KrisFlyer is a frequent flyer program by Singapore Airlines. Singapore Airlines has tied up with various card issuers so that the Reward Points earned on partner card issuers’ credit cards can be converted into KrisFlyer Miles. KrisFlyer Miles can be redeemed on Singapore Airlines’ own services and partner airlines, which include all Star Alliance members, Virgin Australia, Virgin Atlantic, and a number of hotel chains and car hire companies.

Singapore Airlines’ partner card issuers in India include HDFC Bank, Citi Bank, American Express, Axis Bank, and HSBC Bank. In this article, we’ve covered those credit cards by these card issuers that offer some of the highest reward rates on the conversion of Reward Points into KrisFlyer Miles.

List of Best Credit Cards to Earn KrisFlyer Miles in India

The Krisflyer Miles Program by Singapore Airlines gives you an exclusive opportunity to earn Airmiles and use them to save on your travel spends. To provide their customers with the best travel benefits, various card issuers have partnered with Singapore Airlines and offer reward points that are convertible to the KrisFlyer miles.

With hundreds of credit cards available in the country, it might be challenging for you to find credit cards that can earn your KF Miles. To help you out, we are here with the list of best credit cards to earn KrisFlyer Miles and their detailed features.

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

The Axis Bank Atlas credit card is a travel-based card in the sub-premium category, and instead of reward points, it offers Airmiles as Edge Miles for your spends. This card is not co-branded with any airline, but you do get exclusive travel perks, lounge access, dining benefits, and more with the Atlas credit card. You can head over to the Travel Edge portal and transfer Edge Miles to partner airlines miles or redeem them for flight/hotel bookings.

The card offers 5 Edge Miles per Rs. 100 spent on travel and 2 Edge Miles per Rs. 100 spent on other spends, except for airlines, hotels, and Travel Edge. The Edge Miles earned by you can be transferred to KrisFlyer Miles at a 1:2 ratio, where 1 Edge Mile = 2 KrisFlyer Miles.

| Reward Earning Rate | 5 Edge Miles per Rs. 100 spent on travel 2 Edge Miles per Rs. 100 spent elsewhere |

| Miles Conversion Ratio | 1 Edge Mile = 2 KrisFlyer Miles (1:2 ratio) |

| Effective Reward Rate | 10% on travel and 4% on other spends |

Fees

Joining Fee

Renewal Fee

Best Suited For

Shopping

Reward Type

Reward Points

Welcome Benefits

Card Details +

The HDFC Bank Regalia Gold credit card is the newest addition to the Regalia range of cards by the bank, and it offers many elite-level lifestyle and travel privileges to cardholders. The card even offers a complimentary Club Vistara Silver Tier and MMT Black Elite membership on fulfilling certain conditions. The reward rate on the card is decent, and you even get accelerated reward points on partner brands like Myntra, Nykaa, Marks and Spencer, and Reliance Digital.

The Regalia Gold credit card offers 4 RPs per Rs. 150 spent on retail and accelerated 20 RPs per Rs. 150 spent on partner brands like Nykaa, Myntra, Marks and Spencer, and Reliance Digital. The reward points can be transferred to KrisFlyer Miles at a 2:1 ratio, where 2 RPs = 1 KrisFlyer Miles.

| Reward Earning Rate | 4 RPs per Rs. 150 spent on retail 20 RPs per Rs. 150 spent on Myntra, Nykaa, Reliance Digital, and Marks and Spencers |

| Miles Conversion Ratio | 2 RPs = 1 KrisFlyer Mile (2:1 ratio) |

| Effective Reward Rate | 1.33% on normal and 6.66% on partner brand spends |

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

The Axis Bank SELECT Credit Card is a premium credit card offered by Axis Bank and offers great reward points for every spend. The card offers great benefits, such as complimentary access to airport lounges. You also get other benefits with the card, including complimentary golf rounds every year, 24×7 concierge services, and much more.

The SELECT card earns you up to 20 Axis EDGE Points per Rs. 200 spent. These EDGE Points earned are convertible into KrisFlyers Miles, where 10 EDGE REWARD Points = 1 KrisFlyer mile (Ratio 10:1), and the effective reward rate of the SELECT credit card becomes 0.5%.

| Reward Points Earning Rate | 10 EDGE Points for every Rs. 200 spent with the card.

20 EDGE Points for every Rs. 200 spent on retail shopping. |

| Miles Conversion | 10 EDGE REWARD Points = 1 KrisFlyer miles |

| Effective Reward Rate (for redemption against Miles) | 0.5% (on redemption against AirMiles) |

Fees

Joining Fee

Renewal Fee

Best Suited For

Movies

Reward Type

Reward Points

Welcome Benefits

Card Details +

The Axis Bank Magnus Credit Card is a super-premium credit card offered by Axis Bank. The Magnus Card is a reward points-based car with great travel benefits, including complimentary airport lounge access and travel-related insurance covers. It also provides many other benefits, including 24×7 dedicated concierge services, Discounted stays at Oberoi Hotels, and much more.

The Magnus card earns you up to 12 Axis EDGE REWARD Points for every Rs. 200 spent. The EDGE Points earned can be converted into KrisFlyers Miles, where 5 EDGE REWARD Points = 2 KrisFlyer miles (Ratio 5:2), and therefore, the effective reward rate of the Magnus credit card becomes 2.4%. Clients who have a Burgundy account relationship with the bank can continue to transfer their reward points at a ratio of 5:4, where 5 Edge reward points = 4 Club Vistara points at a reward rate of 4.8%.

| Reward Points Earning Rate | 12 Axis EDGE REWARDS Points per Rs. 200 spent on retail upto Rs. 1.5 Lakhs. 35 RPs per Rs. 200 spent on spends above Rs. 1.5 Lakhs and 5X EDGE REWARDS on travel spends. |

| Points Conversion | 5 EDGE REWARD Points = 2 Club Vistara Point |

| Effective Reward Rate (for redemption against Miles) | 2.4% on retail spends, 7% on spends above Rs. 1.5 Lakhs, and 12% on Travel Edge spends |

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

American Express Platinum Travel Credit Card is a premium travel card by American Express. The card comes with a membership fee of Rs. 3,500 per annum and is a travel credit card, that offers many travel benefits to the customers, including complimentary domestic and international airport lounge access, gift vouchers from premium hotel chains like Taj, SleQtions, and Vivanta on achieving the stipulated spends based milestones, etc.

American Express Platinum Travel Credit Card earns you 1 Membership Rewards Point per Rs. 50 spent with the card and accelerated 3X Membership Rewards Points on the Reward Multiplier portal. Like other AmEx cards, the Membership Rewards Points earned on the Platinum Travel Credit Card can be transferred to the KrisFlyer loyalty program as Singapore Airlines is one of American Express’s partner airlines. 2 Membership Rewards Points = 1 KrisFlyer Mile (conversion ratio of 2:1). The reward rate of American Express Platinum Credit Card on redemption against KrisFlyer Miles is 1%.

| Reward Points Earning Rate | 1 Membership Rewards Points per Rs. 50 |

| Miles Conversion | 2 Membership Rewards Points = 1 KrisFlyer Mile |

| Effective Reward Rate (for redemption against Miles) | 1% (on redemption of Membership Rewards Points against KrisFlyer Miles) |

Fees

Joining Fee

Renewal Fee

Best Suited For

Movies

Reward Type

Reward Points

Welcome Benefits

Card Details +

The Reserve credit card by Axis Bank is the most premium card in the bank’s catalog and comes at a high Rs. 50,000 joining fee. The reward rate on the card is quite high, and you also get 2x reward points on international spends with the card. As it is a super-premium card, you get many elite-level privileges like airport lounge access, hotel loyalty program memberships, dining and movie benefits, insurance perks, and more.

The Reserve credit card offers 15 RPs per Rs. 200 spent and 2x RPs on international spends made with the card. The EDGE reward points you earn can be transferred to KrisFlyer Miles at a 5:2 ratio, where 5 RPs = 2 KrisFlyer Miles. Clients who have a Burgundy account relationship with the bank can continue to transfer their reward points at a ratio of 5:4, where 5 Edge reward points = 4 Club Vistara points at a reward rate of 6%.

| Reward Points Earning Rate | 15 Axis EDGE REWARDS Points per Rs. 200 spent, 2x RPs on international spends |

| Points Conversion | 5 EDGE REWARD Points = 2 Club Vistara Points |

| Effective Reward Rate (for redemption against Miles) | 3% on retail and 6% on international spends |

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

Infinia credit card by HDFC Bank is the most premium offering by the bank. The card is invite-only and offers some of the best in class benefits and privileges, including a 24×7 dedicated concierge service, unlimited airport lounge access, travel insurance benefits, etc., and comes with a high membership fee of Rs. 10,000 per annum.

Infinia Credit Card earns you 5 Reward Points for every Rs. 150 spent, which can be converted into AirMiles via net banking on one of partner airlines’ loyalty programs. Since Singapore Airlines is one of HDFC’s partners, you can convert the Reward Points earned on your HDFC Infinia Credit Card into KrisFlyer Miles. 100 Reward Points = 100 KrisFlyer Miles (1:1 conversion ratio), making the effective reward rate of HDFC Infinia Credit Card 3.3% (if Reward Points are redeemed against Air Miles).

| Reward Points Earning Rate | 5 RPs per Rs. 150 spent |

| Miles Conversion | 100 RP = 100 Miles (1:1 ratio) |

| Effective Reward Rate (for redemption against Miles) | 3.33% (on redemption against AirMiles) |

Fees

Joining Fee

Renewal Fee

Best Suited For

Travel

Reward Type

Reward Points

Welcome Benefits

Card Details +

Citi PremierMiles Credit Card is one of the best travel cards in the Indian market. It is a mid-level credit card and comes with a membership fee of Rs. 3,000 (plus GST) per annum. You earn Miles as rewards on your Citi PremierMiles Credit Card. The Miles earned on the Citi Premier Miles Credit Card are transferable to partner airlines’ frequent flyer programs and partner hotel loyalty programs. As Singapore Airlines is one of Citibank’s partner airlines, you can convert the Miles earned on your Citi PremierMIles Credit Card into Krisflyer Miles (1 Citibank Mile = 0.5 Krisflyer Mile. conversion ratio of 2:1).

PremierMIles Credit Card earns you 10 Miles per Rs. 100 was spent on airline transactions and 4 miles per Rs. 100 spent on all other transactions. Considering the Miles earning rate on international transactions and Miles conversion ratio of 2:1, the effective reward rate on Citibank Premier Credit Card is 5%, i.e. you can get 5 KrisFlyer Miles on spending Rs. 100 with your Citibank PremierMiles Credit Card.

| Reward Points Earning Rate | 10 Miles per Rs. 100 on airline spends and 4 MIles per Rs. 100 on all other spends |

| Miles Conversion | 1 (Citibank) Mile = 0.5 KrisFlyer MIle (2:1 conversion ratio) |

| Effective Reward Rate (for redemption against KrisFlyer Miles) | 5% (considering the Citibank Miles earning rate on airlines spends) |

Compare Top Credit Cards for Krisflyer Miles

For a quick reference, here is a comparison of the various credit cards that allow conversion of Reward Points into KrisFlyer Miles-

| Credit Cards | Reward Points Earning Rate | Miles conversion | Effective Reward Rate (for conversion of Reward Points into KrisFlyer Miles) |

| HDFC Bank Infinia Credit Card | 5 RPs per Rs. 150 spent | 100 RP = 100 Miles (1:1 ratio) | 3.33% (on redemption against AirMiles) |

| Axis Bank Magnus (Burgundy Accountholders) | 12 Edge Reward Points per Rs. 200 spent | 5 Edge Points = 4 CV Points (5:4 conversion ratio) | 4.8% (on redemption against Club Vistara Points) |

| Axis Bank Magnus | 12 Axis EDGE REWARDS Points per Rs. 200 spent on retail upto Rs. 1.5 Lakhs. 35 RPs per Rs. 200 spent on spends above Rs. 1.5 Lakhs and 5X EDGE REWARDS on travel spends. | 5 EDGE REWARD Points = 2 Club Vistara Points (5:2 conversion ratio) | 2.4% on retail spends, 7% on spends above Rs. 1.5 Lakhs, and 12% on Travel Edge spends |

| Axis Bank Reserve | 15 RPs per Rs. 200 spent 30 RPs per Rs. 200 on international spends | 5 RPs = 4 KrisFlyer Miles (5:2 ratio) | 6% on normal and 12% on international spends |

| Axis Bank Atlas Credit Card | 5 Edge Miles per Rs. 100 spent on travel 2 Edge Miles per Rs. 100 spent elsewhere | 1 Edge Mile = 2 KrisFlyer Miles (1:2 ratio) | 10% on travel and 4% on other spends |

| HDFC Bank Regalia Credit Card | 4 RPs per Rs. 150 spent on retail 20 RPs per Rs. 150 spent on partner brands like Nykaa, Myntra, etc. | 2 RPs = 1 KrisFlyer Mile (2:1 ratio) | 1.33% on normal and 6.66% on partner brand spends |

| HDFC Bank Diners Club Black Credit Card | 5 RPs per Rs. 150 spent | 100 RP = 100 Miles (1:1 conversion ratio) | 3.33% (on redemption against AirMiles) |

| Axis Bank SELECT Credit Card | 10 EDGE Points per Rs. 200 spent and 20 EDGE Points per Rs. 200 spent on retail shopping | 10 EDGE Reward Points = 1 KrisFlyer Miles | 0.5 (on redemption of Reward Points against KrisFlyer Miles) |

| HDFC Bank Diners Club Premium Credit Card | 4 RPs per Rs. 150 spent | 1 RP = 0.5 Mile (2:1 conversion ratio) | 1.33% (on redemption of Reward Points against KrisFlyer Miles) |

| American Express Platinum Credit Card | 1 Membership Rewards Point per Rs. 40 | 2 Membership Rewards Points = 1 KrisFlyer Mile (2:1 conversion ratio) | 1.25% (considering the reward rate on redemption against KrisFlyer Miles) |

| American Express Platinum Travel Credit card | 1 Membership Rewards Points per Rs. 50 | 2 Membership Rewards Points = 1 KrisFlyer Mile (2:1 conversion ratio) | 1% (on redemption of Membership Rewards Points against KrisFlyer Miles |

| American Express Gold Credit Card | 1 Membership Rewards Points per Rs. 50 spent | 2 Reward Points = 1 KrisFlyer Mile (2:1 conversion ratio) | 1% (on conversion of Membership Rewards Points into KrisFlyer Miles) |

How to Create a Singapore Airlines KrisFlyer Account

Follow these steps to make a Singapore Airlines KrisFlyer account –

- Head over to the Singapore Airlines website

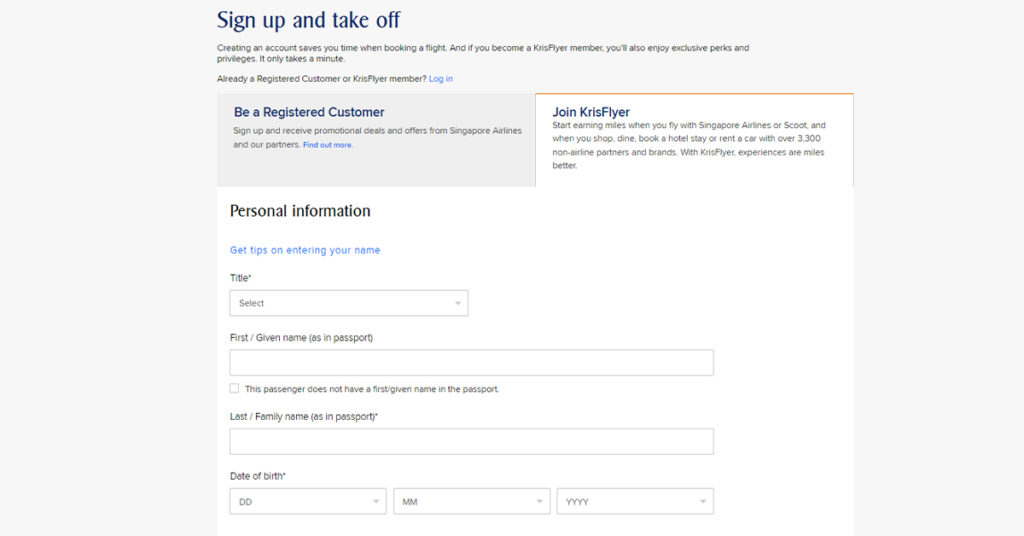

- Near the top right corner of the page, click on the Sign-Up button

- Click on Join KrisFlyer

- Enter the necessary details, including your name, date of birth, nationality, etc.

- Click on Continue and our KrisFlyer account will be up and running

How to Redeem KrisFlyer Miles?

The KrisFlyer Miles Earned are redeemable for tons of options, and you can use the Miles in a very efficient way. Following are the redemption options for KrisFlyer Miles:

For Booking Flights

The most effective way to redeem the earned KrisFlyer Miles is to book flights while traveling. You can redeem your KrisFlyer Miles when traveling with Singapore Airlines or any other Partner airline. The minimum miles that you would require to book the starting economy ticket would be 7,500 KrisFlyer Miles. Also, you can use Miles to get the ticket at a lower price.

You can book flights in three ways – Online, via Chat, and by Phone.

Booking Singapore Airline Flights –

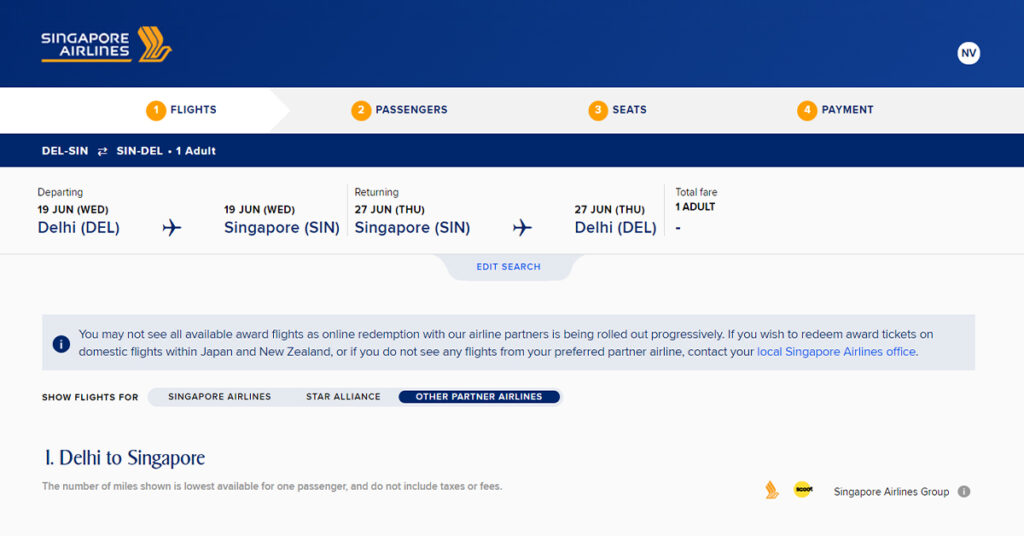

- Visit the Singapore Airlines website and log into your account

- Enter the departure and arrival location, date of travel, arrival and departure location, fare class, etc., and search for flights

- You will see all available flights along with the miles required to book the flights.

- Click on the flight you want to book, check out its details, and proceed with the booking.

Booking Star Alliance Partner Flights –

- Visit the Singapore Airlines website and log into your account.

- Enter the departure and arrival location, date of travel, no. of passengers, etc., and search for flights.

- On the search results page, click on Show Flights for Star Alliance.

- The results will now show available flights for your route operated by Star Alliance members. In front of the flight are the miles required to book.

- Click on the flight you want to book and proceed with the booking.

Booking Other Partner Airline Flights –

- Visit the Singapore Airlines website and log in to your account.

- Enter all details, including arrival and departure location, date of travel, passengers, etc., and click on Search.

- On the search results page, click on Show Flights for Other Partner Airlines.

- You can see flights operated by Air Vistara and other partner airlines for your desired route and date of travel.

- Click on the flight you want to book, go through its details, and proceed with the booking.

Booking via Chat or Phone Support

- The most convenient way to redeem your KrisFlyer Miles is to book flights online. However, you can even get in touch with their Chat or Phone support to book flights via Miles.

- For instance, you have to book a flight from Munich to Delhi and you cannot find it on the Singapore Airlines website.

- However, when you search for flights from other Star Alliance members, you find a flight from Munich to Warsaw and then from Warsaw to Delhi.

- You can contact Singapore Airlines support via Chat or Phone to assist you in booking the flights. Also, the number of miles required to book the flight will be from Munich to Delhi, and not individually for Munich to Warsaw and then from Warsaw to Delhi.

For Booking Hotels

You can use your KrisFlyer Miles to book hotels at over 350,000 hotels worldwide. Also, you can use them to book hotels at Shangri-La’s Golden Circle, a partner hotel with Singapore Airlines.

For Shopping

When you shop from KrisShop.com, you can use your KrisFlyer Miles as a payment option. You can use the miles in full or partially (minimum 1,000 miles).

How to Buy KrisFlyer Miles

- If you want to use your KrisFlyer Miles to redeem an award flight but are short on miles, then you can purchase KrisFlyer Miles. You can purchase KrisFlyer Miles at the price of $40 for 1000 Miles. It is possible to purchase KrisFlyer Miles directly from the website via FAX or Email, but you must have a flight booking or class upgrade planned in order to purchase miles.

- Also, you must have at least 50% of the total miles required to book an award flight or class upgrade in order to purchase KrisFlyer Miles. You must fill out the Miles Top-Up Request Form with your membership details, reservation details, flight itinerary, etc., and send it to Singapore Airlines via FAX or email.

KrisFlyer Membership Tier and Benefits

Whenever you fly with Singapore Airlines, you get KrisFlery Miles that can be used to redeem award flights or upgrade tiers. You can even mix cash and miles to reduce the cost of expensive tickets. Apart from KrisFlyer Miles, you even get Elite Miles that helps you reach higher membership tiers and get access to better privileges. You can even qualify for KrisFlyer Milestone Rewards through Elite Miles.

As you earn more and more Elite Miles, you can advance to higher membership tiers. Let’s know more about the KrisFlyer membership tiers and benefits –

KrisFlyer Base

When you log into the membership program, you automatically get the basic KrisFlyer tier. You can start earning miles when you take flights and even on the ground. Redeem your miles for tier upgrades, award flights, and more.

KrisFlyer Elite Silver

Next up is the KrisFlyer Elite Silver membership, and you need to earn 25000 Elite Miles in a 12-month period to achieve this tier. Members also get the Star Alliance Silver Tier with this. At this tier, you get all the KrisFlyer base tiers benefits and more –

- Bonus 25% tiers on miles flown through Singapore Airlines and Scoot

- Complimentary Standard seat selection whenever you take a Singapore Airlines economy class flight

- Priority airport standby

- Priority reservation waitlist

- Discounted or waived KrisFlyer service fees

KrisFlyer Elite Gold

You earn the KrisFlyer Elite Gold membership on earning 50,000 Elite Miles in a period of 12 months. This tier is equal to the Star Alliance Gold tier and offers everything that the Elite Silver tier offers and more –

- Complimentary Standard and Forward Zone seat selection on Singapore Airlines economy class flights

- Priority check-in at airports

- Complimentary airport lounge access

- Priority boarding, reservation wishlist, immigration and security, and boarding

- Extra baggage allowance

- Discounted or waived KrisFlyer service fees

Next up, there are two highest membership tiers, but before that, you must know about PPS Value. You can’t just qualify for the highest tiers on the basis of miles flown, and it depends on the PPS Value. The PPS Value is earned when you fly Business class, First Class, or Suites on Singapore Airlines, which are counted towards PPS Club status.

The total airfare and surcharges account for the PPS Value, and it is in Singapore Dollars. You won’t earn PPS Value if you fly in Economy or Premium Economy class.

The PPS Club

After the KrisFlyer Gold tier next is the PPS Club, and you will have to spend at least S$25,000 PPS Value within 12 months to qualify for this tier. This includes all the KrisFlyer Elite Gold benefits and more –

- Better airport lounge access

- Additional allowance for check-in baggage

- KrisFlyer Miles do not expire anymore

- Guaranteed Economy class seat on any Singapore Airlines flight

- Complimentary Standard, Forward Zone, and Extra Legroom seat selection on Singapore Airlines economy and premium economy flights

- Meal and seat preferences

- Priority saver award redemption

- Free 30 MB WiFi allowance

- Complimentary Priority magazine subscription

- Shangri-La Circle Gold membership

- Travel accident insurance and AIG Overseas Medical insurance

Solitaire PPS Club

The highest membership tier is the Solitaire PPS Club and you will need to spend total S$250,000 for 5 years consecutive period in PPS Value to qualify for this tier. This tier has all the benefits of the PPS Club and more –

- A Supplementary Solitaire PPS Club card for a person chosen by you

- Private immigration counter at the Changi terminal

- Porter service at Changi Terminal 2 and first-class reception at Changi Terminal 3

- First class counters for check-in overseas

- Lounge access at London Heathrow airport

- Highest priority for saver award redemption

Best Ways to Use KrisFlyer Miles

KrisFlyer Miles, as mentioned above, can be redeemed for spends on Singapore Airlines’ own services or against spends on any of the Star Alliance member airlines. In order to get the best value of the KrisFlyer Miles accumulated in your account, you must keep in mind the following pointers-

- You can get a better value of KrisFlyer Miles when booking a ticket at a value higher than its usual price. This is because, although the price of the ticket increases, the number of Miles to be used for booking the ticket remains the same.

- Booking flights on shorter routes also gives you a better value for KrisFlyer Miles than booking long-distance flights. It is, therefore, a better idea to redeem your KrisFlyer Miles when booking shorter-distance flights.

How To Earn KrisFlyer Miles

You can earn KrisFlyer Miles in a number of ways, including traveling with partner airlines, shopping, using a credit card, and many others. To get detailed information about various ways to earn KrisFlyer, refer to the information given below:

- Convert Credit Card Rewards: Various major credit card issuers, including HDFC Bank, Axis Bank, HSBC Bank, Citi Bank, American Express, etc, allow their credit card reward points conversion to KrisFlyer Miles that can be used against ticket bookings & other travel related spends on Singapore Airlines. Moreover, all the Vistara Co-Branded Credit Cards allow you to convert your earned miles into KrisFlyer miles, as both of these are Singapore Airlines partners.

- Earn while Flying: When you travel with Singapore Airlines, you are rewarded with Bonus KrisFlyer Miles for the flights booked. You also earn KF Miles when you travel via any of the 30 partnered airlines of Singapore Airlines, which include Air Canada, Air France, Alaska Airlines, Asiana Airlines, Brussels Airlines, EGYPTAIR, Eurowings, Fiji Airways, Vistara, and Air India.

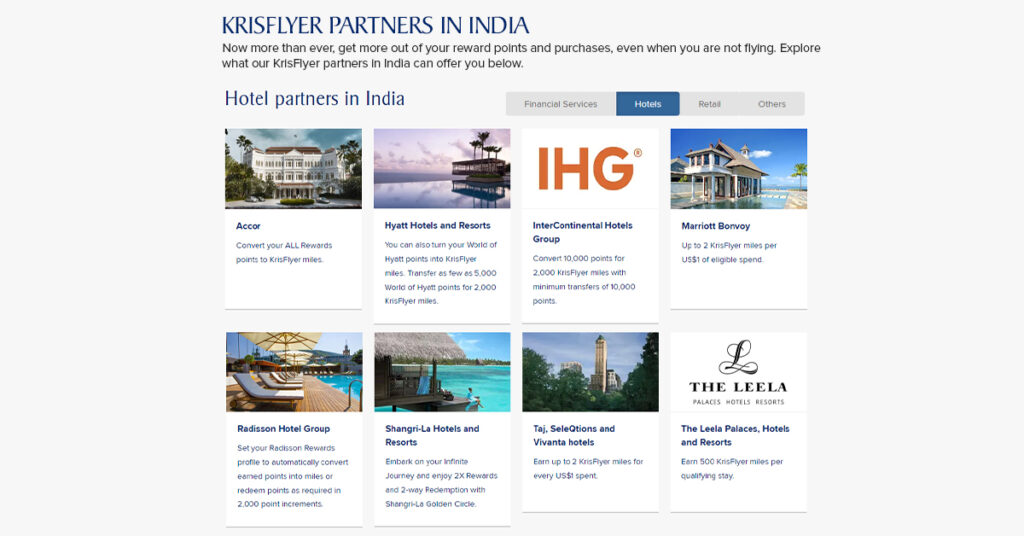

- Earn while staying at Hotels: KrisFlyer partners with many Hotels where you can book your stay and earn KrisFlyer Miles for every booking. Also, you can earn the partner Hotel points program, which can be further converted into KrisFlyer Miles.

- Earn with KrisShop: When you shop from KrisShop, you earn Bonus KrisFlyer Miles for every spend. You can shop from more than 2,000 brands available and earn Bonus Miles while shopping.

Krisflyer Miles Expiry and How to Extend Them

In contrast to various frequent flyer programs, Singapore KrisFlyer miles have a fixed expiry date. Normally, the KrisFlyer Miles expire 36 months from the month they were originally earned. If you had earned Miles in November 2022, then those Miles would expire in November 2025. Even if you earn more Miles during this period, it won’t affect the expiry of Miles that you had earned before.

When you redeem your earned miles, the Miles earned earliest are used first, and you can’t just use miles that you earned a month ago. If you transfer your credit card reward points to KrisFlyer miles, it is better to avoid transferring until you actually need the miles.

If your KrisFlyer miles are getting closer to the expiry date, you can pay to extend their validity period. You can either pay USD 12 or 1200 Miles in order to extend your KrisFlyer Miles by six months. The Miles do not expire for PPS Club members, and Elite Silver and Gold tier members can extend Miles for a 12-month period by making the payment.

Cancellation Charges of Award Tickets

In case of a no-show, you will have to pay cancellation fees on your award tickets –

- Economy – $100

- Premium Economy – $200

- Business Class – $300

- First Class – $300

Apart from the cancellation fee, you will have to pay for redeposit of your miles – $50 for Advantage and $75 for Saver Award.

Miles Redemption for Others

You can book an award ticket for anyone, and you can add up to 5 people as your redemption nominees. It will allow you to redeem miles to book award tickets or class upgrades for them.

Once you add a nominee, it is not possible to change them for six months. Also, you can add a nominee for free, but to delete one, you will have to pay via money or miles.

Miles Redemption for Infant/Child

If you are traveling on an award or redemption ticket, you can opt for not booking a ticket for your infant child below two years, and carry him on your lap. If you want your child to be seated on your lap, then you have to pay 10% of the cheapest adult ticket in the fare class for it. You cannot get an in-lap ticket for an infant via redeeming miles.

If you want to book a separate seat for your infant, then you can book it with miles, and it will cost the same as an adult award ticket.

Which Credit Card is best for KrisFlyer Miles?

Every Credit card that is in partnership with the KrisFlyer Miles program is best to earn KrisFlyer Miles. No one card can be considered best, as the requirements of using a credit card depend upon your spending habits. Therefore, the list of credit cards provided above is best for earning Kris Flyer Miles.

Bottom Line

If you are a frequent international flyer, it is certainly worthwhile to consider one of these credit cards that offer a high reward rate on redemption of Reward Points against KrisFlyer AirMiles as KrisFlyer Miles can be redeemed not only on Singapore Airlines but also on many other major international careers including Star Alliance member Airlines, Virgin Atlantic and Virgin Australia and many international hotel chains.

Also, apart from KrisFlyer Miles, the Reward Points earned on these credit cards can be redeemed against AirMiles on many other frequent flyer programs as well. In order to maximize the benefits of KrisFlyer miles, you should make sure that you use your credit card rewards as well as miles carefully and wisely by not letting any of the miles expire without using them.