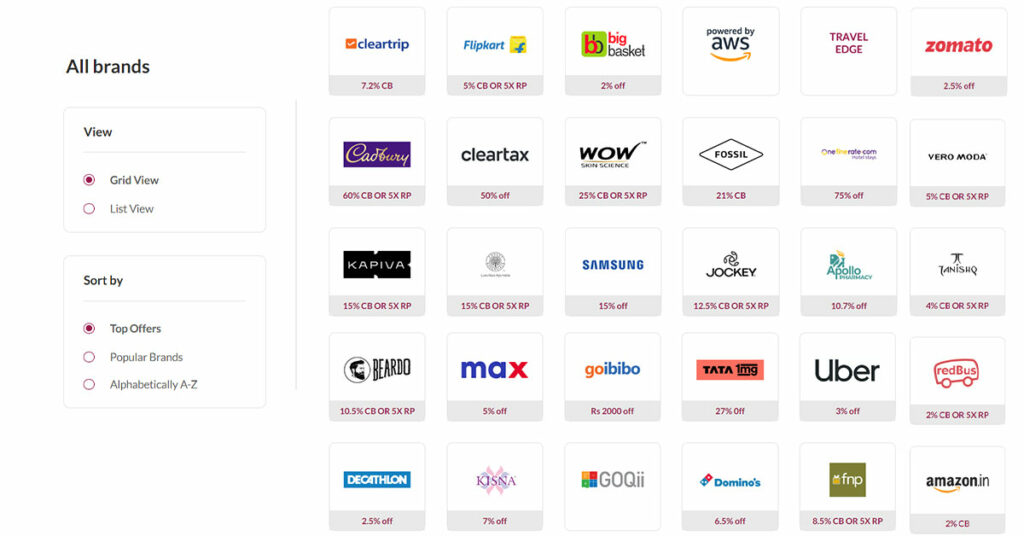

Axis Bank Grab Deals Website

At the Axis Bank Grab Deals website, you can benefit from exclusive offers and discounts on some of the top brands in the country. You can earn cashback and reward points when you shop at merchant websites via the Grab Deals portal.

- Head over to the Grab Deals portal and check out the latest offers and discounts on top brands. Click on the brand whose offer you want to claim.

- You will be given the option to choose between either Reward Points or Cashback. If your credit card earns reward points, you can go for the reward points offer; otherwise, you should click on the Cashback offer.

- Next, you need to authenticate yourself and enter the last 4 digits of your Axis Bank credit card. Click on Submit, and you will be redirected to the merchant portal, where you can search for products to buy.

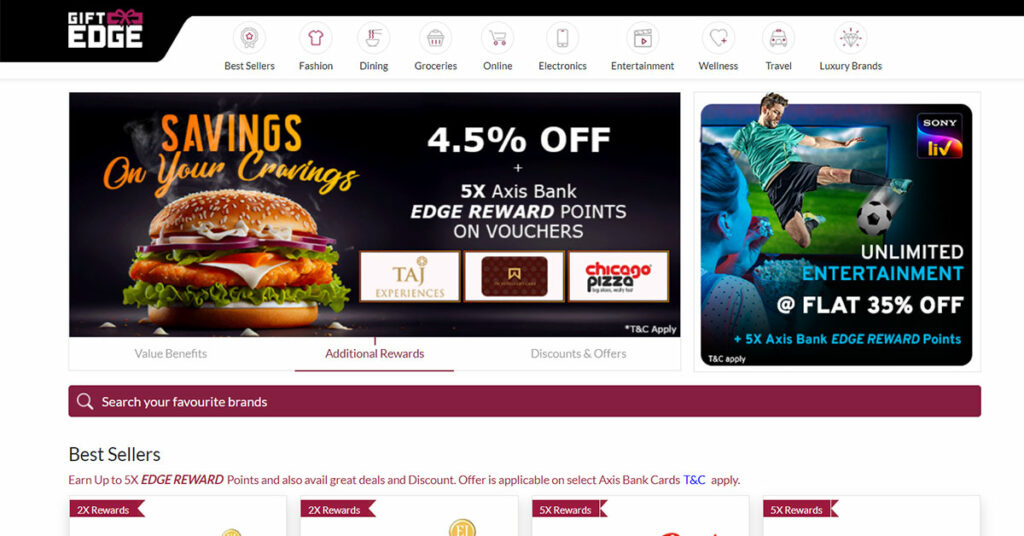

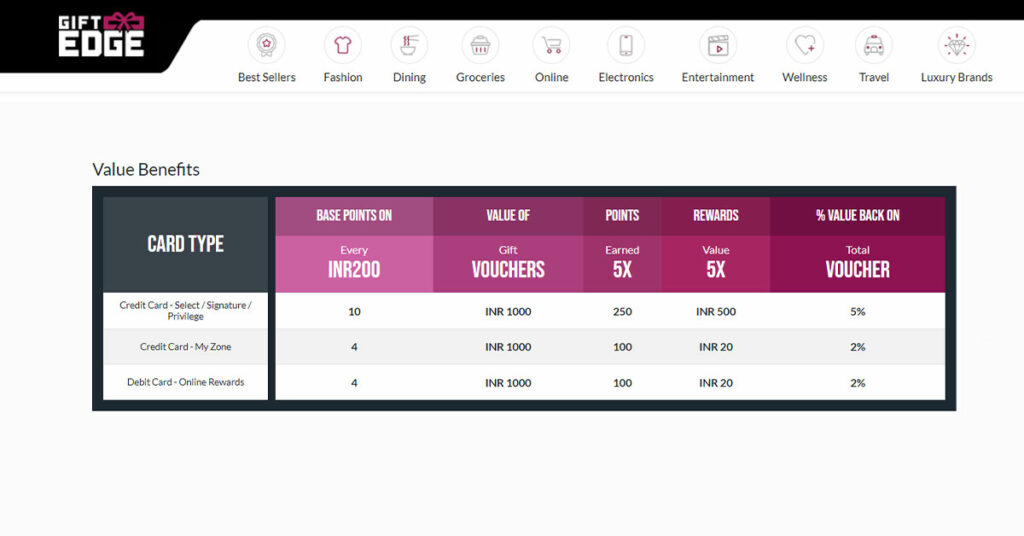

On the Gyftr Website

At the Gyftr EDGE Rewards portal, you can earn up to 10x EDGE reward points when you purchase gift cards or discount vouchers for some of the most popular brands in the country. You can earn reward points by purchasing gift cards for brands across multiple categories, including Fashion, Online Shopping, Electronics, Travel, Health and Wellness, Dining, etc.

Axis Bank EDGE Reward Points – Terms and Conditions

Axis Bank’s EDGE Rewards program allows cardholders to earn points for their spends based on the reward structure and rate of their particular credit card. When you start earning and redeeming your EDGE reward points, you should keep the following details in mind –

- Only valid and eligible Axis Bank credit cards can earn EDGE Reward points.

- EDGE Reward points are valid for 3 years from the date of earning, and you must have a minimum of 300 EDGE reward points if you want to make a redemption.

- In case no transaction is made on a credit card that earns reward points for 365 days, previously earned EDGE reward points also expire.

- Only the primary cardholder can redeem EDGE reward points. Add-on cardholders can just earn points to the primary cardholder’s account but cannot redeem them.

- Once expired, you cannot earn the expired reward points again.

- Axis Bank has the right to change the EDGE Rewards program policy any time without prior notice.

Axis EDGE Reward Points – How to Check Balance

You should regularly keep an eye on your reward points balance, and you can check the balance either through your account or by credit card statement. Here is how you can check your EDGE reward points balance –

Net Banking/Mobile App

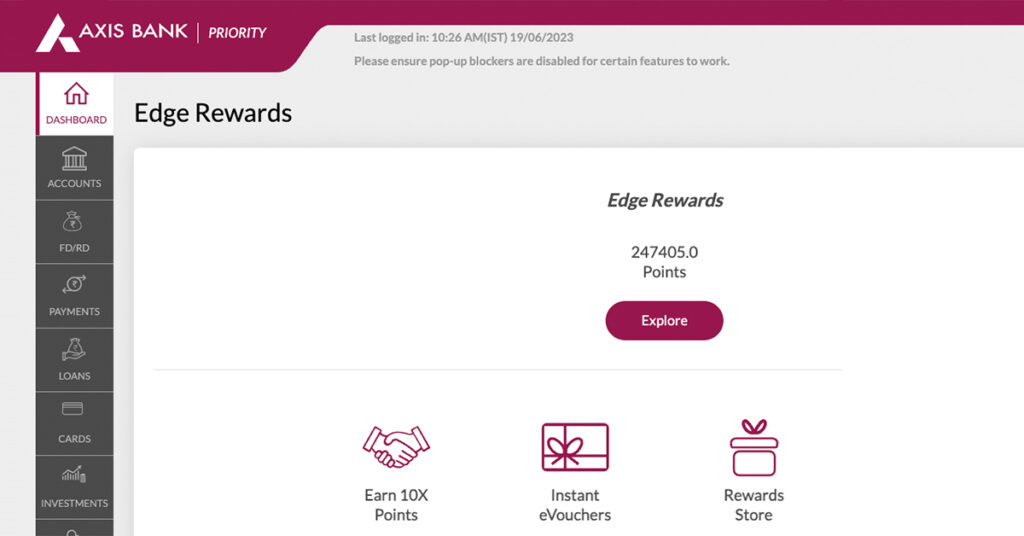

- Visit the official Axis Bank website or mobile application and log in to your account.

- On the left side of the page, you will see a menu. Scroll to the bottom and click on Edge Rewards.

- You can see your available Edge Rewards balance on the screen.

Credit Card Statement – You receive a monthly statement for your credit card from the bank, and it includes information about your EDGE reward points. You can see the total balance and the expiry date of your available reward points.

Call/SMS – Send the text <EDGEBAL> to 5676782 or missed call the number 1800-419-6622 through your registered phone number, and you will get the details of your EDGE reward points balance.

Axis Bank Credit Cards Reward Points – How to Redeem

Most of the Axis Bank credit cards offer you EDGE reward points for your spends. You can redeem these reward points at the Axis Bank rewards portal for shopping, products, gift vouchers, etc., where you get 1 EDGE RP = Rs. 0.20 value. You can redeem your reward points either through the EDGE rewards website or through Netbanking or a mobile app.

Via the EDGE Rewards Portal

Here is how you can redeem your EDGE reward points via the rewards portal –

- Head over to the official EDGE Rewards portal by Axis Bank.

- Near the top of the page, click on Redeem Now and log in to your credit card account.

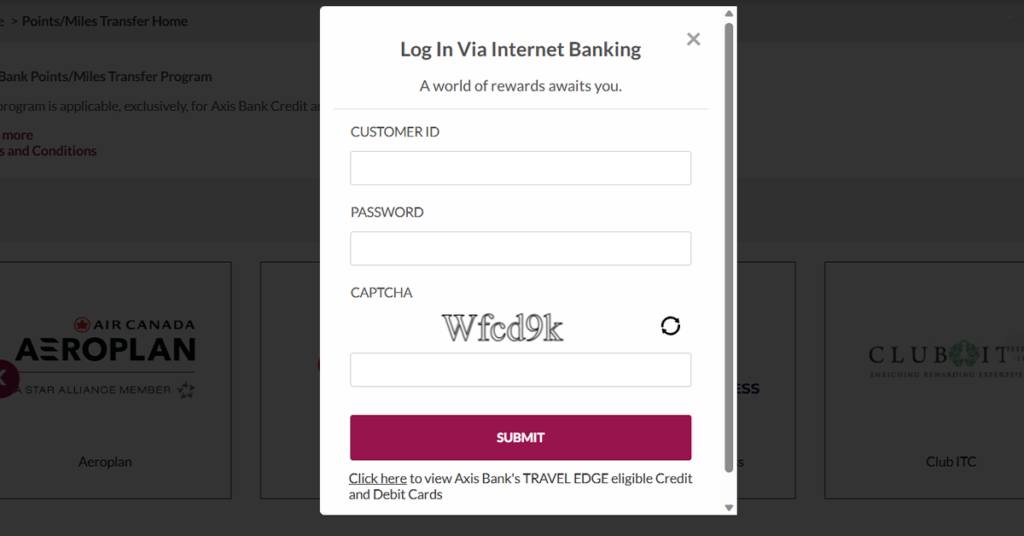

- You will need to provide your credit card’s internet banking login ID and valid password.

- After logging in, you can see all the available products, gift vouchers, etc., that you can get by redeeming your EDGE Reward points.

- Add the items you want to purchase to the cart and set the range of reward points that you wish to redeem for the products in your cart.

- Proceed and complete the redemption process.

Via the Mobile Application or NetBanking

You can even redeem your EDGE reward points while on the go through the official mobile application or Netbanking.

- Open the official Axis Bank website or the official mobile application

- Login to your credit card account through your customer ID and valid Password

- Head over to the rewards page and check your available reward points balance

- Next, click on Redeem Now, and you will be redirected to the Rewards Store

- Go through and accept terms and conditions and then finalize the products or vouchers you want to purchase through reward points

- Add your products to the cart and confirm the number of EDGE reward points you wish to redeem and proceed with the purchase.

Converting EDGE Reward Points to Partner Airlines Miles or Hotel Points

Axis Bank allows credit card holders to transfer their EDGE reward points to their partner hotel and airline miles. We will talk about the points transfer by premium cards – Axis Bank Reserve, Magnus, Burgundy Private, Atlas credit cards, affluent cards, and other cards.

Let’s take a look at the transfer ratio of the above-mentioned cards to partner airlines or points.

Airline Partners

| Airlines | Loyalty Program Name | Transfer Ratio (Magnus, Burgundy Private, and Reserve credit cards) | Transfer Ratio (Atlas credit card) | Transfer Ratio for Affluent Cards | Transfer Ratio for Other Cards |

| Air Asia | Airasia rewards | 5:4 | 1:2 | 5:1 | 10:1 |

| Accor | Accor Live Limitless (ALL) | 5:4 | 1:2 | 10:1 | 20:1 |

| Air Canada | Aeroplan | 5:4 | 1:2 | 10:1 | 20:1 |

| Air France | Flying Blue | 5:4 | 1:2 | 10:1 | 20:1 |

| Air Vistara | Club Vistara | 5:4 | 1:2 | 5:1 | 10:1 |

| Ethiopian Airlines | ShebaMiles | 5:4 | 1:2 | 10:1 | 20:1 |

| Etihad Airways | Etihad Guest | 5:4 | 1:2 | 10:1 | 20:1 |

| Japan Airlines | JAL Mileage Bank | 5:4 | 1:2 | 10:1 | 20:1 |

| Qantas Airways | Qantas Frequent Flyer | 5:4 | 1:2 | 10:1 | 20:1 |

| Qatar Airways | Privilege Club | 5:4 | 1:2 | 10:1 | 20:1 |

| Singapore Airlines | KrisFlyer | 5:4 | 1:2 | 10:1 | 20:1 |

| SpiceJet | SpiceClub | 5:4 | 1:2 | 5:1 | 10:1 |

| Thai Airways | Royal Orchid Plus | 5:4 | 1:2 | 10:1 | 20:1 |

| Turkish Airlines | Miles&Smiles | 5:4 | 1:2 | 10:1 | 20:1 |

| United Airlines | United MileagePlus | 5:4 | 1:2 | 10:1 | 20:1 |

| IHG Hotels & Resorts | IHG One Rewards | 5:4 | 1:2 | 10:1 | 20:1 |

| ITC | Club ITC | 5:4 | 1:2 | 5:1 | 10:1 |

| Marriott International | Marriott Bonvoy | 5:4 | 2:1 | 10:1 | 20:1 |

| Wyndham Hotels & Resorts | Wyndham Rewards | 5:4 | 1:2 | 10:1 | 20:1 |

How to Transfer EDGE Reward Points to Partner Airmiles or Hotel Points?

- Head over to the Axis Bank TravelEdge portal and login through your Customer ID and password.

- Next, click on the Points/Miles Transfer option

- You will see the list of all available transfer partners and click on the one to which you wish to transfer your EDGE reward points

- If you are doing it for the first time, you must click on Link Member and link your ID for the points transfer

- Provide the OTP sent on your number for verification. Then, choose the amount of EDGE reward points you want to transfer to a partner hotel or airline miles.

- Proceed with the transfer, and the request will be processed soon, depending on the loyalty program you are transferring points to.

Redeeming CV Points Offered by Axis Bank Vistara Co-Branded Credit Cards

There are three co-branded credit cards offered by Axis Bank in partnership with Air Vistara. All these cards offer your Club Vistara (CV) points as reward points for your spends, and you can redeem these points for Vistara fare class upgrades, award flight booking, reservations, and other privileges.

Moreover, you can redeem CV points against Vistara’s airline partners, including Silk Air, Air Canada, United Airlines, Japanese Airlines, and more. Follow these steps to redeem CV points-

- Head over to the official Club Vistara website and log in to your account.

- Click on Book>Flights and then choose Redeem Flights.

- Enter the departure and arrival location, date of travel, and other information to search for flights.

- You will see all available flights along with the CV points required to book the flight.

- Click on the flight you want to book to check out its details, and click on Next to finalize the booking.

Conclusion

Credit cards are great financial tools if you use them in the right way, as they offer exclusive privileges and benefits to the cardholders. The best part about Axis Bank credit cards is the EDGE reward points you earn on your spends with the card. Depending on your card, you earn a number of reward points on spends and even accelerated reward rates on certain categories.

Some credit cards also offer you cashback and airmiles as rewards, and it is recommended that you know all possible ways to earn as well as redeem reward points. We learned about how we can earn EDGE reward points in different ways with Axis Bank credit cards.

Keep an eye on your EDGE reward points balance and make sure you redeem them for maximum benefits before they expire.

FAQs:

- You can make spends on your Axis Bank credit card and earn reward points.

- You can get reward points as a welcome benefit on some cards.

- You can get reward points as a milestone benefit on some cards.

- You can shop through the Axis Bank Grab Deals website and earn reward points.

- You can head over to Gyftr to purchase gift cards and vouchers and earn reward points.

- Through Net Banking/Mobile Application

- Through your Credit Card statement

- Through Call/SMS

- You can redeem your EDGE reward points at the EDGE Rewards portal for various products and gift vouchers, where 1 RP = Rs. 0.20.

- You can redeem reward points through Netbanking or the Mobile Application

- You can redeem reward points offline’